Answered step by step

Verified Expert Solution

Question

1 Approved Answer

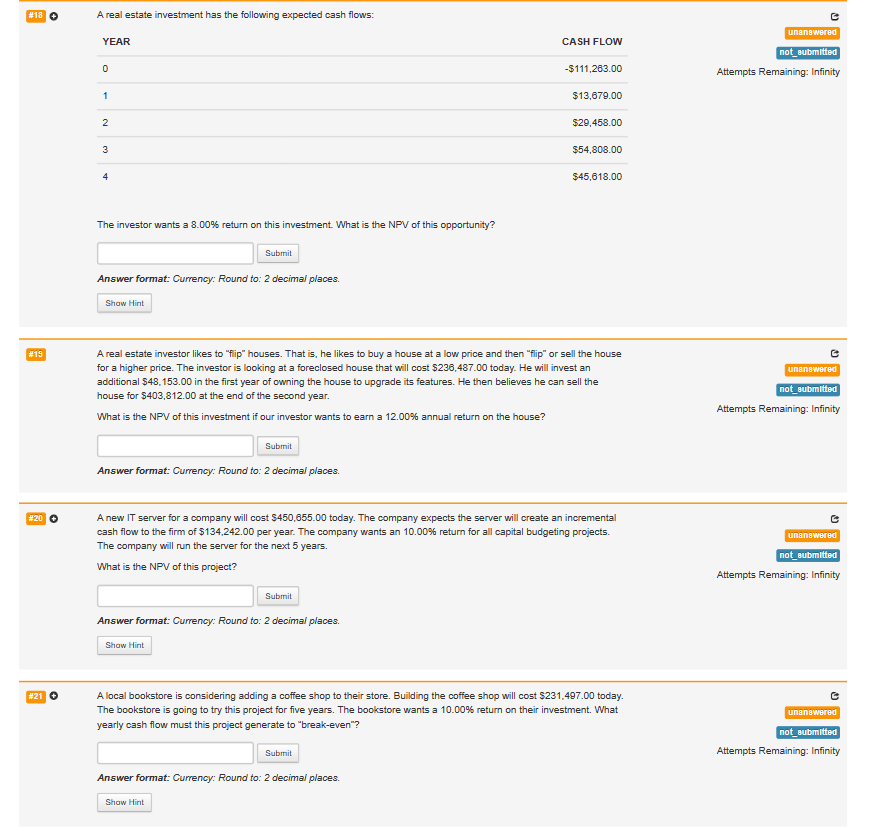

Please answer! No work is needed, just final CORRECT answer. ral aetate investmont hae tha follnwinn avmontar raeh flmwe: Attempts Remaining: Infinity The investor wants

Please answer! No work is needed, just final CORRECT answer.

ral aetate investmont hae tha follnwinn avmontar raeh flmwe: Attempts Remaining: Infinity The investor wants a 8.00% return on this investment. What is the NPV of this opportunity? Answer format: Currency: Round to: 2 decimal places. A real estate investor likes to "flip" houses. That is, he likes to buy a house at a low price and then "flip" or sell the house for a higher price. The investor is looking at a foreclosed house that will cost $236,487.00 today. He will invest an additional $48,153.00 in the first year of owning the house to upgrade its features. He then believes he can sell the house for $403,812.00 at the end of the second year. Attempts Remaining: Infinity What is the NPV of this investment if our investor wants to earn a 12.00% annual return on the house? Answer format: Currency: Round to: 2 decimal places. A new IT server for a company will cost $450,655.00 today. The company expects the server will create an incremental cash flow to the firm of $134,242.00 per year. The company wants an 10.00% return for all capital budgeting projects. The company will run the server for the next 5 years. What is the NPV of this project? Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places. A local bookstore is considering adding a coffee shop to their store. Building the coffee shop will cost $231,497.00 today. The bookstore is going to try this project for five years. The bookstore wants a 10.00% return on their investment. What yearly cash flow must this project generate to "break-evenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started