Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer part c regarding profit diagram and strategy and maximum profit and loss. (a) The stock of MMG Pharmacies currently trades for E95 per

Please answer part c regarding profit diagram and strategy and maximum profit and loss.

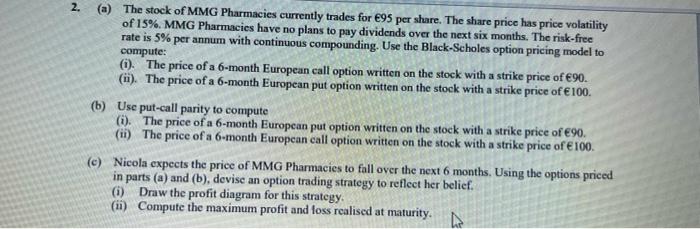

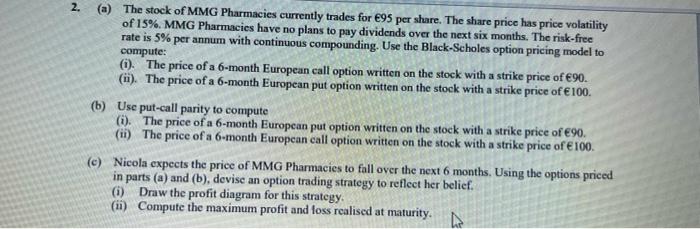

(a) The stock of MMG Pharmacies currently trades for E95 per share. The share price has price volatility of 15%. MMG Pharmacies have no plans to pay dividends over the next six months, The risk-free rate is 5% per annum with continuous compounding. Use the Black-Scholes option pricing model to compute: (i). The price of a 6-month European call option written on the stock with a strike price of 90. (ii). The price of a 6-month European put option written on the stock with a strike price of 100. (b) Use put-call parity to compute (i). The price of a 6-month European put option written on the stock with a strike price of 90. (ii) The price of a 6-month European call option written on the stock with a strike price of 100. (c) Nicola expects the price of MMG Pharmacies to fall over the next 6 months. Using the options priced in parts (a) and (b), devise an option trading strategy to reflect her belief. (i) Draw the profit diagram for this strategy. (ii) Compute the maximum profit and foss realised at maturity. (a) The stock of MMG Pharmacies currently trades for E95 per share. The share price has price volatility of 15%. MMG Pharmacies have no plans to pay dividends over the next six months, The risk-free rate is 5% per annum with continuous compounding. Use the Black-Scholes option pricing model to compute: (i). The price of a 6-month European call option written on the stock with a strike price of 90. (ii). The price of a 6-month European put option written on the stock with a strike price of 100. (b) Use put-call parity to compute (i). The price of a 6-month European put option written on the stock with a strike price of 90. (ii) The price of a 6-month European call option written on the stock with a strike price of 100. (c) Nicola expects the price of MMG Pharmacies to fall over the next 6 months. Using the options priced in parts (a) and (b), devise an option trading strategy to reflect her belief. (i) Draw the profit diagram for this strategy. (ii) Compute the maximum profit and foss realised at maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started