Question

PLEASE ANSWER MY QUESTION BY FOLLOWING THE PICTURE'S SAMPLE INSTRUCTION. QUESTION. Mr. Mahfuz is a service holder. He received basic salary of Tk. 22,500 in

PLEASE ANSWER MY QUESTION BY FOLLOWING THE PICTURE'S SAMPLE INSTRUCTION.

QUESTION.

Mr. Mahfuz is a service holder. He received basic salary of Tk. 22,500 in the month of July 2016 following the salary structure of 18,000 - 1,500 x 4 = 24,000. The date of annual increment is 16 November. Besides basic salary he received: Medical Allowance Tk. 1,500 per month; Conveyance Allowance Tk. 2,500 per month; Entertainment Allowance Tk. 500 per month; Performance bonus Tk. 80,000; Mobile bill allowance Tk. 2,000 per month; and Overtime allowance 25,000. He has been provided free furnished accommodation for which the company paid rent of Tk. 5,500 per month. He received two festival bonuses (one in October and another in December) each equal to one month's basic salary. He contributed 10% of basic salary to Recognized Provident Fund (RPF) like his employer. He received interest @ 16% Tk. 12,800 on the accumulated balance of RPF. During the year he incurred and made the following expenses and investments: Life insurance premium paid: Own (policy value Tk. 500,000) Tk. 60,000 and Spouse (policy value Tk. 300,000) Tk. 25,000; Family expenses Tk. 85,000; Contribution to approved superannuation fund Tk. 48,000; Purchase of shares: Initial public offerings Tk. 40,000; Unlisted company Tk. 30,000; Listed company Tk. 22,000; Donated to: Prime Minister's Relief Fund Tk. 15,000; Religious institution Tk. 10,000; Zakat fund Tk. 30,000; Dhanmondi Sports club Tk. 8,000; Deposited to Pension Scheme per month Tk. 6,000; Purchase of books Tk. 12,000; Purchase of land Tk. 80,000 and Purchase of motor vehicles Tk. 250,000.

Requirements: Calculate taxable income and net tax liability for the assessment year 2017-18

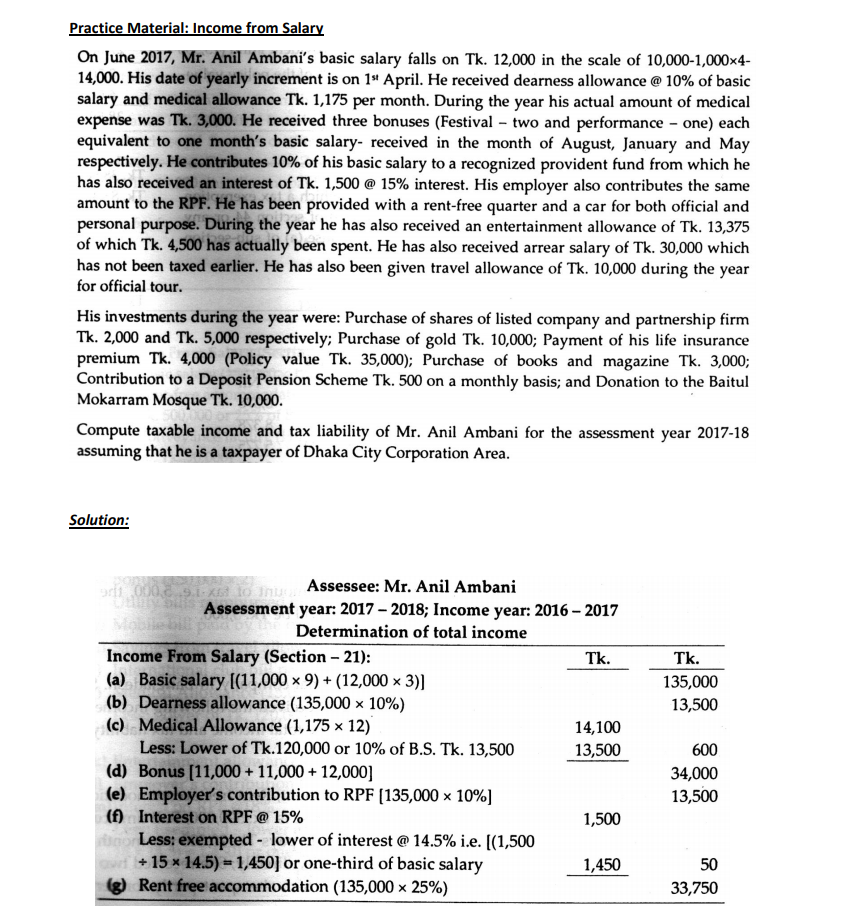

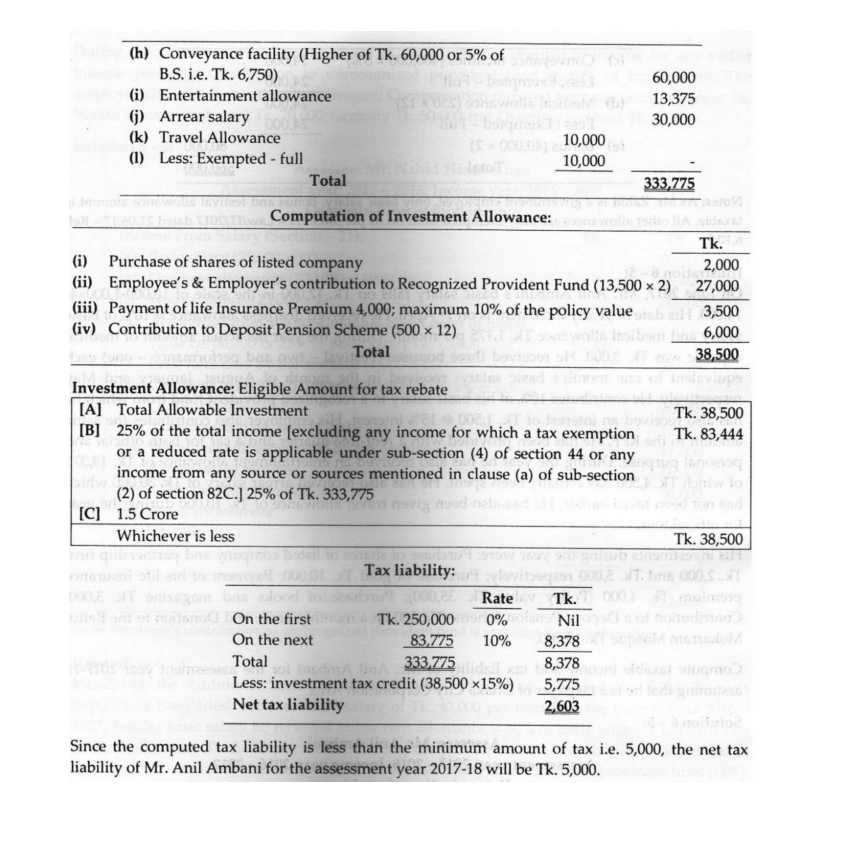

Practice Material: Income from Salary On June 2017, Mr. Anil Ambani's basic salary falls on Tk. 12,000 in the scale of 10,000-1,000x4- 14,000. His date of yearly increment is on 1" April. He received dearness allowance @ 10% of basic salary and medical allowance Tk. 1,175 per month. During the year his actual amount of medical expense was Tk. 3,000. He received three bonuses (Festival two and performance - one) each equivalent to one month's basic salary- received in the month of August, January and May respectively. He contributes 10% of his basic salary to a recognized provident fund from which he has also received an interest of Tk. 1,500 @ 15% interest. His employer also contributes the same amount to the RPF. He has been provided with a rent-free quarter and a car for both official and personal purpose. During the year he has also received an entertainment allowance of Tk. 13,375 of which Tk. 4,500 has actually been spent. He has also received arrear salary of Tk. 30,000 which has not been taxed earlier. He has also been given travel allowance of Tk. 10,000 during the year for official tour. His investments during the year were: Purchase of shares of listed company and partnership firm Tk. 2,000 and Tk. 5,000 respectively; Purchase of gold Tk. 10,000; Payment of his life insurance premium Tk. 4,000 (Policy value Tk. 35,000); Purchase of books and magazine Tk. 3,000; Contribution to a Deposit Pension Scheme Tk. 500 on a monthly basis; and Donation to the Baitul Mokarram Mosque Tk. 10,000. Compute taxable income and tax liability of Mr. Anil Ambani for the assessment year 2017-18 assuming that he is a taxpayer of Dhaka City Corporation Area. Solution: Tk. 135,000 13,500 9000 9.1.X to nie Assessee: Mr. Anil Ambani Assessment year: 2017 - 2018; Income year: 2016 - 2017 Determination of total income Income From Salary (Section - 21): Tk. (a) Basic salary (11,000 x 9) + (12,000 * 3)] (b) Dearness allowance (135,000 ~ 10%) (c) Medical Allowance (1,175 x 12) 14,100 Less: Lower of Tk.120,000 or 10% of B.S. Tk. 13,500 13,500 (d) Bonus [11,000 + 11,000 + 12,000] (e) Employer's contribution to RPF [135,000 10%] (f) Interest on RPF @ 15% 1,500 Less: exempted - lower of interest @ 14.5% i.e. [(1,500 + 15 * 14.5) - 1,450) or one-third of basic salary (8) Rent free accommodation (135,000 x 25%) 600 34,000 13,500 1,450 50 33,750 (h) Conveyance facility (Higher of Tk. 60,000 or 5% of B.S. i.e. Tk. 6,750) (i) Entertainment allowance 6) Arrear salary (k) Travel Allowance (1) Less: Exempted - full Total 60,000 13,375 30,000 (coo) 10,000 10,000 333,775 Computation of Investment Allowance: (i) Purchase of shares of listed company (ii) Employee's & Employer's contribution to Recognized Provident Fund (13,500 x 2) (iii) Payment of life Insurance Premium 4,000; maximum 10% of the policy value (iv) Contribution to Deposit Pension Scheme (500 x 12) Total Tk. 2,000 27,000 3,500 6,000 38,500 Tk. 38,500 Tk. 83,444 Investment Allowance: Eligible Amount for tax rebate [A] Total Allowable Investment [B] 25% of the total income [excluding any income for which a tax exemption or a reduced rate is applicable under sub-section (4) of section 44 or any income from any source or sources mentioned in clause (a) of sub-section (2) of section 82C.) 25% of Tk. 333,775 [C] 1.5 Crore Whichever is less Tax liability: 000 Rate Tk. SA FOTO On the first Tk. 250,000 0% Nil On the next 83,775 10% 8,378 Total 333.775 BOLSA bilidsil 8,378 Less: investment tax credit (38,500 x15%) 5,775 Net tax liability 2,603 Tk. 38,500 Since the computed tax liability is less than the minimum amount of tax i.e. 5,000, the net tax liability of Mr. Anil Ambani for the assessment year 2017-18 will be Tk. 5,000. Practice Material: Income from Salary On June 2017, Mr. Anil Ambani's basic salary falls on Tk. 12,000 in the scale of 10,000-1,000x4- 14,000. His date of yearly increment is on 1" April. He received dearness allowance @ 10% of basic salary and medical allowance Tk. 1,175 per month. During the year his actual amount of medical expense was Tk. 3,000. He received three bonuses (Festival two and performance - one) each equivalent to one month's basic salary- received in the month of August, January and May respectively. He contributes 10% of his basic salary to a recognized provident fund from which he has also received an interest of Tk. 1,500 @ 15% interest. His employer also contributes the same amount to the RPF. He has been provided with a rent-free quarter and a car for both official and personal purpose. During the year he has also received an entertainment allowance of Tk. 13,375 of which Tk. 4,500 has actually been spent. He has also received arrear salary of Tk. 30,000 which has not been taxed earlier. He has also been given travel allowance of Tk. 10,000 during the year for official tour. His investments during the year were: Purchase of shares of listed company and partnership firm Tk. 2,000 and Tk. 5,000 respectively; Purchase of gold Tk. 10,000; Payment of his life insurance premium Tk. 4,000 (Policy value Tk. 35,000); Purchase of books and magazine Tk. 3,000; Contribution to a Deposit Pension Scheme Tk. 500 on a monthly basis; and Donation to the Baitul Mokarram Mosque Tk. 10,000. Compute taxable income and tax liability of Mr. Anil Ambani for the assessment year 2017-18 assuming that he is a taxpayer of Dhaka City Corporation Area. Solution: Tk. 135,000 13,500 9000 9.1.X to nie Assessee: Mr. Anil Ambani Assessment year: 2017 - 2018; Income year: 2016 - 2017 Determination of total income Income From Salary (Section - 21): Tk. (a) Basic salary (11,000 x 9) + (12,000 * 3)] (b) Dearness allowance (135,000 ~ 10%) (c) Medical Allowance (1,175 x 12) 14,100 Less: Lower of Tk.120,000 or 10% of B.S. Tk. 13,500 13,500 (d) Bonus [11,000 + 11,000 + 12,000] (e) Employer's contribution to RPF [135,000 10%] (f) Interest on RPF @ 15% 1,500 Less: exempted - lower of interest @ 14.5% i.e. [(1,500 + 15 * 14.5) - 1,450) or one-third of basic salary (8) Rent free accommodation (135,000 x 25%) 600 34,000 13,500 1,450 50 33,750 (h) Conveyance facility (Higher of Tk. 60,000 or 5% of B.S. i.e. Tk. 6,750) (i) Entertainment allowance 6) Arrear salary (k) Travel Allowance (1) Less: Exempted - full Total 60,000 13,375 30,000 (coo) 10,000 10,000 333,775 Computation of Investment Allowance: (i) Purchase of shares of listed company (ii) Employee's & Employer's contribution to Recognized Provident Fund (13,500 x 2) (iii) Payment of life Insurance Premium 4,000; maximum 10% of the policy value (iv) Contribution to Deposit Pension Scheme (500 x 12) Total Tk. 2,000 27,000 3,500 6,000 38,500 Tk. 38,500 Tk. 83,444 Investment Allowance: Eligible Amount for tax rebate [A] Total Allowable Investment [B] 25% of the total income [excluding any income for which a tax exemption or a reduced rate is applicable under sub-section (4) of section 44 or any income from any source or sources mentioned in clause (a) of sub-section (2) of section 82C.) 25% of Tk. 333,775 [C] 1.5 Crore Whichever is less Tax liability: 000 Rate Tk. SA FOTO On the first Tk. 250,000 0% Nil On the next 83,775 10% 8,378 Total 333.775 BOLSA bilidsil 8,378 Less: investment tax credit (38,500 x15%) 5,775 Net tax liability 2,603 Tk. 38,500 Since the computed tax liability is less than the minimum amount of tax i.e. 5,000, the net tax liability of Mr. Anil Ambani for the assessment year 2017-18 will be Tk. 5,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started