Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer number 3 using number 2 for help thanks 2. Assume you are 22 years and seck to retire 43 years from now when

please answer number 3 using number 2 for help thanks

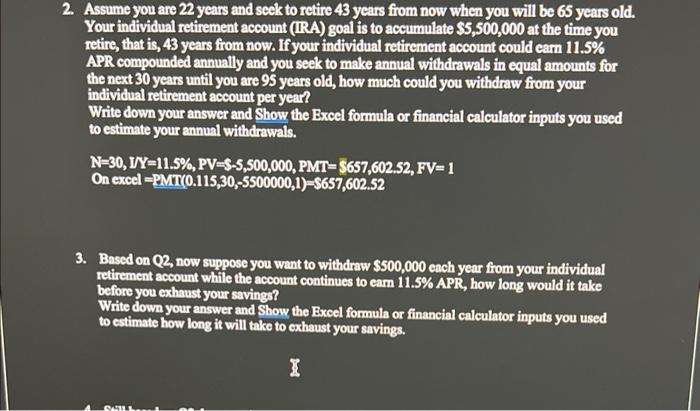

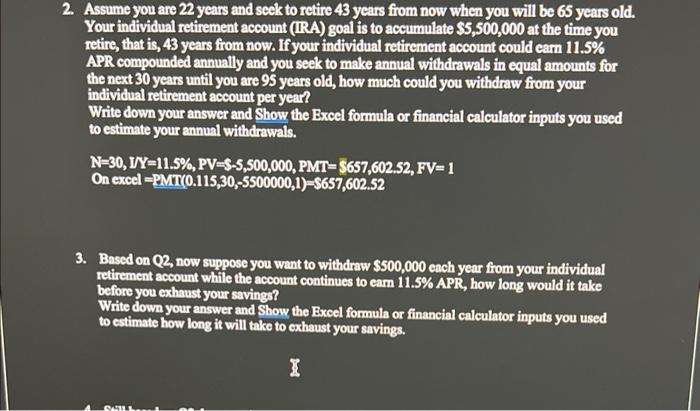

2. Assume you are 22 years and seck to retire 43 years from now when you will be 65 years old. Your individual retirement account (IRA) goal is to accumulate $5,500,000 at the time you retire, that is, 43 years from now. If your individual retirement account could carn 11.5% APR compounded annually and you seek to make annual withdrawals in equal amounts for the next 30 years until you are 95 years old, how much could you withdraw from your individual retirement account per year? Write down your answer and Show the Excel formula or financial calculator inputs you used to estimate your annual withdrawals. N=30,IY=11.5%,PV=35,500,000,PMT=$657,602.52,FV=1Onexcel=PMT(0.115,30,5500000,1)=5657,602.52 3. Based on Q2, now suppose you want to withdraw $500,000 each year from your individual retirement account while the account continues to eam 11.5\% APR, how long would it take before you exhaust your savings? Write down your answer and Show the Excel formula or financial calculator inputs you used to estimate how long it will take to exhaust your savings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started