Answered step by step

Verified Expert Solution

Question

1 Approved Answer

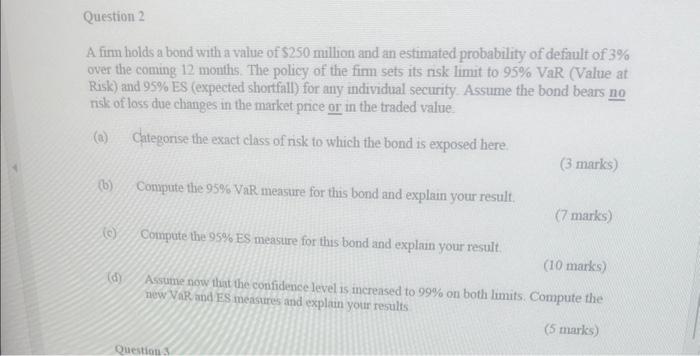

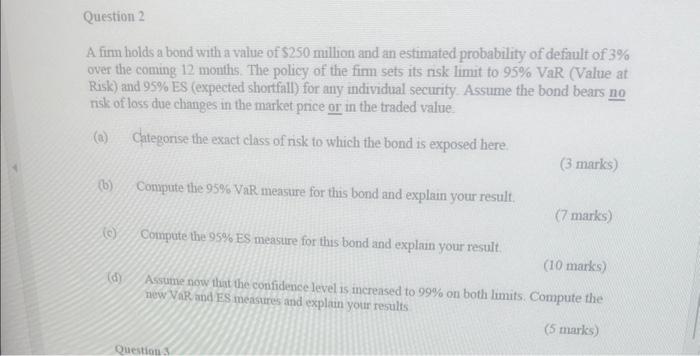

please answer only if you can solve the whole question A fim holds a bond with a value of $250 milhon and an estimated probability

please answer only if you can solve the whole question

A fim holds a bond with a value of $250 milhon and an estimated probability of default of 3% over the coming 12 months. The policy of the firm sets its rak limit to 95%VaR.Value at Risk) and 95% ES (expected shortfall) for any individual security. Assume the bond bears no risk of loss due changes in the market price or in the traded value. (a) Categonse the exact class of nisk to which the bond is exposed here. (3marks) (b) Compute the 95% VaR meastre for this bond and explain your result. (7 marks) (c) Compute the 95% ES meastre for this bond and explan your result. (10marks) (d) Assume now that the confidence level is increased to 99% on both limits. Compute the new VaR ond ES measures and explain your results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started