please answer

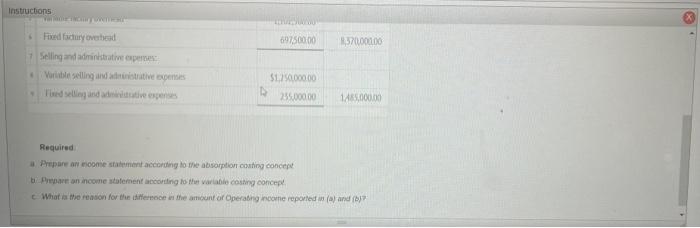

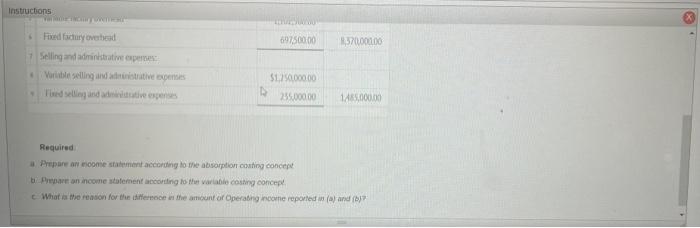

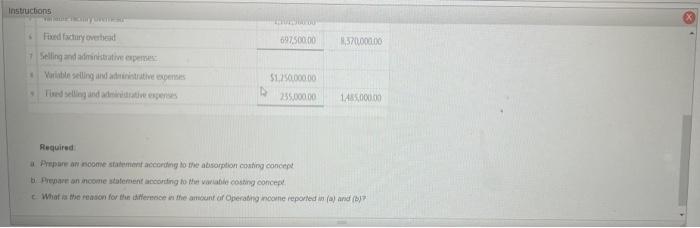

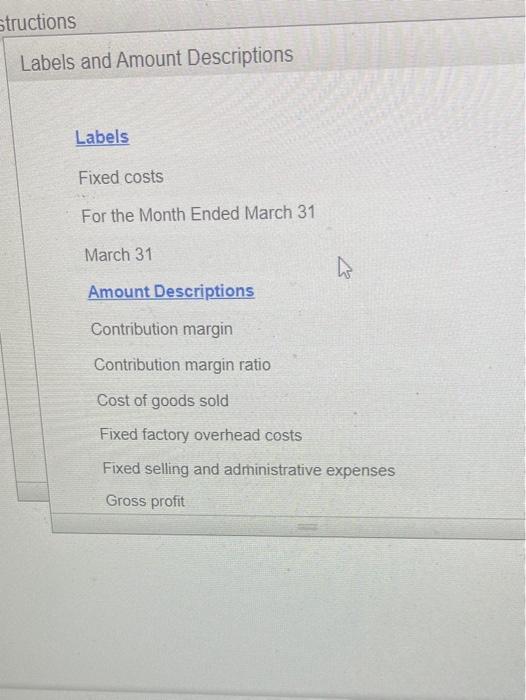

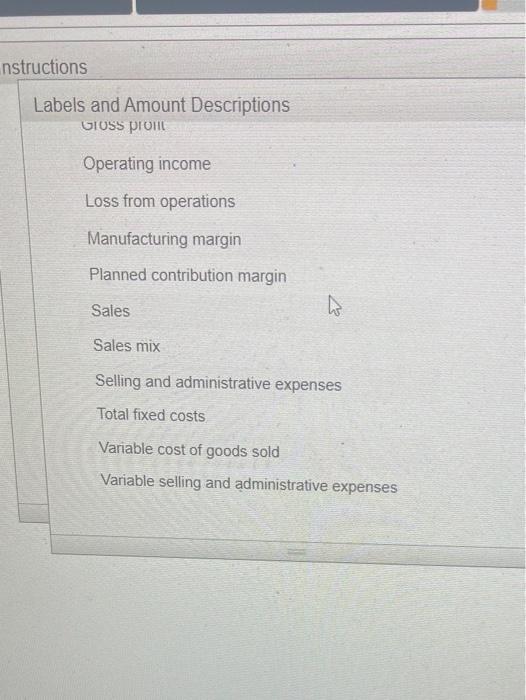

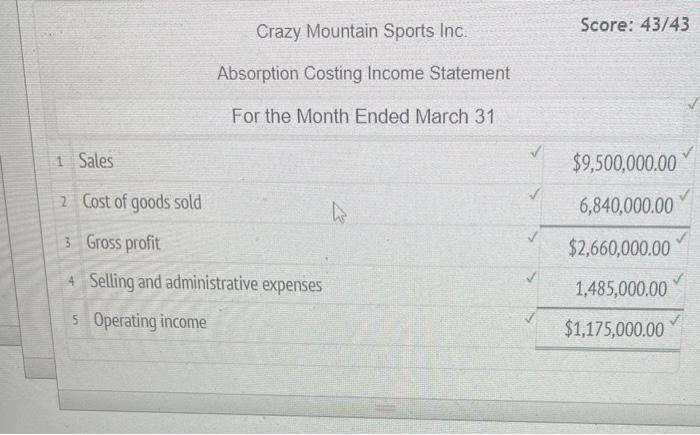

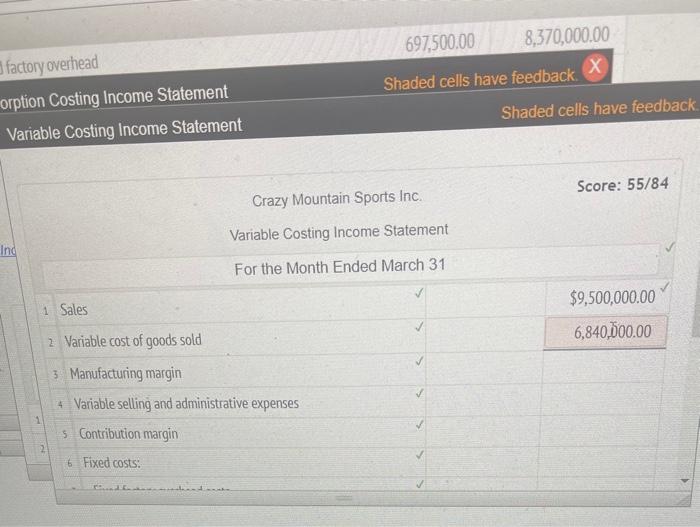

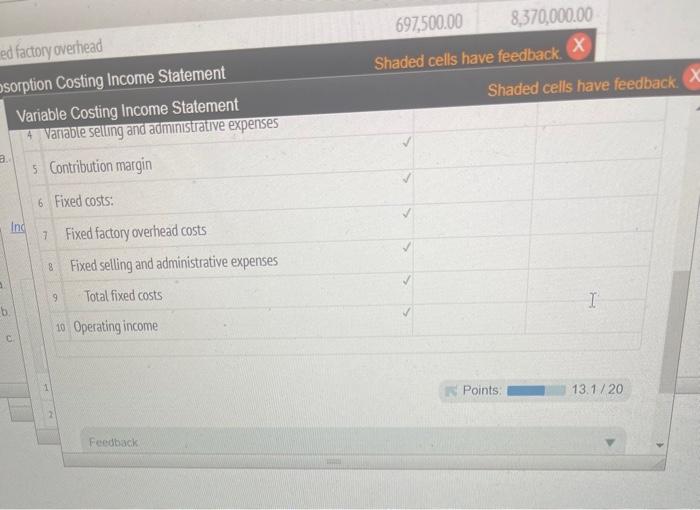

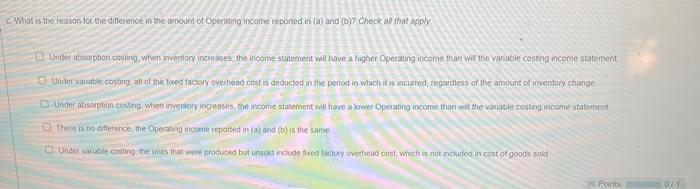

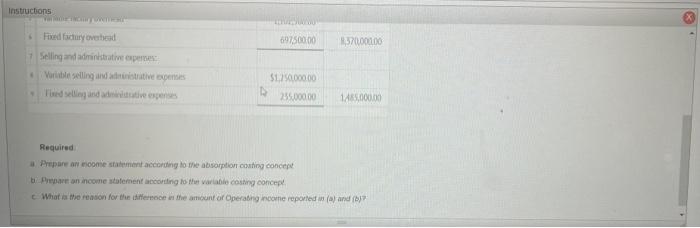

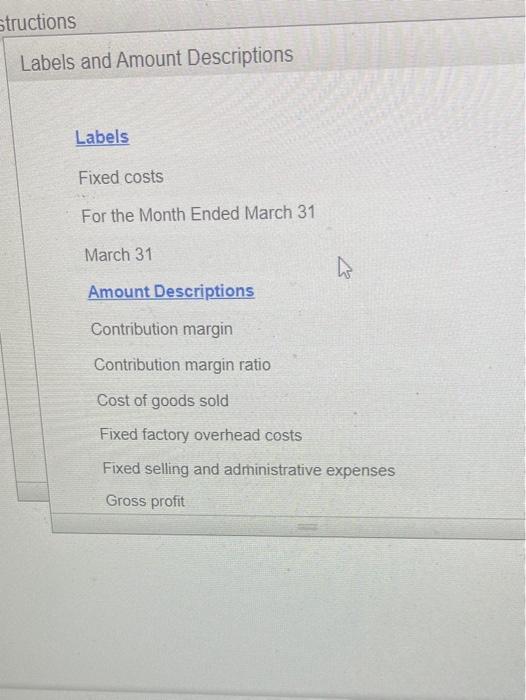

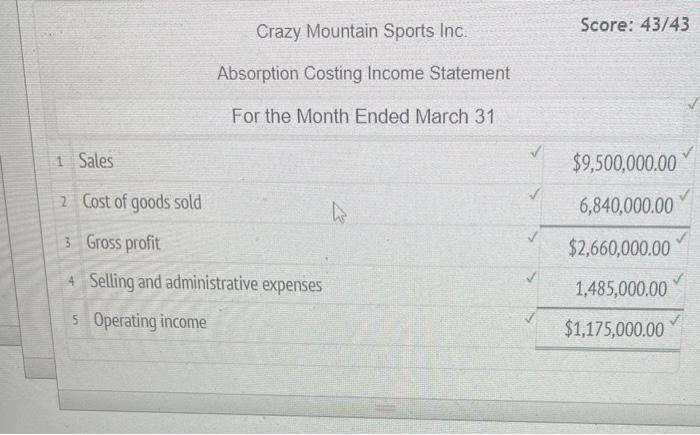

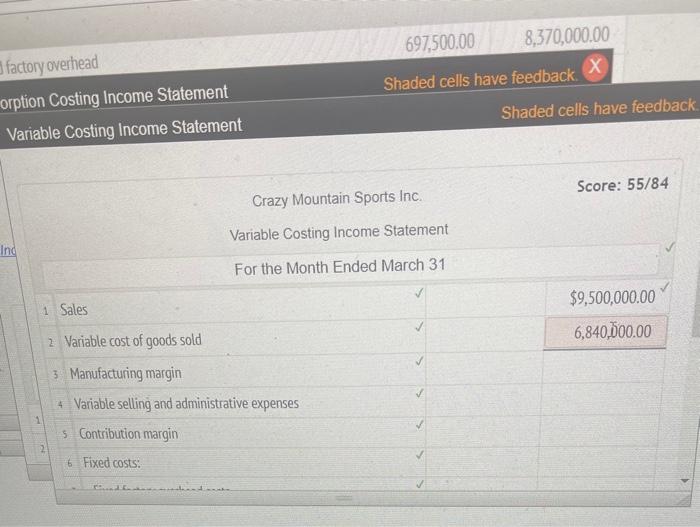

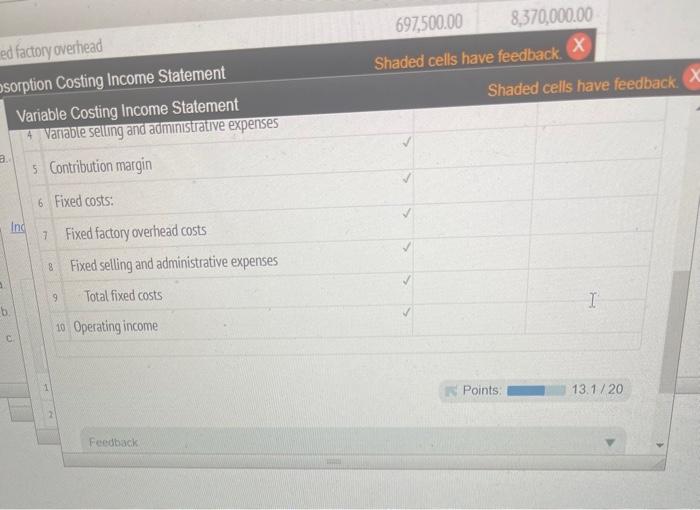

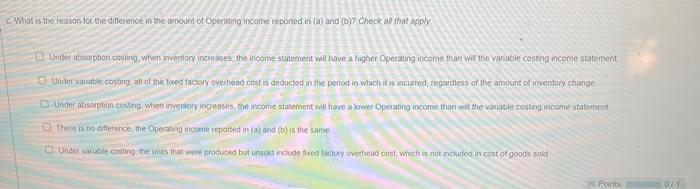

Labels and Amount Descriptions Labels and Amount Descriptions viuss pruili Operating income Loss from operations Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total fixed costs Variable cost of goods sold Variable selling and administrative expenses What is tho reason foc the difference in the amount of Operating income reported in (a) and (b)? Check al that apply. Under absorpbon costing, witen unventoy increases, the income statement will have a higber Operaung income than will the variable costing ancome statement Under vanatle cosing at of the foxed tactory oyerbead cost is deducted in the period in which it us anciured, regardhess of the amount of inventory change. Thete is no diflerence, the Operating necone reported in (a) and (b) is the sans. Under vatuble costing, the units that weie produced but unscid include sxed factory creshead cost. which is not ndudod in cost of goods sold Crazy Mountain Sports Inc. Score: 43/43 Absorption Costing Income Statement For the Month Ended March 31 1 Sales 2 Cost of goods sold 3 Gross profit 4 Selling and administrative expenses 5 Operating income \begin{tabular}{|c|} \hline \\ \hline 6,840,000.00 \\ \hline$2,660,000.00 \\ \hline 1,485,000.00 \\ \hline$1,175,000.00 \\ \hline \end{tabular} Required a Prepare an noone statement according io the absorption conting concept c. What a the reason for the Liffernoce an the amount of Operabing noone reponted in (a) and (b)? Required a Prepare an roone statement accoridng to the absorption couting concept c. What ia the reasion for the idiflemoce in the amount of Operabing noone reponted in (a) and (b) ? ed factory overhead sorption Costing Income Statement Variable Costing Income Statement 4 varrable selling and administrative expenses 5. Contribution margin 6 Fixed costs: Ind 1. Fixed factory overhead costs 8 Fixed selling and administrative expenses 9 Total fixed costs 10 Operating income Shaded cells have feedback. Shaded cells have feedback. factory overhead 697,500,008,370,000.00 orption Costing Income Statement Variable Costing Income Statement Shaded cells have feedback. Crazy Mountain Sports Inc. Variable Costing Income Statement For the Month Ended March 31 Score: 55/84 Score: 55/84 1 Sales 2. Variable cost of goods sold 3 Manufacturing margin 4 Variable selling and administrative expenses 5 Contribution margin 6 Fixed costs: Shaded cells have feedback