Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER PART B Note: You can right-click the image then open in a new tab to better see the problem Exercise 5-1 On January

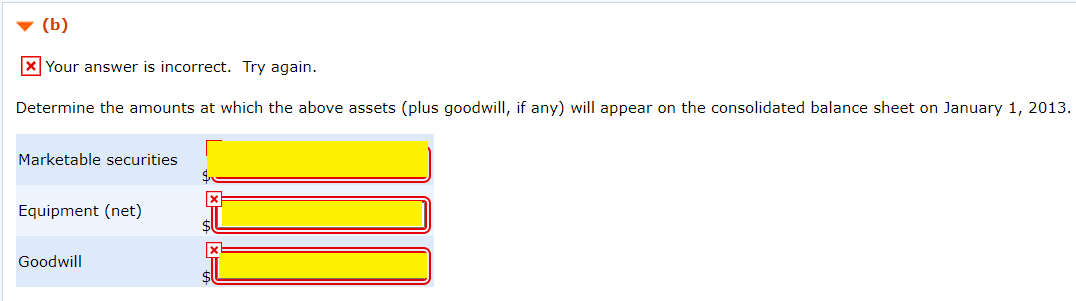

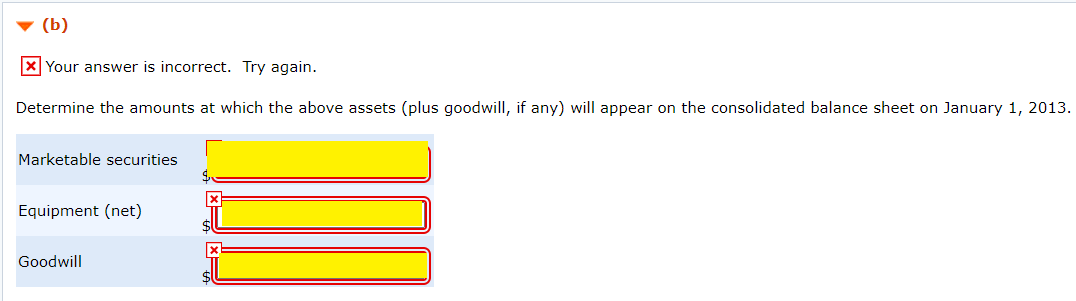

PLEASE ANSWER PART B

Note: You can right-click the image then open in a new tab to better see the problem

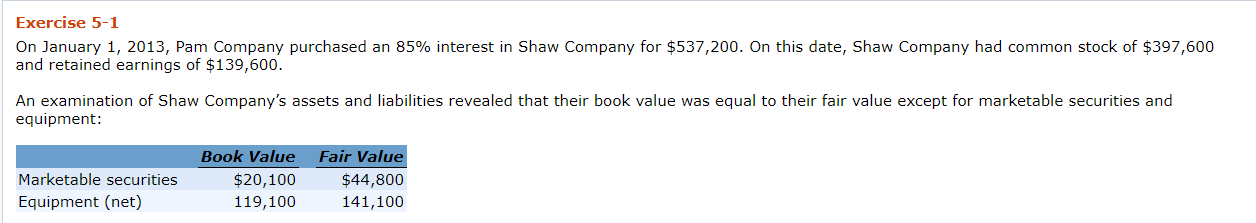

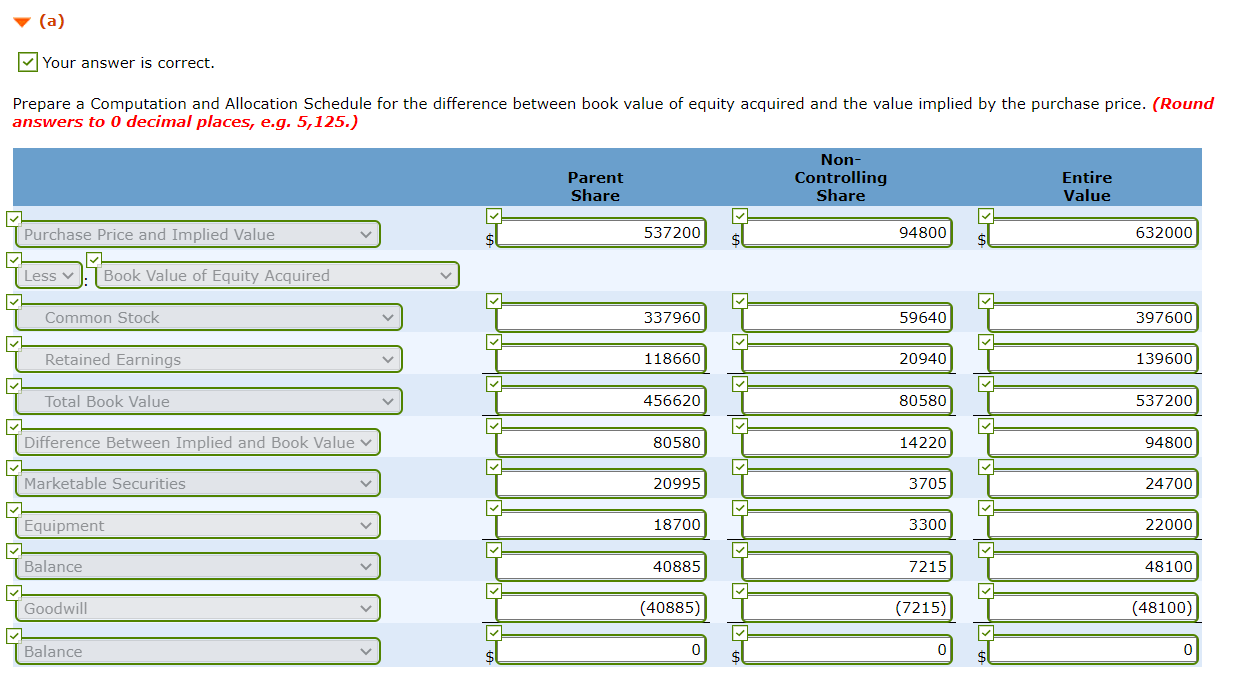

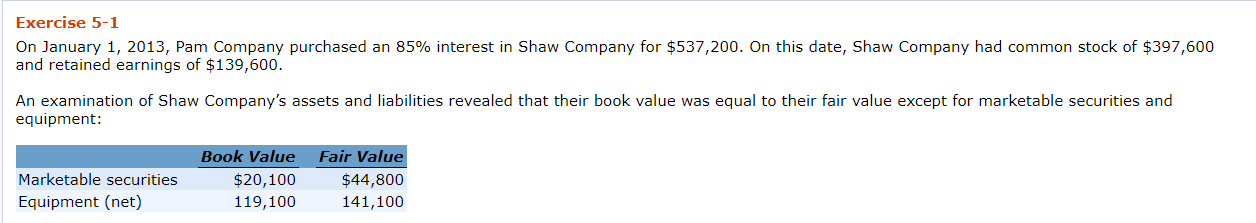

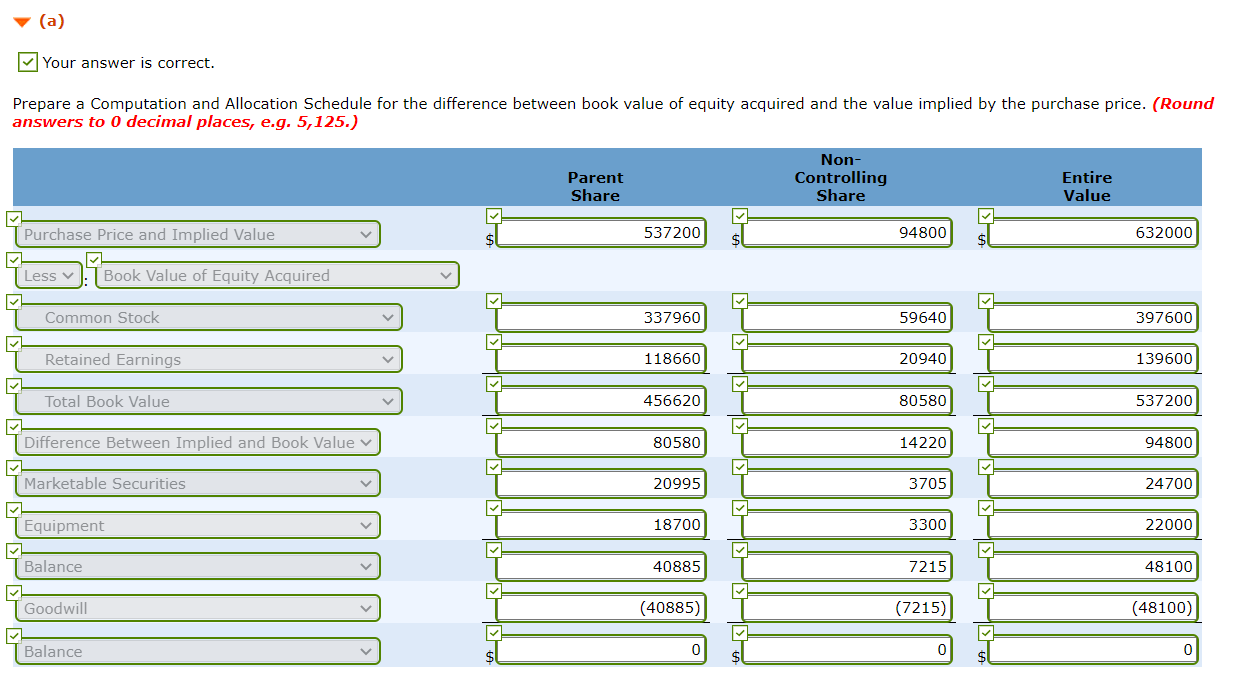

Exercise 5-1 On January 1, 2013, Pam Company purchased an 85% interest in Shaw Company for $537,200. On this date, Shaw Company had common stock of $397,600 and retained earnings of $139,600. An examination of Shaw Company's assets and liabilities revealed that their book value was equal to their fair value except for marketable securities and equipment: Marketable securities Equipment (net) Book Value $20,100 119,100 Fair Value $44,800 141,100 (a) Your answer is correct. Prepare a Computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. (Round answers to o decimal places, e.g. 5,125.) Parent Share Non- Controlling Share Entire Value Purchase Price and Implied Value 537200 94800 632000 Less Book Value of Equity Acquired Common Stock 337960 59640 397600 Retained Earnings 118660 20940 139600 Total Book Value 456620 80580 537200 Difference Between Implied and Book Value v 80580 14220 94800 Marketable Securities 20995 3705 24700 Equipment 18700 3300 22000 Balance 40885 7215 48100 Goodwill (40885) (7215) (48100) Balance 0 0 $U (b) x Your answer is incorrect. Try again. Determine the amounts at which the above assets (plus goodwill, if any) will appear on the consolidated balance sheet on January 1, 2013. Marketable securities Equipment (net) GoodwillStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started