Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ON EXCEL AND SHOW FORMULAS/EQUATIONS!! THANKS 1) You are 30 years old today and are considering studying for an MBA. You currently earn

PLEASE ANSWER ON EXCEL AND SHOW FORMULAS/EQUATIONS!! THANKS

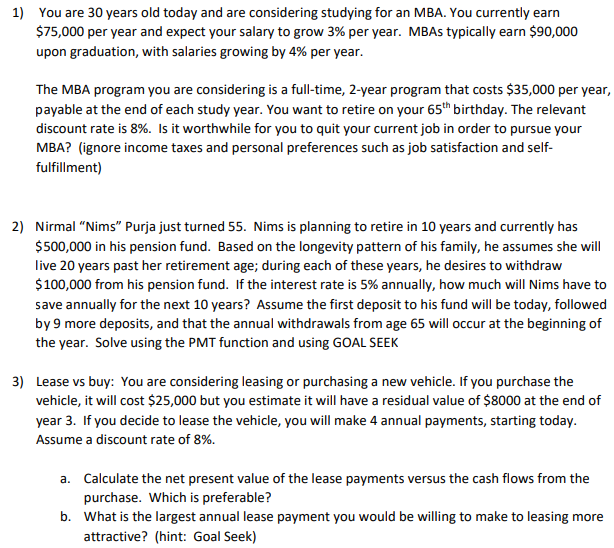

1) You are 30 years old today and are considering studying for an MBA. You currently earn $75,000 per year and expect your salary to grow 3% per year. MBAs typically earn $90,000 upon graduation, with salaries growing by 4% per year. The MBA program you are considering is a full-time, 2-year program that costs $35,000 per year, payable at the end of each study year. You want to retire on your 65th birthday. The relevant discount rate is 8%. Is it worthwhile for you to quit your current job in order to pursue your MBA? (ignore income taxes and personal preferences such as job satisfaction and self- fulfillment) 2) Nirmal "Nims" Purja just turned 55. Nims is planning to retire in 10 years and currently has $500,000 in his pension fund. Based on the longevity pattern of his family, he assumes she will live 20 years past her retirement age; during each of these years, he desires to withdraw $100,000 from his pension fund. If the interest rate is 5% annually, how much will Nims have to save annually for the next 10 years? Assume the first deposit to his fund will be today, followed by 9 more deposits, and that the annual withdrawals from age 65 will occur at the beginning of the year. Solve using the PMT function and using GOAL SEEK 3) Lease vs buy: You are considering leasing or purchasing a new vehicle. If you purchase the vehicle, it will cost $25,000 but you estimate it will have a residual value of $8000 at the end of year 3. If you decide to lease the vehicle, you will make 4 annual payments, starting today. Assume a discount rate of 8%. a. Calculate the net present value of the lease payments versus the cash flows from the purchase. Which is preferable? b. What is the largest annual lease payment you would be willing to make to leasing more attractive? (hint: Goal Seek) 1) You are 30 years old today and are considering studying for an MBA. You currently earn $75,000 per year and expect your salary to grow 3% per year. MBAs typically earn $90,000 upon graduation, with salaries growing by 4% per year. The MBA program you are considering is a full-time, 2-year program that costs $35,000 per year, payable at the end of each study year. You want to retire on your 65th birthday. The relevant discount rate is 8%. Is it worthwhile for you to quit your current job in order to pursue your MBA? (ignore income taxes and personal preferences such as job satisfaction and self- fulfillment) 2) Nirmal "Nims" Purja just turned 55. Nims is planning to retire in 10 years and currently has $500,000 in his pension fund. Based on the longevity pattern of his family, he assumes she will live 20 years past her retirement age; during each of these years, he desires to withdraw $100,000 from his pension fund. If the interest rate is 5% annually, how much will Nims have to save annually for the next 10 years? Assume the first deposit to his fund will be today, followed by 9 more deposits, and that the annual withdrawals from age 65 will occur at the beginning of the year. Solve using the PMT function and using GOAL SEEK 3) Lease vs buy: You are considering leasing or purchasing a new vehicle. If you purchase the vehicle, it will cost $25,000 but you estimate it will have a residual value of $8000 at the end of year 3. If you decide to lease the vehicle, you will make 4 annual payments, starting today. Assume a discount rate of 8%. a. Calculate the net present value of the lease payments versus the cash flows from the purchase. Which is preferable? b. What is the largest annual lease payment you would be willing to make to leasing more attractive? (hint: Goal Seek)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started