Answered step by step

Verified Expert Solution

Question

1 Approved Answer

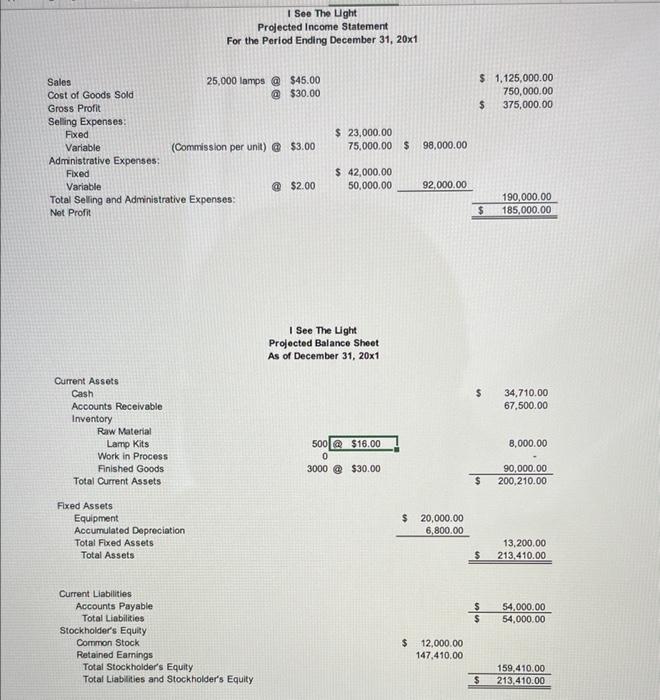

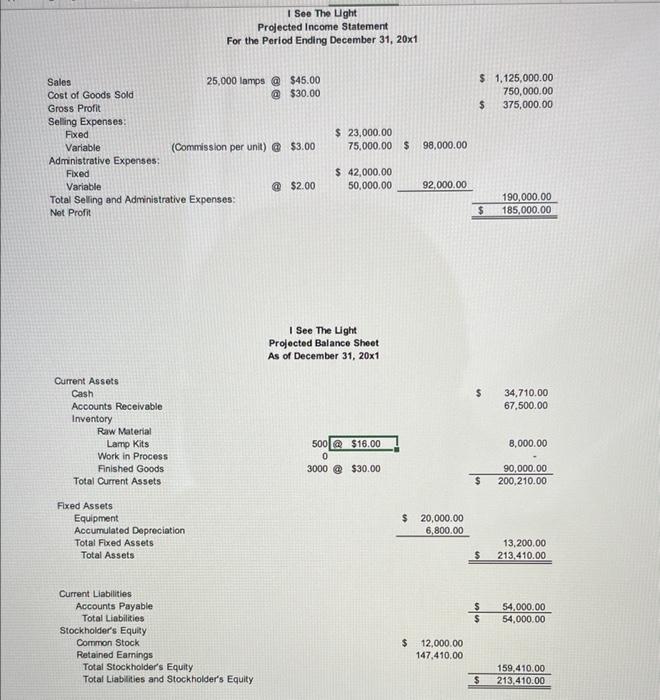

Please answer part 4 and 5 with all work Asap! Thanks! I See The Ught Projected Income Statement For the Period Ending December 31, 20x1

Please answer part 4 and 5 with all work Asap! Thanks!

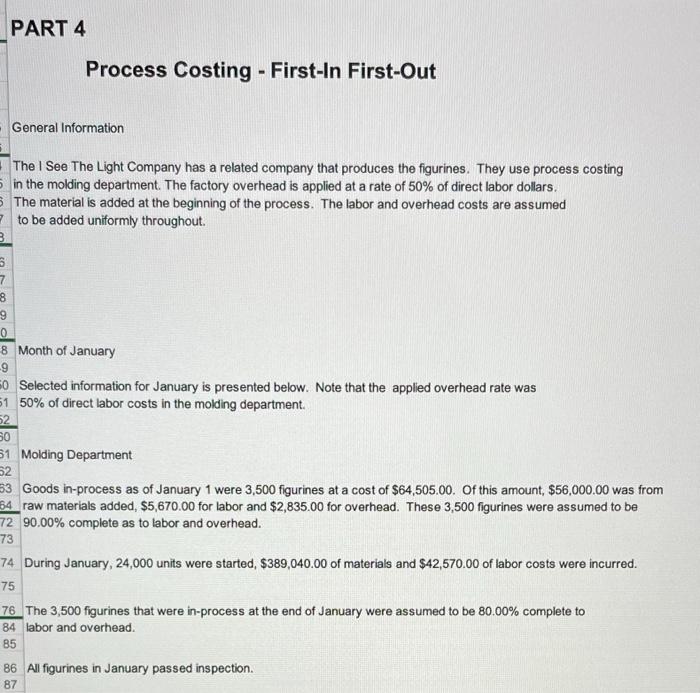

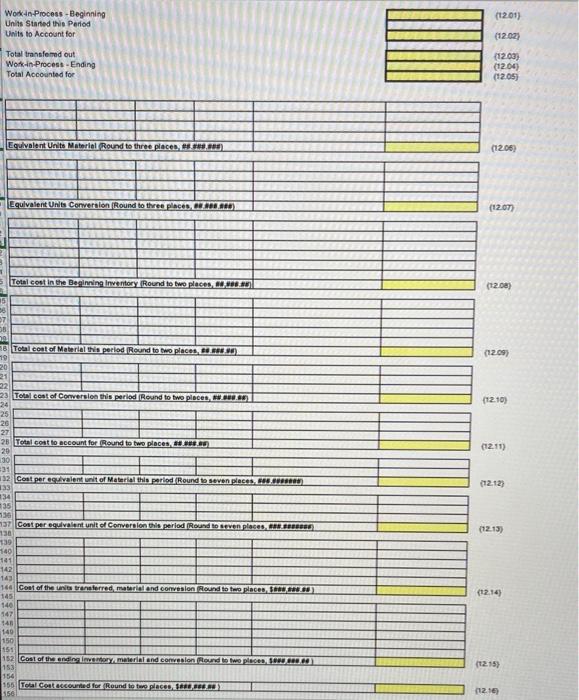

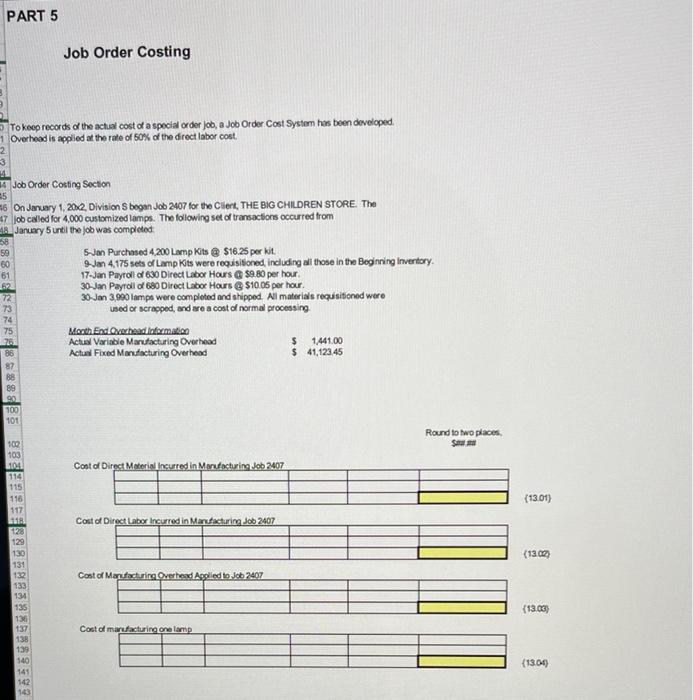

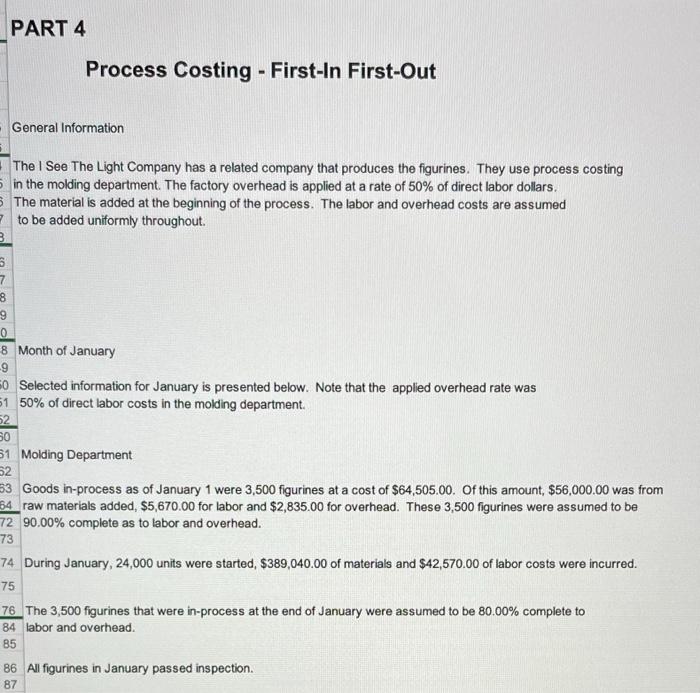

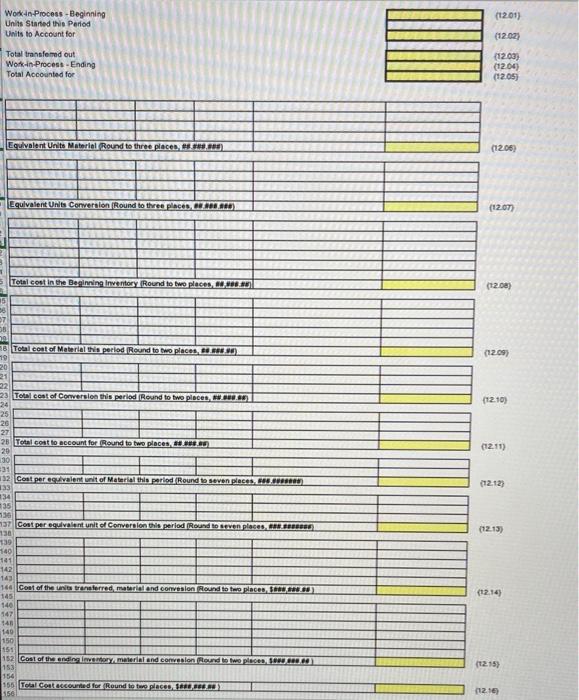

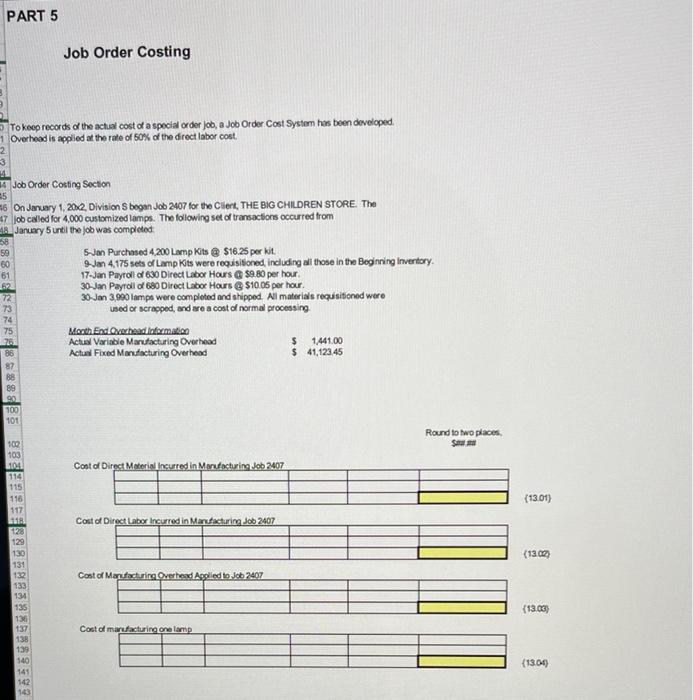

I See The Ught Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 750,000.00 $ 375,000.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $30.00 Gross Profit Selling Expenses Fixed Variable (Commission per unit) @ $3.00 Administrative Expenses Fixed Variable @ $2.00 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 75,000.00 $ 98,000.00 $ 42,000.00 50,000.00 92,000.00 190,000.00 185,000.00 $ I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8,000.00 500 @ $16.00 0 3000 $30.00 90,000.00 200,210.00 $ Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 $ 13,200.00 213,410.00 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 147.410.00 159.410.00 213,410.00 $ PART 4 Process Costing - First-In First-Out General Information The I See The Light Company has a related company that produces the figurines. They use process costing s in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. 5. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. 7 3 5 7 8 9 0 8 Month of January -9 0 Selected information for January is presented below. Note that the applied overhead rate was 51 50% of direct labor costs in the molding department. 52 50 51 Molding Department 52 53 Goods in-process as of January 1 were 3,500 figurines at a cost of $64,505.00. Of this amount, $56,000.00 was from 54 raw materials added, $5,670.00 for labor and $2,835.00 for overhead. These 3,500 figurines were assumed to be 72 90.00% complete as to labor and overhead. 73 74 During January, 24,000 units were started, $389,040.00 of materials and $42,570.00 of labor costs were incurred. 75 76 The 3,500 figurines that were in-process at the end of January were assumed to be 80.00% complete to 84 labor and overhead. 85 86 All figurines in January passed inspection 87 (1201) Work in Process -Beginning Units Started the Period Units to Account for (12.02) Total transferred out Work in Process - Ending Total Accounted for (12.03) (1200 (1205) Equivalent Unito Material Round to three places (12.06) Equivalent UNES Conversion Round to the places ABSO (12.07 Total cost in the Beginning Inventory Round to two places (12.00) 5 (12.09 (12.109 (12.11) (12.12) 37 35 20 78 Total cost of Material is period Round to two places, S.R.O 19 20 21 22 23 Total cost of Conversion this period Round to two places, U.2.88) 25 26 27 28 Total cost to account for Round to two places, .. 29 30 31 132 Cost percevalent of Material this period Round to seven places. RRERO 133 234 35 36 137 Cost per equivalent unit of Conversion period Round seven places, RBSED 130 139 140 181 142 143 16 Cost of the warensferred material and convenion Round to the places so 140 147 140 140 150 151 152Cost of thingsmaterial and convenient found to two pieces 153 154 155 Total Concounted for Round to two places 1.B ASSO 1156 (12.13) 145 (12.14 (1215) 12.10 PART 5 Job Order Costing To keep records of the actual cost of a special order job, a Job Order Cost System has been developed 1 Overhead is applied at the rate of 50% of the direct labor cost 2 3 24 Job Order Costing Section 45 6 On January 1, 202. Division S began Job 2407 for the Client, THE BIG CHILDREN STORE The 7 Job called for 4,000 customized lamps. The following set of transactions occurred from 18 January 5 until the job was completed 58 59 sjan Purchased 4 200 Lump Kits @ $16.25 per kit. 60 9. Jan 4,175 sets of Lomp Kits were requisitioned, including all those in the Beginning invertory 61 17-Jan Payroll 630 Direct Labor Hours $9 80 per hour 62 30-Jan Payroll of 680 Direct Labor Hours $10.05 per hour 72 30 Jan 3.900 lamps were completed and shipped. All materials requisitioned were 73 used or scrapped, and are a cost of normal processing 74 75 Morth End Overhead Information Actual Variable Manufacturing Overhead $ 1.44100 Actual Fixed Manufacturing Overhead $ 41,12345 89 98 100 101 Round to two places 100 103 Cost of Direct Material incurred in Manufacturing Job 2407 114 115 116 117 (13.01) Cost of Direct Labor Incurred in Manufacturing Job 2407 (13.023 Cost of Manufacturing Overhead Applied to Job 2407 128 129 130 131 132 133 131 135 136 137 138 139 140 145 142 143 (13.03) Cost of manufacturing one lamp (13.00) I See The Ught Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 750,000.00 $ 375,000.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $30.00 Gross Profit Selling Expenses Fixed Variable (Commission per unit) @ $3.00 Administrative Expenses Fixed Variable @ $2.00 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 75,000.00 $ 98,000.00 $ 42,000.00 50,000.00 92,000.00 190,000.00 185,000.00 $ I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8,000.00 500 @ $16.00 0 3000 $30.00 90,000.00 200,210.00 $ Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 $ 13,200.00 213,410.00 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 147.410.00 159.410.00 213,410.00 $ PART 4 Process Costing - First-In First-Out General Information The I See The Light Company has a related company that produces the figurines. They use process costing s in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. 5. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. 7 3 5 7 8 9 0 8 Month of January -9 0 Selected information for January is presented below. Note that the applied overhead rate was 51 50% of direct labor costs in the molding department. 52 50 51 Molding Department 52 53 Goods in-process as of January 1 were 3,500 figurines at a cost of $64,505.00. Of this amount, $56,000.00 was from 54 raw materials added, $5,670.00 for labor and $2,835.00 for overhead. These 3,500 figurines were assumed to be 72 90.00% complete as to labor and overhead. 73 74 During January, 24,000 units were started, $389,040.00 of materials and $42,570.00 of labor costs were incurred. 75 76 The 3,500 figurines that were in-process at the end of January were assumed to be 80.00% complete to 84 labor and overhead. 85 86 All figurines in January passed inspection 87 (1201) Work in Process -Beginning Units Started the Period Units to Account for (12.02) Total transferred out Work in Process - Ending Total Accounted for (12.03) (1200 (1205) Equivalent Unito Material Round to three places (12.06) Equivalent UNES Conversion Round to the places ABSO (12.07 Total cost in the Beginning Inventory Round to two places (12.00) 5 (12.09 (12.109 (12.11) (12.12) 37 35 20 78 Total cost of Material is period Round to two places, S.R.O 19 20 21 22 23 Total cost of Conversion this period Round to two places, U.2.88) 25 26 27 28 Total cost to account for Round to two places, .. 29 30 31 132 Cost percevalent of Material this period Round to seven places. RRERO 133 234 35 36 137 Cost per equivalent unit of Conversion period Round seven places, RBSED 130 139 140 181 142 143 16 Cost of the warensferred material and convenion Round to the places so 140 147 140 140 150 151 152Cost of thingsmaterial and convenient found to two pieces 153 154 155 Total Concounted for Round to two places 1.B ASSO 1156 (12.13) 145 (12.14 (1215) 12.10 PART 5 Job Order Costing To keep records of the actual cost of a special order job, a Job Order Cost System has been developed 1 Overhead is applied at the rate of 50% of the direct labor cost 2 3 24 Job Order Costing Section 45 6 On January 1, 202. Division S began Job 2407 for the Client, THE BIG CHILDREN STORE The 7 Job called for 4,000 customized lamps. The following set of transactions occurred from 18 January 5 until the job was completed 58 59 sjan Purchased 4 200 Lump Kits @ $16.25 per kit. 60 9. Jan 4,175 sets of Lomp Kits were requisitioned, including all those in the Beginning invertory 61 17-Jan Payroll 630 Direct Labor Hours $9 80 per hour 62 30-Jan Payroll of 680 Direct Labor Hours $10.05 per hour 72 30 Jan 3.900 lamps were completed and shipped. All materials requisitioned were 73 used or scrapped, and are a cost of normal processing 74 75 Morth End Overhead Information Actual Variable Manufacturing Overhead $ 1.44100 Actual Fixed Manufacturing Overhead $ 41,12345 89 98 100 101 Round to two places 100 103 Cost of Direct Material incurred in Manufacturing Job 2407 114 115 116 117 (13.01) Cost of Direct Labor Incurred in Manufacturing Job 2407 (13.023 Cost of Manufacturing Overhead Applied to Job 2407 128 129 130 131 132 133 131 135 136 137 138 139 140 145 142 143 (13.03) Cost of manufacturing one lamp (13.00)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started