Question

PLEASE ANSWER PART 4 ALL OTHER ANSWERS ARE PROVIDED Using the married filing jointly status and their income and expense statement, calculate the 2017 tax

PLEASE ANSWER PART 4 ALL OTHER ANSWERS ARE PROVIDED

Using the married filing jointly status and their income and expense statement, calculate the

2017

tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the following itemizeddeductions:

| Income | Expenses | |||

| Earned income | $56,000.00 | Home mortgage interest | $8,500.00 | |

| Interest income | 2,100.00 | Real estate and state income taxes | 3,800.00 | |

| Miscellaneous deductions | 700.00 |

Shameka and Curtis' total gross income for the

2017

tax year is

$58100.

(Round to the nearest cent.)

Part 2

Assuming Shameka and Curtis are filing jointly, their exemption amount for the

2017

tax year is

$8,100.00

(Round to the nearest cent.)

Part 3

If Shameka and Curtis use the standard deduction, their standard deduction amount for the

2017

tax year is

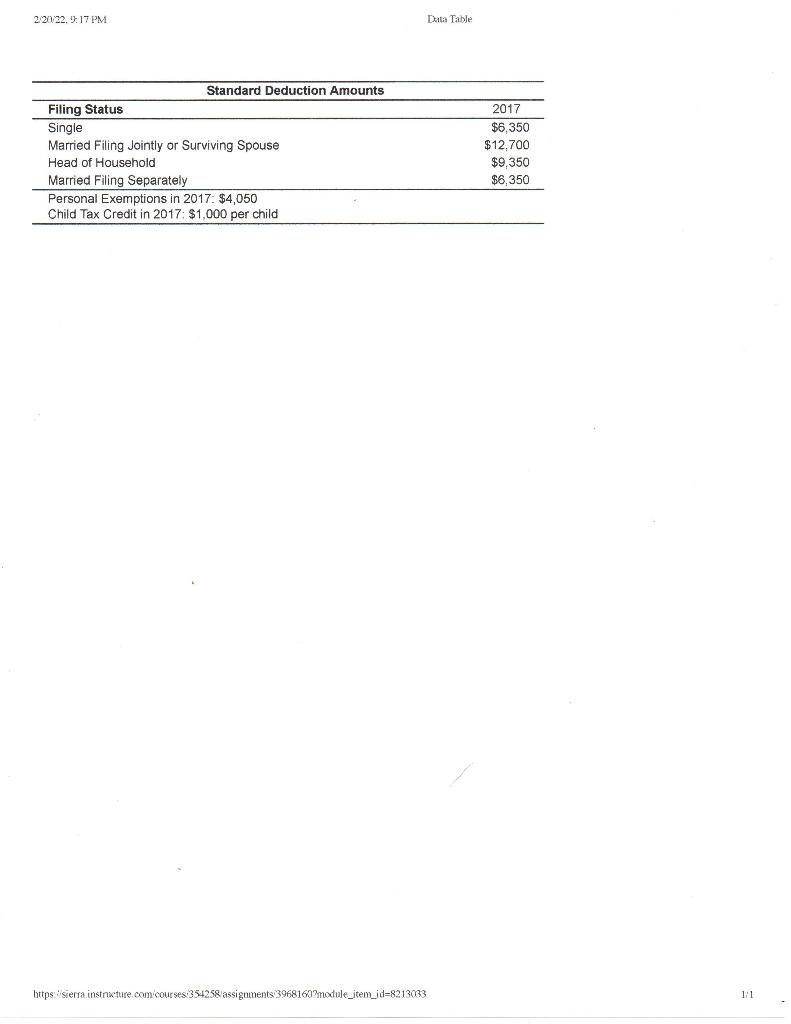

$12700 (Round to the nearest dollar.)Note: Miscellaneousdeductions, unlike charitable contributions are subject to a deduction threshold.) Click the following link for a

standard

deduction table.

LOADING...

Part 4

Their taxable income for the

2017

tax year is ????

$enter your response here.

(Round to the nearest cent.)

2:20 22.9.17 PM Data Table Standard Deduction Amounts Filing Status Single Married Filing Jointly or Surviving Spouse Head of Household Married Filing Separately Personal Exemptions in 2017: $4,050 Child Tax Credit in 2017: $1,000 per child 2017 $6.350 $12.700 $9,350 $6,350 https: sierra instrxture com courses 354258 assignments 3968160?module_item_id=8213033 1:1 2:20 22.9.17 PM Data Table Standard Deduction Amounts Filing Status Single Married Filing Jointly or Surviving Spouse Head of Household Married Filing Separately Personal Exemptions in 2017: $4,050 Child Tax Credit in 2017: $1,000 per child 2017 $6.350 $12.700 $9,350 $6,350 https: sierra instrxture com courses 354258 assignments 3968160?module_item_id=8213033 1:1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started