Question

Please answer only if you can answer all the questions correctly with a proper explanation. Else leave for other experts. 21. The CRO at a

Please answer only if you can answer all the questions correctly with a proper explanation. Else leave for other experts.

21. The CRO at a bank wants to strengthen the banks capability to defend itself against emerging cyber-threats. To help achieve this goal, the CRO is assessing the current range of practices regarding the sharing of cybersecurity information between different types of institutions, as well as the potential benefits from sharing information. Which of the following statements would be most appropriate for the CRO to make? A. The sharing of cybersecurity information among banks is less frequently observed and generally considered to be less effective than other cyber-security information-sharing practices. B. The scope and depth of information-sharing practices among banks may significantly vary between financial markets, depending on the level of trust among participating banks. C. Information-sharing among different national regulators has evolved significantly over the past several years and is now a widespread practice at a large majority of jurisdictions.

D. Existing peer-sharing mechanisms among banks focus on the exchange of information related to cyber- security incidents, but such information is generally not shared from banks to regulators.

22. A risk manager is training junior risk analysts at an international bank. The manager is instructing them about the difference between repurchase agreements (repos) and reverse repurchase agreements (reverse repos), as well as the relevant market participants. Which of the following is a correct statement for the manager to present to the class? A. A trader who would like to short a bond could enter into a repo to borrow the bond. B. Haircuts on collateral are typically charged to those who lend collateral in repo transactions, but margin calls are usually not made. C. When financing a purchase of securities, financial institutions often sell the repo to avoid putting up full purchase price for the securities. D. Money market mutual funds tend to enter into a repo to invest short-term liquid instruments.

23. The risk audit committee of an equity mutual fund is reviewing a portfolio construction technique proposed by a new portfolio manager who has recently been allocated capital to manage. The fund typically grants its portfolio managers flexibility in selecting and implementing appropriate portfolio construction procedures but requires that any methodology adopted fulfills key risk control objectives set by the firm. Which of the following portfolio construction techniques and its capability for risk control in portfolio construction is correct?

A. Quadratic programming allows for risk control through parameter estimation but generally requires many more inputs estimated from market data than other portfolio construction techniques require. B. The screening technique provides superior risk control by concentrating stocks in selected sectors based on expected alpha. C. When using the stratification technique, risk control is implemented by overweighting the categories with lower risks and underweighting the categories with higher risks. D. When using the linear programming technique, risk is controlled by selecting the portfolio with the lowest level of active risk.

26. A packaging materials manufacturer is considering a project that has an estimated risk-adjusted return on capital (RAROC) of 15%. Suppose that the risk-free rate is 3% per year, the expected market rate of return is 11% per year, and the company's equity beta is 1.8. Using the criterion of adjusted risk-adjusted return on capital (ARAROC), the company should: A. Reject the project because the ARAROC is higher than the market expected excess return. B. Accept the project because the ARAROC is higher than the market expected excess return. C. Reject the project because the ARAROC is lower than the risk-free rate. D. Accept the project because the ARAROC is lower than the risk-free rate.

27. A derivative trading firm only trades derivatives on rare commodities. The company and a handful of other firms, all of whom have large notional outstanding contracts with the company, dominate the market for such derivatives. The companys management would like to mitigate its overall counterparty exposure, with the goal of reducing it to almost zero. Which of the following methods, if implemented, could best achieve this goal? A. Ensuring that sufficient collateral is posted by counterparties B. Diversifying among counterparties C. Cross-product netting on a single counterparty basis D. Purchasing credit derivatives, such as credit default swaps

28. HIP Bank (HIP) often enters into interest rate swaps with ADB Banking Corporation (ADB) on terms that reflect appropriate counterparty risk. Earlier in the year, HIP and ADB entered into a 3-year swap in which ADB agreed to pay HIP a fixed rate of 5% in return for 6-month LIBOR plus a spread. Since the swap was entered into, both banks were downgraded. As a result of the ratings changes, the credit spread for HIP has increased from 36 bps to 144 bps, while the credit spread for ADB has increased from 114 bps to 156 bps. Assuming no change in the LIBOR curve, if an identical 3-year swap was entered into today, which of the following is the most likely to be correct? A. Since HIPs spread increased more than ADBs spread, HIPs DVA will increase and ADBs DVA will decrease. B. Since HIPs spread increased more than ADBs spread, HIPs CVA will increase and ADBs CVA will decrease. C. Since both banks spreads increased, the CVA on both sides of the contract will be higher. D. Since both banks spreads increased, the DVA on both sides of the contract will be lower.

29. A risk analyst estimates that the hazard rate for a company is 0.12 per year. Assuming a constant hazard rate model, what is the probability that the company will survive in the first year and then default before the end of the second year?

A. 8.9% B. 10.0% C. 11.3% D. 21.3%

30. Computing VaR on a portfolio containing a very large number of positions can be simplified by mapping these positions to a smaller number of elementary risk factors. Which of the following mapping techniques for the given positions is the most appropriate? A. USD/EUR forward contracts are mapped to the USD/EUR spot exchange rate. B. Each position in a corporate bond portfolio is mapped to the bond with the closest maturity among a set of government bonds. C. Zero-coupon government bonds are mapped to government bonds paying regular coupons. D. A position in the stock market index is mapped to a position in a stock within that index.

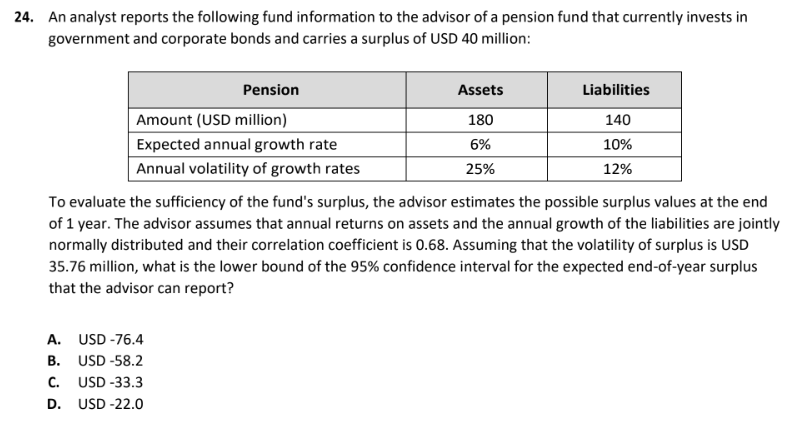

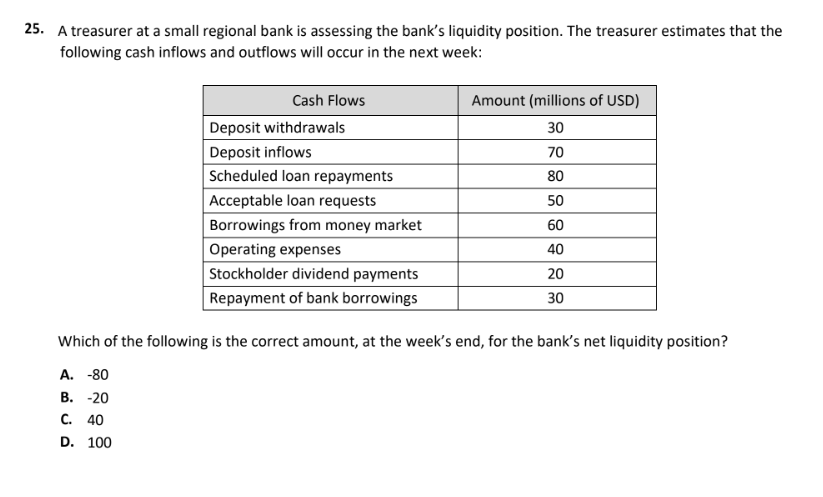

An analyst reports the following fund information to the advisor of a pension fund that currently invests in government and corporate bonds and carries a surplus of USD 40 million: To evaluate the sufficiency of the fund's surplus, the advisor estimates the possible surplus values at the end of 1 year. The advisor assumes that annual returns on assets and the annual growth of the liabilities are jointly normally distributed and their correlation coefficient is 0.68. Assuming that the volatility of surplus is USD 35.76 million, what is the lower bound of the 95% confidence interval for the expected end-of surplear that the advisor can report? A. USD -76.4 B. USD -58.2 C. USD -33.3 D. USD 22.0 5. A treasurer at a small regional bank is assessing the bank's liquidity position. The treasurer estimates that the following cash inflows and outflows will occur in the next week: Which of the following is the correct amount, at the week's end, for the bank's net liquidity position? A. 80 B. 20 C. 40 D. 100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started