Answered step by step

Verified Expert Solution

Question

1 Approved Answer

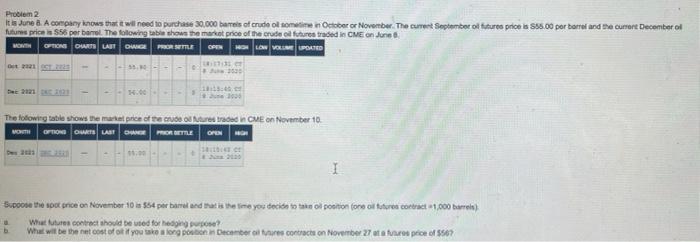

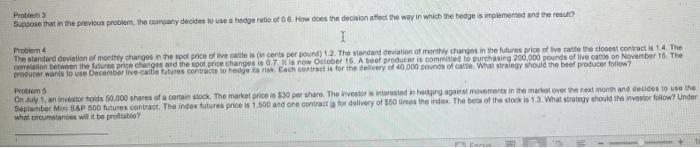

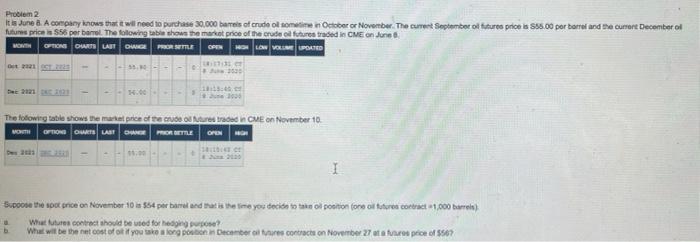

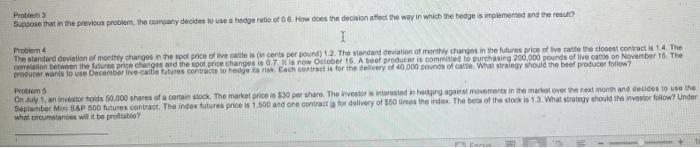

Please answer only problem 3 Problem 2 Ita June 8. A company knows that wil need to purchase 30,000 barrels of crude or sometime in

Please answer only problem 3

Problem 2 Ita June 8. A company knows that wil need to purchase 30,000 barrels of crude or sometime in October or November. The current September of future price is $85.00 per borrel and the currere December ol futurs price is 56 per bal. The following table shows the market price of the crude oil futuros traded in CME on June OF CUT LART DWG PORT OPEN HOW LOW VOLUPDATED Brt 1 - . 300 100 The following table shows the market price of the curred in CME on November 10 MOTH OPTION DE LAST GAME OPEN 1 Suppose the spot once on November 10 i 554 per bare and that is the time you decide toportion one of the contract 1,000 barrels) What u contract should be used for help? What will be the netost t you take a long pon December oltres contract on November 27 et a forespect of 5567 Problem 3 Suppose that in the previous problem, the comey decides to use a hedge ratio of How does the decision afect the way in which the hedge is implemented and there! 1 Probion 4 The stated deviation of monthly changes in the spot price of live cattle is in cents per pound) 12. The standard deviation of many changes in the futures prion of live at the domestici 4. The cortion between the future price charges and the spot price changes is all now October 16. A beof producer is committed to purchasing 200.000 pounds of live catre on November 15 The DOUDO want to use Decarbor live-Guit futures contracts to her. Each contract is for the delivery of 40.000 Bonds of Cat. What to should the beef producer follow? Protions On May an investor hoids 50,000 shares of a certain stock. The market price is 5.30 per here. The involontorstod hedging against movements in the market over the month and decides to use the September Mini SAP 500 futures contract. The index future price is 1.500 and one contraste for delivery of 150 times the index. The best of the stock is 13. What strategy should the investor follow? Under what circumstances will it be profitable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started