Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer me this questions by giving th right choice 10. In a currency board arrangement: A. The country issues its own currency, but that

please answer me this questions by giving th right choice

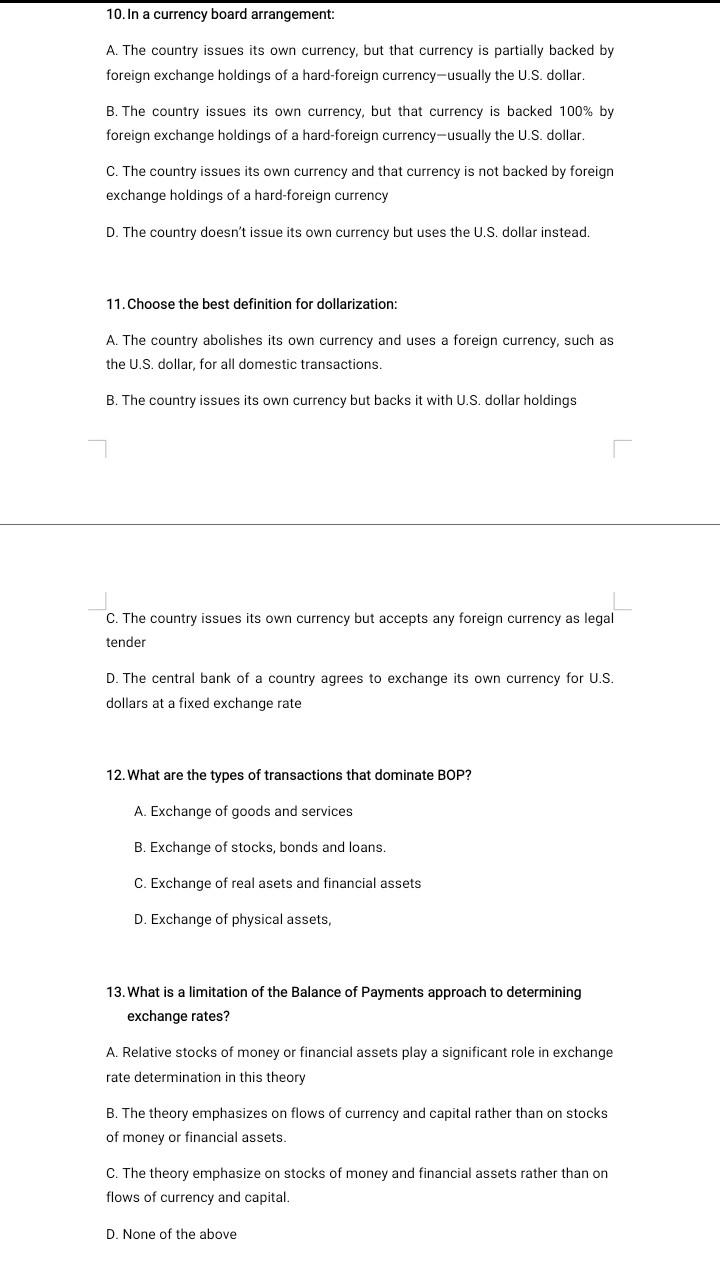

10. In a currency board arrangement: A. The country issues its own currency, but that currency is partially backed by foreign exchange holdings of a hard-foreign currency-usually the U.S. dollar. B. The country issues its own currency, but that currency is backed 100% by foreign exchange holdings of a hard-foreign currency-usually the U.S. dollar. C. The country issues its own currency and that currency is not backed by foreign exchange holdings of a hard-foreign currency D. The country doesn't issue its own currency but uses the U.S. dollar instead. 11. Choose the best definition for dollarization: A. The country abolishes its own currency and uses a foreign currency, such as the U.S. dollar, for all domestic transactions. B. The country issues its own currency but backs it with U.S. dollar holdings C. The country issues its own currency but accepts any foreign currency as legal tender D. The central bank of a country agrees to exchange its own currency for U.S. dollars at a fixed exchange rate 12. What are the types of transactions that dominate BOP? A. Exchange of goods and services B. Exchange of stocks, bonds and loans. C. Exchange of real asets and financial assets D. Exchange of physical assets, 13. What is a limitation of the Balance of Payments approach to determining exchange rates? A. Relative stocks of money or financial assets play a significant role in exchange rate determination in this theory B. The theory emphasizes on flows of currency and capital rather than on stocks of money or financial assets. C. The theory emphasize on stocks of money and financial assets rather than on flows of currency and capital. D. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started