Answered step by step

Verified Expert Solution

Question

1 Approved Answer

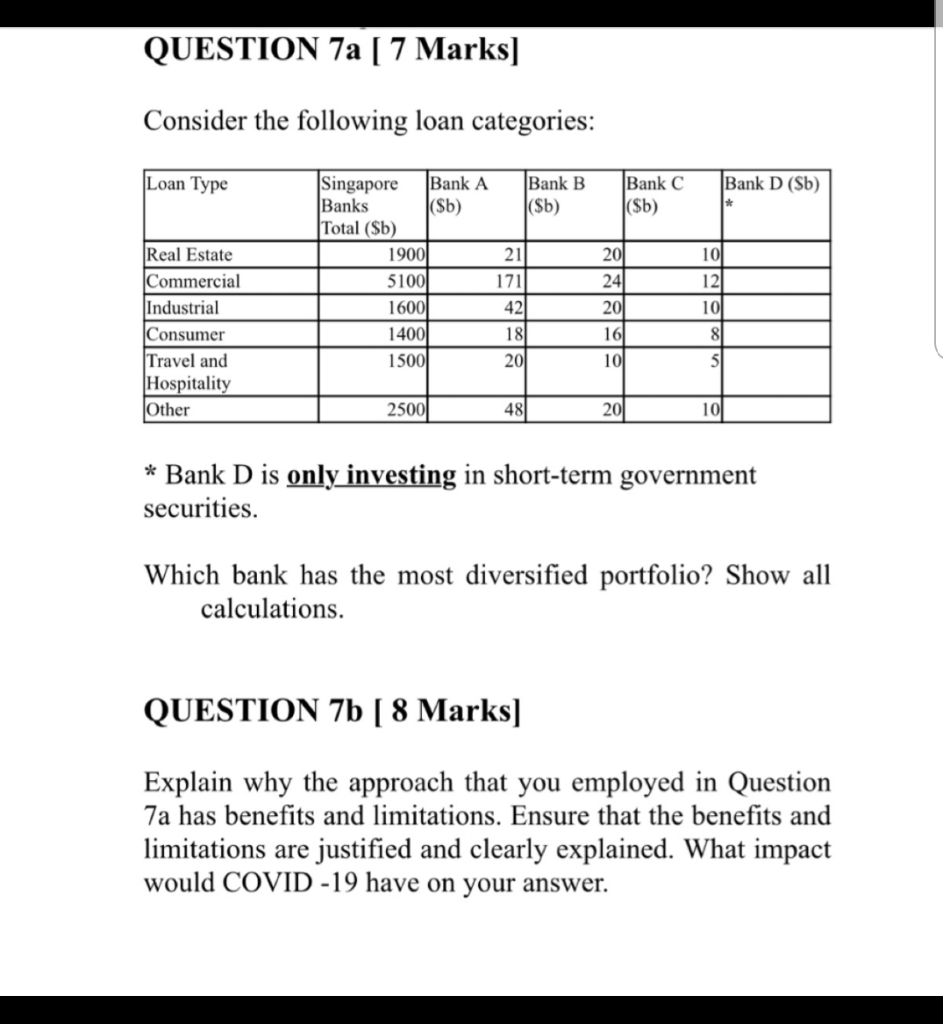

Please answer only question 7b Thank you so much! QUESTION 7a ( 7 Marks] Consider the following loan categories: Loan Type Bank A Bank D

Please answer only question 7b Thank you so much!

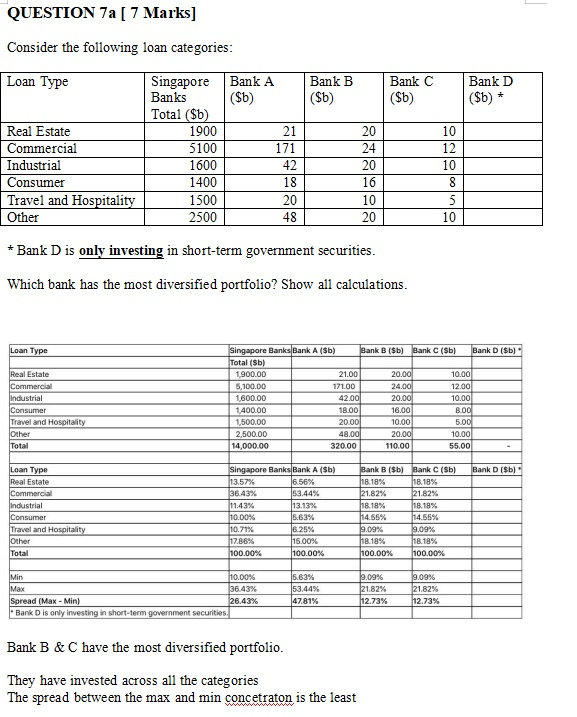

QUESTION 7a ( 7 Marks] Consider the following loan categories: Loan Type Bank A Bank D (Sb) Bank B (Sb) Bank C ($b) * Real Estate Commercial Industrial Consumer Travel and Hospitality Other Singapore Banks (Sb) Total (Sb) 19001 51001 1600 1400 15001 21 171 42 18 20 201 241 20 16 10 10 12 10 8 5 2500 481 201 10 * Bank D is only investing in short-term government securities. Which bank has the most diversified portfolio? Show all calculations. QUESTION 7b [ 8 Marks] Explain why the approach that you employed in Question 7a has benefits and limitations. Ensure that the benefits and limitations are justified and clearly explained. What impact would COVID -19 have on your answer. QUESTION 7a [ 7 Marks] Consider the following loan categories: Loan Type Bank A ($6) Bank B ($b) Bank C ($) Bank D ($b) * Real Estate Commercial Industrial Consumer Travel and Hospitality Other Singapore Banks Total ($) 1900 5100 1600 1400 1500 2500 21 171 42 18 20 48 20 24 20 16 10 20 10 12 10 8 5 10 * Bank D is only investing in short-term government securities. Which bank has the most diversified portfolio? Show all calculations. Loan Type Real Estate Commercial Industrial Consumer Travel and Hospitality Other Total Singapore Banks Bank A ($b) Bank B ($b) Bank C (Sb) Bank D ($b) Total (Sb) 1.900.00 21.00 20.00 10.00 5,100.00 171.00 24.00 12.00 1,600.00 42.00 20.00 10.00 1,400.00 18.00 16.00 8.00 1,500.00 20.00 10.00 5.00 2,500.00 48.00 20.00 10.00 14,000.00 320.00 110.00 55.00 Bank D (sb) Loan Type Real Estate Commercial industrial Consumer Travel and Hospitality Other Total Singapore Banks Bank A (Sb) 13.57% 16.56% 36.43% 53.44% 11.43% 13.13% 10.00% 5.63% 10.71% 6.25% 17.86% 15.00% 100.00% 100.00% Bank B (b) Bank (Sb) 18.18% 18.18% 21.82% 21.82% 18.18% 18.18% 14.55% 14.55% 9.09% 9.09% 18.18% 18.18% 100.00% 100.00% Min 10.00% Max 36.43% Spread (Max - Min) 26.43% Bank D is only investing in short-term government securities. 5.63% 53.44% 47.81% 9.09% 21.82% 12.73% 9.09% 21.82% 12.73% Bank B & C have the most diversified portfolio. They have invested across all the categories The spread between the max and min concetraton is the least QUESTION 7a ( 7 Marks] Consider the following loan categories: Loan Type Bank A Bank D (Sb) Bank B (Sb) Bank C ($b) * Real Estate Commercial Industrial Consumer Travel and Hospitality Other Singapore Banks (Sb) Total (Sb) 19001 51001 1600 1400 15001 21 171 42 18 20 201 241 20 16 10 10 12 10 8 5 2500 481 201 10 * Bank D is only investing in short-term government securities. Which bank has the most diversified portfolio? Show all calculations. QUESTION 7b [ 8 Marks] Explain why the approach that you employed in Question 7a has benefits and limitations. Ensure that the benefits and limitations are justified and clearly explained. What impact would COVID -19 have on your answer. QUESTION 7a [ 7 Marks] Consider the following loan categories: Loan Type Bank A ($6) Bank B ($b) Bank C ($) Bank D ($b) * Real Estate Commercial Industrial Consumer Travel and Hospitality Other Singapore Banks Total ($) 1900 5100 1600 1400 1500 2500 21 171 42 18 20 48 20 24 20 16 10 20 10 12 10 8 5 10 * Bank D is only investing in short-term government securities. Which bank has the most diversified portfolio? Show all calculations. Loan Type Real Estate Commercial Industrial Consumer Travel and Hospitality Other Total Singapore Banks Bank A ($b) Bank B ($b) Bank C (Sb) Bank D ($b) Total (Sb) 1.900.00 21.00 20.00 10.00 5,100.00 171.00 24.00 12.00 1,600.00 42.00 20.00 10.00 1,400.00 18.00 16.00 8.00 1,500.00 20.00 10.00 5.00 2,500.00 48.00 20.00 10.00 14,000.00 320.00 110.00 55.00 Bank D (sb) Loan Type Real Estate Commercial industrial Consumer Travel and Hospitality Other Total Singapore Banks Bank A (Sb) 13.57% 16.56% 36.43% 53.44% 11.43% 13.13% 10.00% 5.63% 10.71% 6.25% 17.86% 15.00% 100.00% 100.00% Bank B (b) Bank (Sb) 18.18% 18.18% 21.82% 21.82% 18.18% 18.18% 14.55% 14.55% 9.09% 9.09% 18.18% 18.18% 100.00% 100.00% Min 10.00% Max 36.43% Spread (Max - Min) 26.43% Bank D is only investing in short-term government securities. 5.63% 53.44% 47.81% 9.09% 21.82% 12.73% 9.09% 21.82% 12.73% Bank B & C have the most diversified portfolio. They have invested across all the categories The spread between the max and min concetraton is the leastStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started