Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer part d of the question. The answer wasn't 0 or 110,000. Problem 20-29 (LO. 1, 4) Pink Corporation acquired land and securities in

Please answer part d of the question.

The answer wasn't 0 or 110,000.

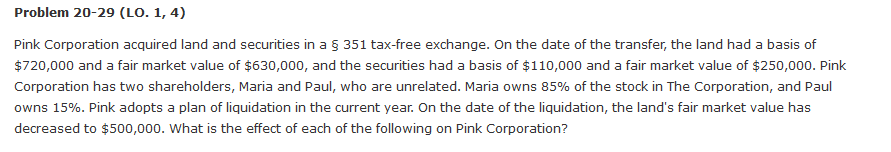

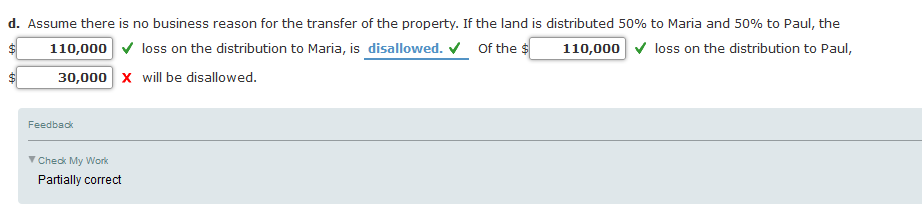

Problem 20-29 (LO. 1, 4) Pink Corporation acquired land and securities in a 351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 and a fair market value of $630,000, and the securities had a basis of $110,000 and a fair market value of $250,000. Pink Corporation has two shareholders, Maria and Paul, who are unrelated. Maria owns 85% of the stock in The Corporation, and Paul owns 15%. Pink adopts a plan of liquidation in the current year. On the date of the liquidation, the land's fair market value has decreased to $500,000. What is the effect of each of the following on Pink Corporation? d. Assume there is no business reason for the transfer of the property. If the land is distributed 50% to Maria and 50% to Paul, the 110,000loss on the distribution to Maria, is disallowed. Of the $ loss on the distribution to Paul, 110,000 30,000 X will be disallowed. Feedback Check My Work Partially correct Problem 20-29 (LO. 1, 4) Pink Corporation acquired land and securities in a 351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 and a fair market value of $630,000, and the securities had a basis of $110,000 and a fair market value of $250,000. Pink Corporation has two shareholders, Maria and Paul, who are unrelated. Maria owns 85% of the stock in The Corporation, and Paul owns 15%. Pink adopts a plan of liquidation in the current year. On the date of the liquidation, the land's fair market value has decreased to $500,000. What is the effect of each of the following on Pink Corporation? d. Assume there is no business reason for the transfer of the property. If the land is distributed 50% to Maria and 50% to Paul, the 110,000loss on the distribution to Maria, is disallowed. Of the $ loss on the distribution to Paul, 110,000 30,000 X will be disallowed. Feedback Check My Work Partially correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started