Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer my qoustion! Ms. A is an employee of a Canadian public company, Square Co. (SQUARE/Employer). She lives in Mississauga, ON and her salary

please answer my qoustion!

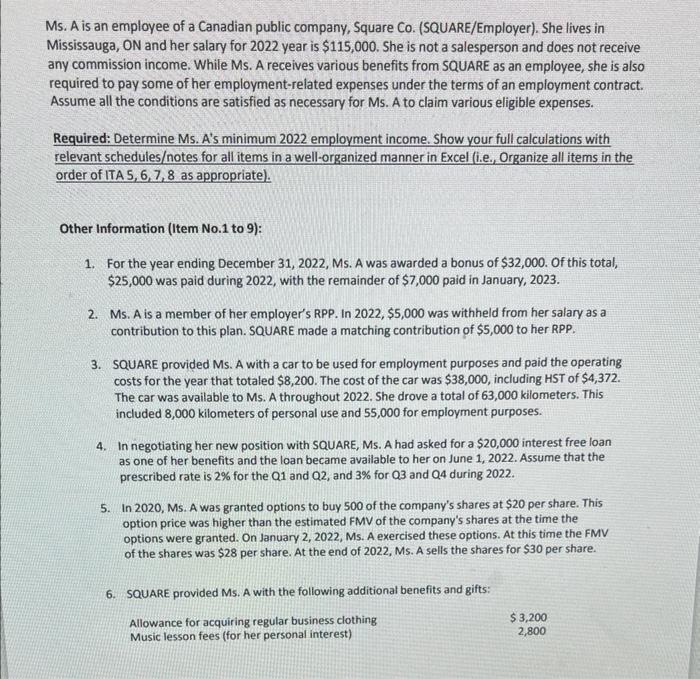

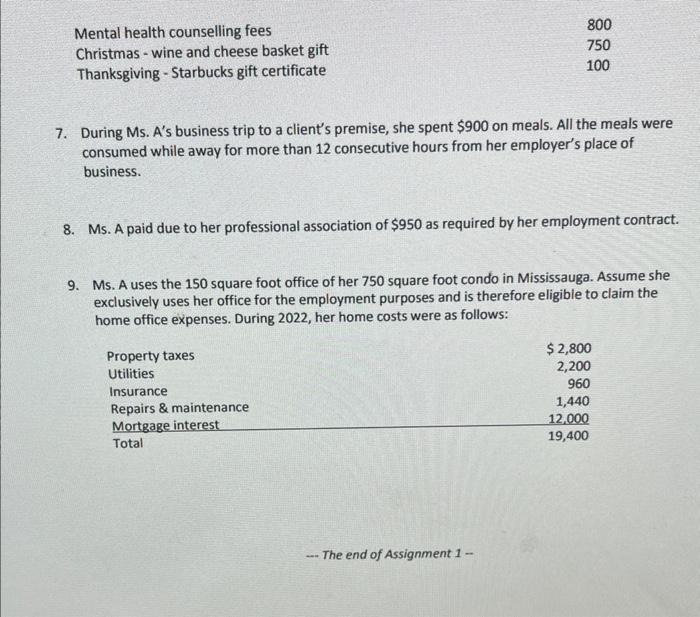

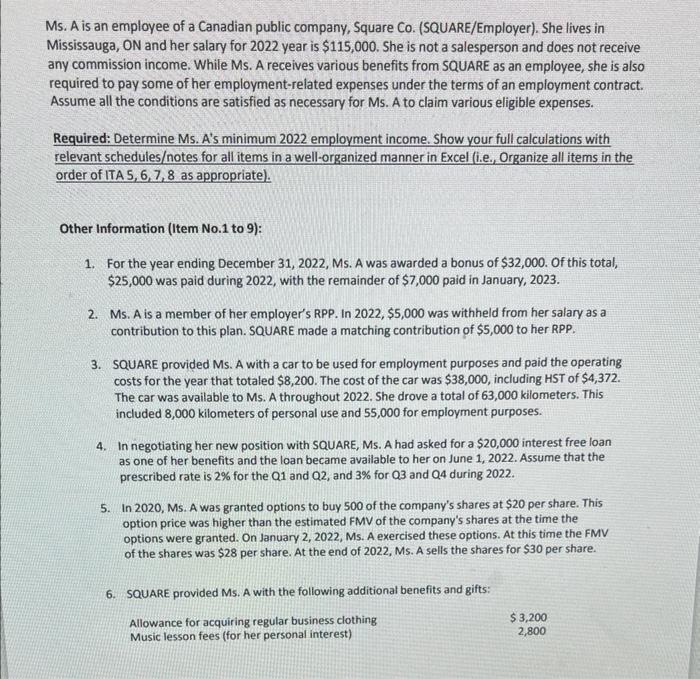

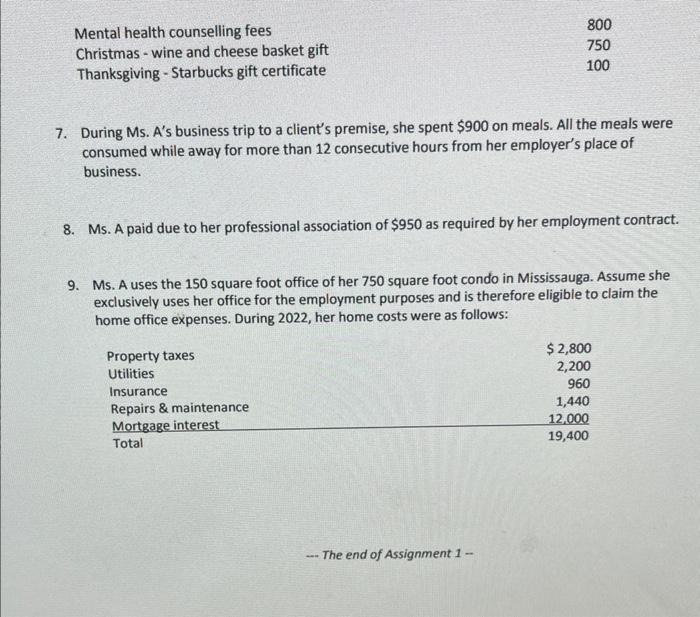

Ms. A is an employee of a Canadian public company, Square Co. (SQUARE/Employer). She lives in Mississauga, ON and her salary for 2022 year is $115,000. She is not a salesperson and does not receive any commission income. While Ms. A receives various benefits from SQUARE as an employee, she is also required to pay some of her employment-related expenses under the terms of an employment contract. Assume all the conditions are satisfied as necessary for Ms. A to claim various eligible expenses. Required: Determine Ms. A's minimum 2022 employment income. Show your full calculations with relevant schedulesotes for all items in a well-organized manner in Excel (i.e., Organize all items in the order of ITA 5,6,7,8 as appropriate). Other Information (Item No.1 to 9): 1. For the year ending December 31,2022 , Ms. A was awarded a bonus of $32,000.0 Of this total, $25,000 was paid during 2022, with the remainder of $7,000 paid in January, 2023. 2. Ms. A is a member of her employer's RPP. In 2022,$5,000 was withheld from her salary as a contribution to this plan. SQUARE made a matching contribution of $5,000 to her RPP. 3. SQUARE provided Ms. A with a car to be used for employment purposes and paid the operating costs for the year that totaled $8,200. The cost of the car was $38,000, including HST of $4,372. The car was available to Ms. A throughout 2022. She drove a total of 63,000 kilometers. This included 8,000 kilometers of personal use and 55,000 for employment purposes. 4. In negotiating her new position with SQUARE, Ms. A had asked for a $20,000 interest free loan as one of her benefits and the loan became available to her on June 1,2022 . Assume that the prescribed rate is 2% for the Q1 and Q2, and 3% for Q3 and Q4 during 2022. 5. In 2020,Ms. A was granted options to buy 500 of the company's shares at $20 per share. This option price was higher than the estimated FMV of the company's shares at the time the options were granted. On January 2, 2022, Ms. A exercised these options. At this time the FMV of the shares was $28 per share. At the end of 2022, Ms. A sells the shares for $30 per share. 6. SQUARE provided Ms. A with the following additional benefits and gifts: 7. During Ms. A's business trip to a client's premise, she spent $900 on meals. All the meals were consumed while away for more than 12 consecutive hours from her employer's place of business. 8. Ms. A paid due to her professional association of $950 as required by her employment contract. 9. Ms. A uses the 150 square foot office of her 750 square foot condo in Mississauga. Assume she exclusively uses her office for the employment purposes and is therefore eligible to claim the home office expenses. During 2022, her home costs were as follows: - The end of Assignment 1 - Ms. A is an employee of a Canadian public company, Square Co. (SQUARE/Employer). She lives in Mississauga, ON and her salary for 2022 year is $115,000. She is not a salesperson and does not receive any commission income. While Ms. A receives various benefits from SQUARE as an employee, she is also required to pay some of her employment-related expenses under the terms of an employment contract. Assume all the conditions are satisfied as necessary for Ms. A to claim various eligible expenses. Required: Determine Ms. A's minimum 2022 employment income. Show your full calculations with relevant schedulesotes for all items in a well-organized manner in Excel (i.e., Organize all items in the order of ITA 5,6,7,8 as appropriate). Other Information (Item No.1 to 9): 1. For the year ending December 31,2022 , Ms. A was awarded a bonus of $32,000.0 Of this total, $25,000 was paid during 2022, with the remainder of $7,000 paid in January, 2023. 2. Ms. A is a member of her employer's RPP. In 2022,$5,000 was withheld from her salary as a contribution to this plan. SQUARE made a matching contribution of $5,000 to her RPP. 3. SQUARE provided Ms. A with a car to be used for employment purposes and paid the operating costs for the year that totaled $8,200. The cost of the car was $38,000, including HST of $4,372. The car was available to Ms. A throughout 2022. She drove a total of 63,000 kilometers. This included 8,000 kilometers of personal use and 55,000 for employment purposes. 4. In negotiating her new position with SQUARE, Ms. A had asked for a $20,000 interest free loan as one of her benefits and the loan became available to her on June 1,2022 . Assume that the prescribed rate is 2% for the Q1 and Q2, and 3% for Q3 and Q4 during 2022. 5. In 2020,Ms. A was granted options to buy 500 of the company's shares at $20 per share. This option price was higher than the estimated FMV of the company's shares at the time the options were granted. On January 2, 2022, Ms. A exercised these options. At this time the FMV of the shares was $28 per share. At the end of 2022, Ms. A sells the shares for $30 per share. 6. SQUARE provided Ms. A with the following additional benefits and gifts: 7. During Ms. A's business trip to a client's premise, she spent $900 on meals. All the meals were consumed while away for more than 12 consecutive hours from her employer's place of business. 8. Ms. A paid due to her professional association of $950 as required by her employment contract. 9. Ms. A uses the 150 square foot office of her 750 square foot condo in Mississauga. Assume she exclusively uses her office for the employment purposes and is therefore eligible to claim the home office expenses. During 2022, her home costs were as follows: - The end of Assignment 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started