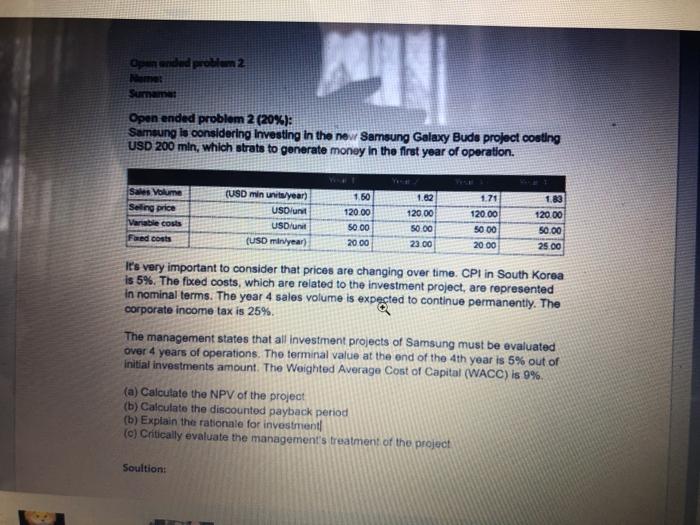

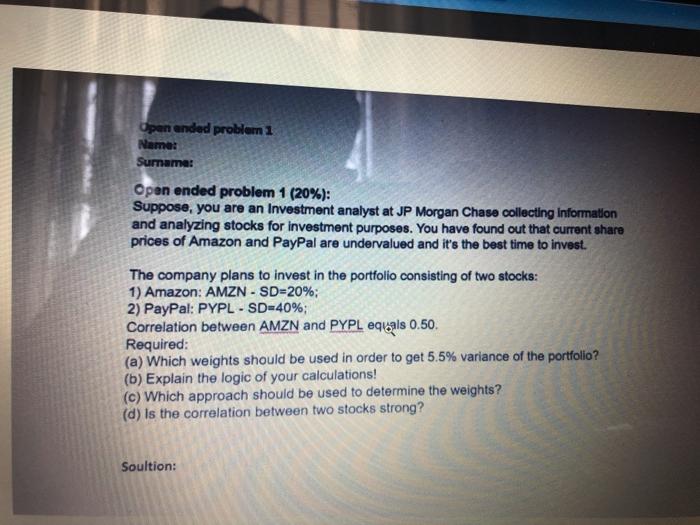

Open anded problem 2 Home: Sumama Open ended problem 2 (20%): Samsung is considering Investing in the new Samsung Galaxy Buds project costing USD 200 min, which strats to generate money in the first year of operation. 1.62 Sales Volume Seling price Variable costs Faed costs (USD min units year) USOlunt USD/unit (USD myear) 1.50 120.00 50.00 120.00 50.00 23 00 1.71 120.00 50 00 2000 1.83 120.00 50.00 25.00 2000 It's very important to consider that prices are changing over time. CPI in South Korea is 5%. The fixed costs, which are related to the investment project, are represented in nominal terms. The year 4 sales volume is expected to continue permanently. The corporate income tax is 25%. The management states that all investment projects of Samsung must be evaluated over 4 years of operations. The terminal value at the end of the 4th year is 5% out of initial investments amount. The Weighted Average Cost of Capital (WACC) is 9% (a) Calculate the NPV of the project (b) Calculate the discounted payback period (b) Explain the rationale for investment (c) Critically evaluate the management's treatment of the project Soultion: Open anded problem 1 Name: Surname: Open ended problem 1 (20%): Suppose, you are an Investment analyst at JP Morgan Chase collecting Information and analyzing stocks for investment purposes. You have found out that current share prices of Amazon and PayPal are undervalued and it's the best time to invest. The company plans to invest in the portfolio consisting of two stocks: 1) Amazon: AMZN - SD=20%; 2) PayPal: PYPL - SD=40%; Correlation between AMZN and PYPL equals 0.50 Required: (a) Which weights should be used in order to get 5.5% variance of the portfolio? (b) Explain the logic of your calculations! (c) Which approach should be used to determine the weights? (d) is the correlation between two stocks strong? Soultion: Open anded problem 2 Home: Sumama Open ended problem 2 (20%): Samsung is considering Investing in the new Samsung Galaxy Buds project costing USD 200 min, which strats to generate money in the first year of operation. 1.62 Sales Volume Seling price Variable costs Faed costs (USD min units year) USOlunt USD/unit (USD myear) 1.50 120.00 50.00 120.00 50.00 23 00 1.71 120.00 50 00 2000 1.83 120.00 50.00 25.00 2000 It's very important to consider that prices are changing over time. CPI in South Korea is 5%. The fixed costs, which are related to the investment project, are represented in nominal terms. The year 4 sales volume is expected to continue permanently. The corporate income tax is 25%. The management states that all investment projects of Samsung must be evaluated over 4 years of operations. The terminal value at the end of the 4th year is 5% out of initial investments amount. The Weighted Average Cost of Capital (WACC) is 9% (a) Calculate the NPV of the project (b) Calculate the discounted payback period (b) Explain the rationale for investment (c) Critically evaluate the management's treatment of the project Soultion: Open anded problem 1 Name: Surname: Open ended problem 1 (20%): Suppose, you are an Investment analyst at JP Morgan Chase collecting Information and analyzing stocks for investment purposes. You have found out that current share prices of Amazon and PayPal are undervalued and it's the best time to invest. The company plans to invest in the portfolio consisting of two stocks: 1) Amazon: AMZN - SD=20%; 2) PayPal: PYPL - SD=40%; Correlation between AMZN and PYPL equals 0.50 Required: (a) Which weights should be used in order to get 5.5% variance of the portfolio? (b) Explain the logic of your calculations! (c) Which approach should be used to determine the weights? (d) is the correlation between two stocks strong? Soultion