Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer my question. 1A) On September 1, 2020, Concord Corporation acquired Skysofig Enterprises for a cash payment of $790,000. At the time of purchase,

Please answer my question.

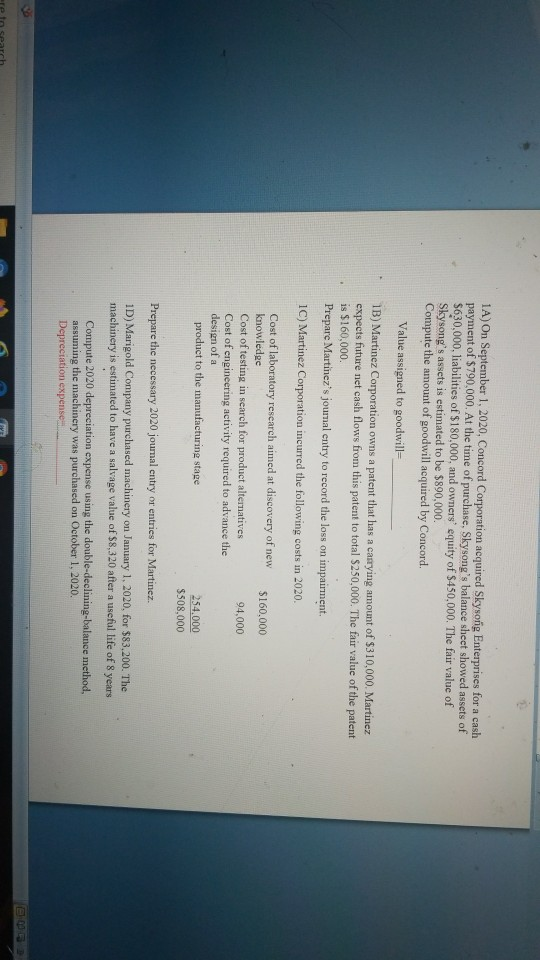

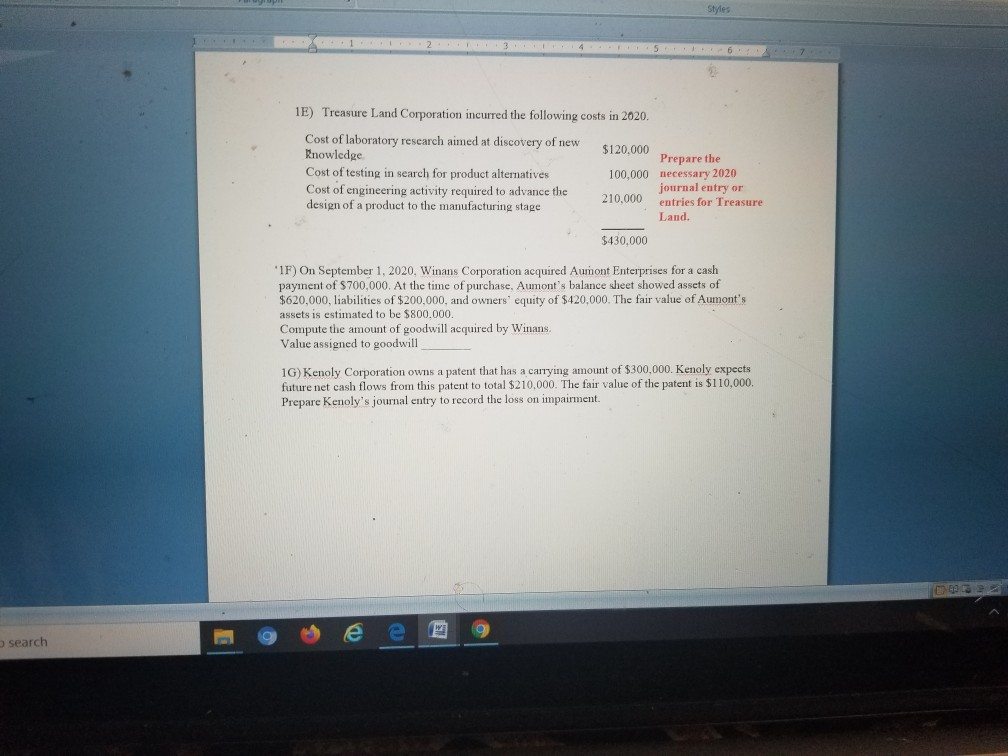

1A) On September 1, 2020, Concord Corporation acquired Skysofig Enterprises for a cash payment of $790,000. At the time of purchase, Skysong's balance sheet showed assets of $630,000, liabilities of $180,000, and owners' equity of $450,000. The fair value of Skysong's assets is estimated to be $890,000. Compute the amount of goodwill acquired by Concord. Value assigned to goodwille 13) Martinez Corporation owns a patent that has a carrying amount of $310.000. Martinez expects future net cash flows from this patent to total $250,000. The fair value of the patent is $160,000 Prepare Martinez's journal entry to record the loss on impairment. 1C) Martinez Corporation incurred the following costs in 2020. Cost of laboratory research aimed at discovery of new knowledge Cost of testing in search for product alternatives Cost of engineering activity required to advance the design of a product to the manufacturing stage $160,000 94.000 254.000 $508,000 Prepare the necessary 2020 journal entry or entries for Martinez 1D) Marigold Company purchased machinery on January 1, 2020, for $83.200. The machinery is estimated to have a salvage value of $8,320 after a useful life of 8 years Compute 2020 depreciation expense using the double-declining balance method. assuming the machinery was purchased on October 1. 2020. Depreciation expenses 2002 ere to search Styles 1E) Treasure Land Corporation incurred the following costs in 2020. $120,000 Cost of laboratory research aimed at discovery of new Knowledge Cost of testing in search for product alternatives Cost of engineering activity required to advance the design of a product to the manufacturing stage 100,000 Prepare the necessary 2020 journal entry or entries for Treasure Land. 210,000 $430,000 "1F) On September 1, 2020, Winans Corporation acquired Aumont Enterprises for a cash payinent of $700,000. At the time of purchase, Aumont's balance sheet showed assets of $620,000, liabilities of $200,000, and owners' equity of $420,000. The fair value of Aumont's assets is estimated to be $800.000. Compute the amount of goodwill acquired by Winans. Value assigned to goodwill 1G) Kenoly Corporation owns a patent that has a carrying amount of $300,000. Kenoly expects future net cash flows from this patent to total $210,000. The fair value of the patent is $110.000. Prepare Kenoly's journal entry to record the loss on impairment. searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started