Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer Part II in detail. Thanks! Question 1 (36 Marks) Part I The capital structure of a company with relevant market information are shown

Please answer Part II in detail. Thanks!

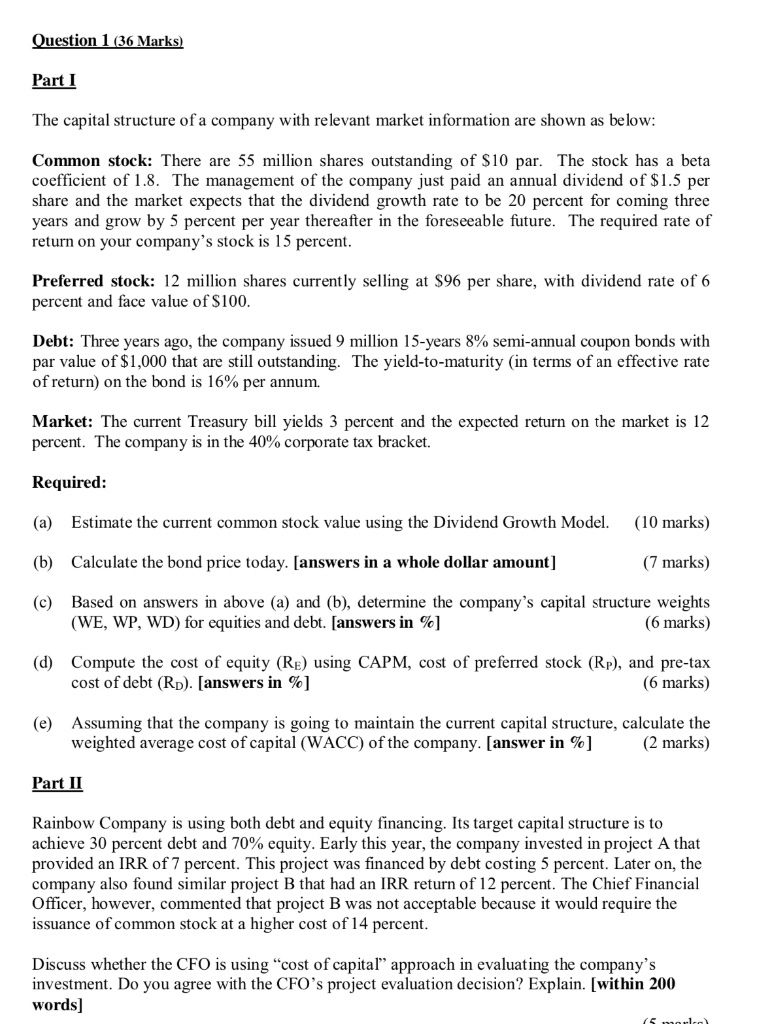

Question 1 (36 Marks) Part I The capital structure of a company with relevant market information are shown as below: Common stock: There are 55 million shares outstanding of $10 par. The stock has a beta coefficient of 1.8. The management of the company just paid an annual dividend of $1.5 per share and the market expects that the dividend growth rate to be 20 percent for coming three years and grow by 5 percent per year thereafter in the foreseeable future. The required rate of return on your company's stock is 15 percent. Preferred stock: 12 million shares currently selling at $96 per share, with dividend rate of 6 percent and face value of $100. Debt: Three years ago, the company issued 9 million 15-years 8% semi-annual coupon bonds with par value of $1,000 that are still outstanding. The yield-to-maturity in terms of an effective rate of return) on the bond is 16% per annum. Market: The current Treasury bill yields 3 percent and the expected return on the market is 12 percent. The company is in the 40% corporate tax bracket. Required: (a) Estimate the current common stock value using the Dividend Growth Model. (10 marks) (b) Calculate the bond price today. [answers in a whole dollar amount] (7 marks) (c) Based on answers in above (a) and (b), determine the company's capital structure weights (WE, WP, WD) for equities and debt. (answers in %] (6 marks) (d) Compute the cost of equity (Re) using CAPM, cost of preferred stock (Rp), and pre-tax cost of debt (RD). [answers in %] (6 marks) (e) Assuming that the company is going to maintain the current capital structure, calculate the weighted average cost of capital (WACC) of the company. [answer in %] (2 marks) Part II Rainbow Company is using both debt and equity financing. Its target capital structure is to achieve 30 percent debt and 70% equity. Early this year, the company invested in project A that provided an IRR of 7 percent. This project was financed by debt costing 5 percent. Later on, the company also found similar project B that had an IRR return of 12 percent. The Chief Financial Officer, however, commented that project B was not acceptable because it would require the issuance of common stock at a higher cost of 14 percent. Discuss whether the CFO is using "cost of capital" approach in evaluating the company's investment. Do you agree with the CFO's project evaluation decision? Explain. [within 200 words] (5 more) Question 1 (36 Marks) Part I The capital structure of a company with relevant market information are shown as below: Common stock: There are 55 million shares outstanding of $10 par. The stock has a beta coefficient of 1.8. The management of the company just paid an annual dividend of $1.5 per share and the market expects that the dividend growth rate to be 20 percent for coming three years and grow by 5 percent per year thereafter in the foreseeable future. The required rate of return on your company's stock is 15 percent. Preferred stock: 12 million shares currently selling at $96 per share, with dividend rate of 6 percent and face value of $100. Debt: Three years ago, the company issued 9 million 15-years 8% semi-annual coupon bonds with par value of $1,000 that are still outstanding. The yield-to-maturity in terms of an effective rate of return) on the bond is 16% per annum. Market: The current Treasury bill yields 3 percent and the expected return on the market is 12 percent. The company is in the 40% corporate tax bracket. Required: (a) Estimate the current common stock value using the Dividend Growth Model. (10 marks) (b) Calculate the bond price today. [answers in a whole dollar amount] (7 marks) (c) Based on answers in above (a) and (b), determine the company's capital structure weights (WE, WP, WD) for equities and debt. (answers in %] (6 marks) (d) Compute the cost of equity (Re) using CAPM, cost of preferred stock (Rp), and pre-tax cost of debt (RD). [answers in %] (6 marks) (e) Assuming that the company is going to maintain the current capital structure, calculate the weighted average cost of capital (WACC) of the company. [answer in %] (2 marks) Part II Rainbow Company is using both debt and equity financing. Its target capital structure is to achieve 30 percent debt and 70% equity. Early this year, the company invested in project A that provided an IRR of 7 percent. This project was financed by debt costing 5 percent. Later on, the company also found similar project B that had an IRR return of 12 percent. The Chief Financial Officer, however, commented that project B was not acceptable because it would require the issuance of common stock at a higher cost of 14 percent. Discuss whether the CFO is using "cost of capital" approach in evaluating the company's investment. Do you agree with the CFO's project evaluation decision? Explain. [within 200 words] (5 more)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started