Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer only question C Comprehensive Exercise on Portfolio Valuation (Two-Asset Case) Regent Portfolio Management Limited (RPML) have an opportunity of investing Mr. Clark's N7.5million

please answer only question C

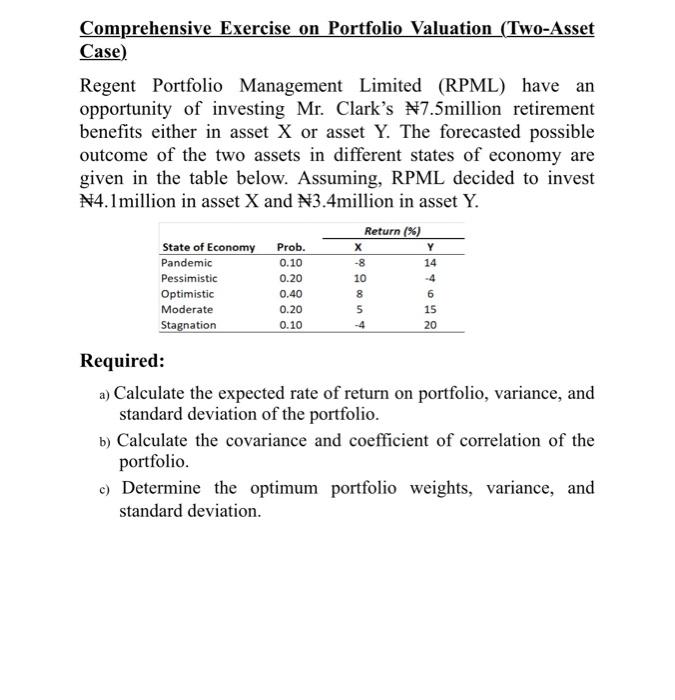

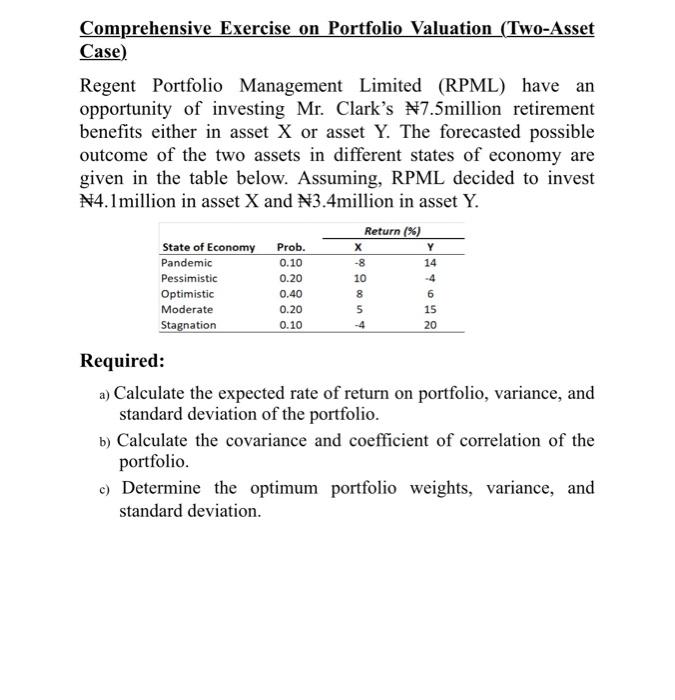

Comprehensive Exercise on Portfolio Valuation (Two-Asset Case) Regent Portfolio Management Limited (RPML) have an opportunity of investing Mr. Clark's N7.5million retirement benefits either in asset X or asset Y. The forecasted possible outcome of the two assets in different states of economy are given in the table below. Assuming, RPML decided to invest N4.1million in asset X and N3.4million in asset Y. State of Economy Pandemic Pessimistic Optimistic Moderate Stagnation Prob. 0.10 0.20 0.40 0.20 0.10 Return (%) Y -8 14 10 -4 8 6 5 15 20 Required: a) Calculate the expected rate of return on portfolio, variance, and standard deviation of the portfolio. b) Calculate the covariance and coefficient of correlation of the portfolio c) Determine the optimum portfolio weights, variance, and standard deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started