Please answer problem 3, problem 1 is just for reference

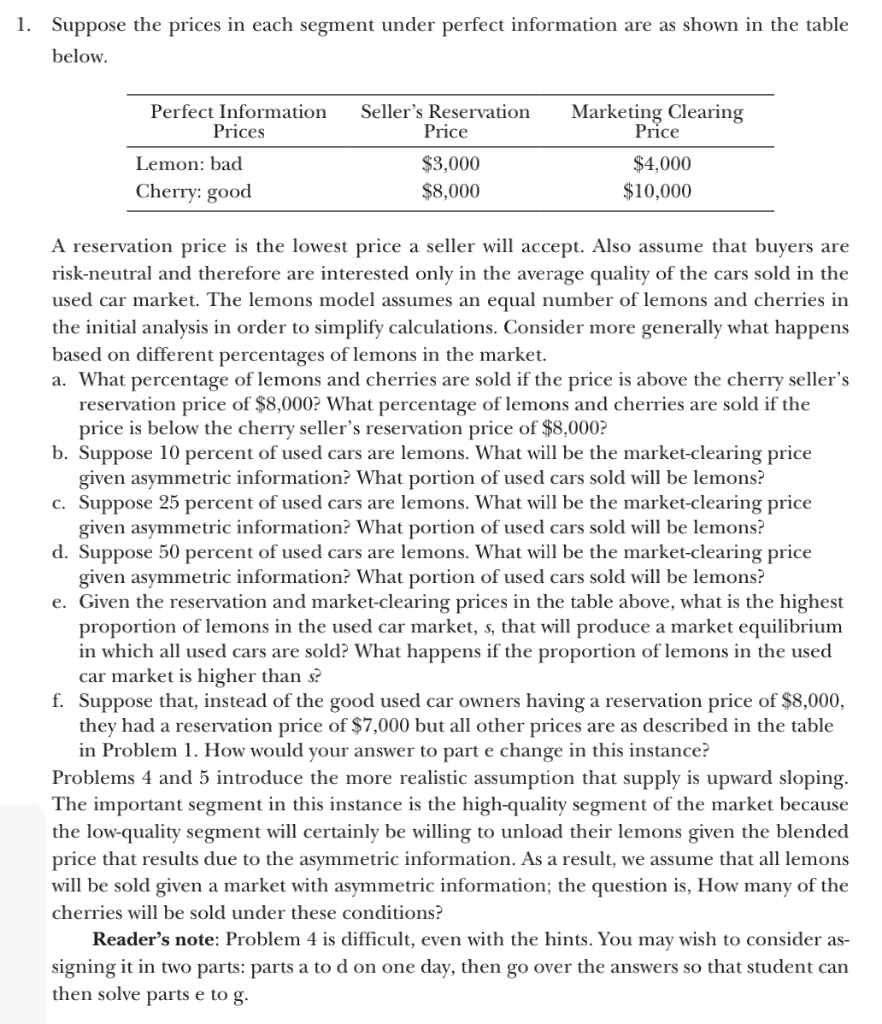

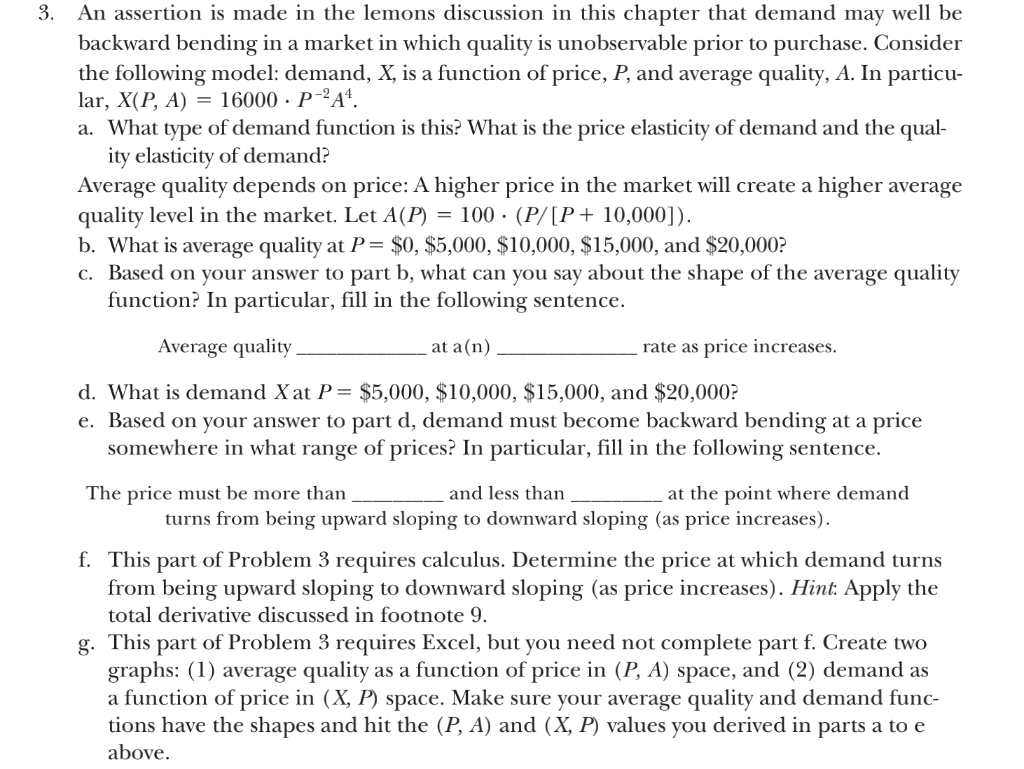

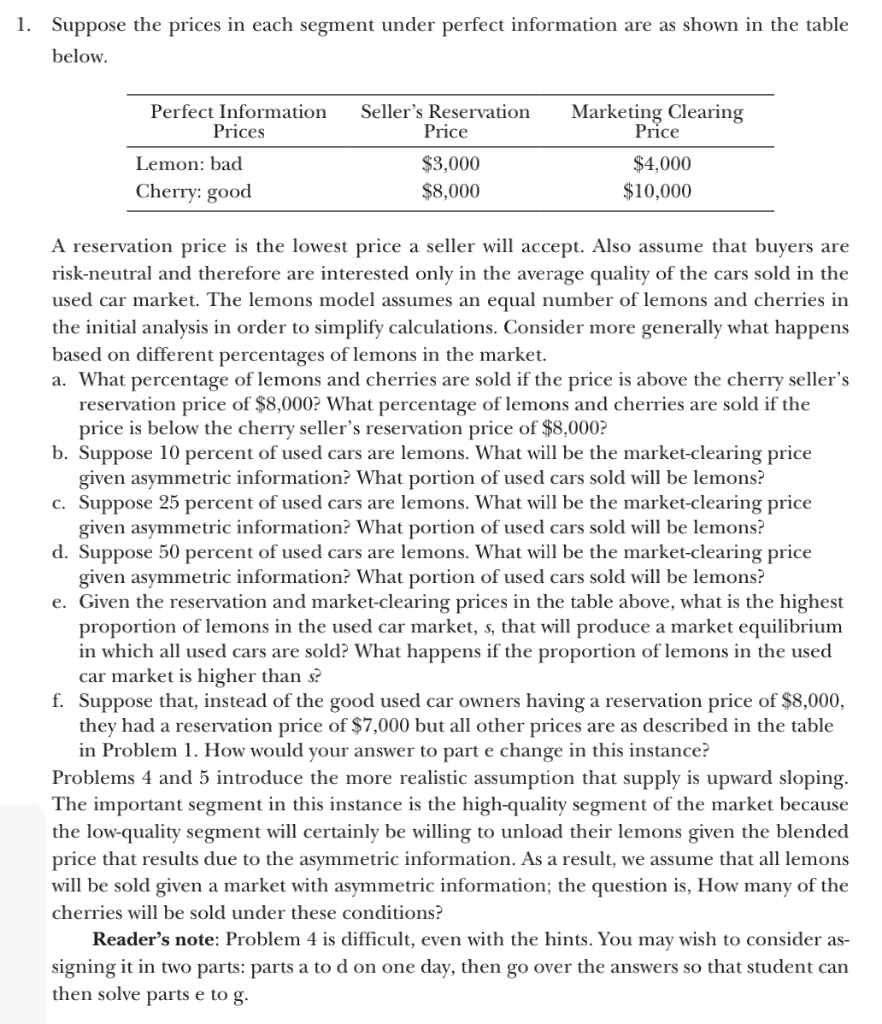

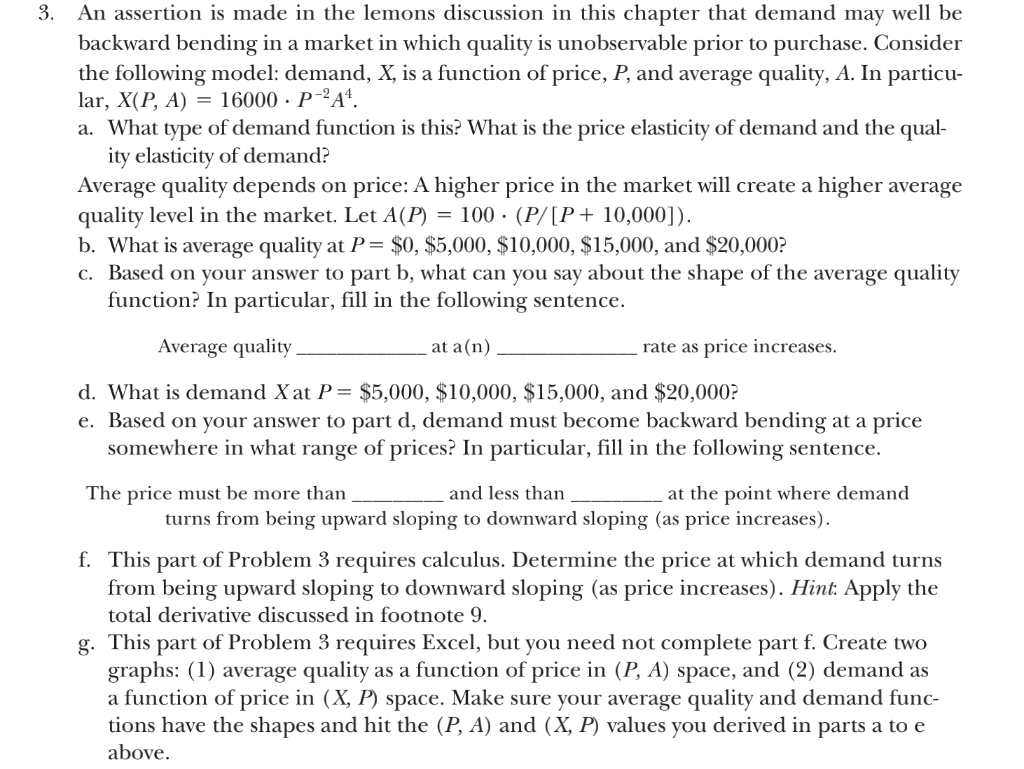

1. Suppose the prices in each segment under perfect information are as shown in the table below. Perfect Information Prices Seller's Reservation Price Marketing Clearing Price Lemon: bad Cherry: good $3,000 $8,000 $4,000 $10,000 A reservation price is the lowest price a seller will accept. Also assume that buyers are risk-neutral and therefore are interested only in the average quality of the cars sold in the used car market. The lemons model assumes an equal number of lemons and cherries in the initial analysis in order to simplify calculations. Consider more generally what happens based on different percentages of lemons in the market. a. What percentage of lemons and cherries are sold if the price is above the cherry seller's reservation price of $8,000? What percentage of lemons and cherries are sold if the price is below the cherry seller's reservation price of $8,000? b. Suppose 10 percent of used cars are lemons. What will be the market-clearing price given asymmetric information? What portion of used cars sold will be lemons? c. Suppose 25 percent of used cars are lemons. What will be the market-clearing price given asymmetric information? What portion of used cars sold will be lemons? d. Suppose 50 percent of used cars are lemons. What will be the market-clearing price given asymmetric information? What portion of used cars sold will be lemons? e. Given the reservation and market-clearing prices in the table above, what is the highest proportion of lemons in the used car market, s, that will produce a market equilibrium in which all used cars are sold? What happens if the proportion of lemons in the used car market is higher than s? f. Suppose that, instead of the good used car owners having a reservation price of $8,000, they had a reservation price of $7,000 but all other prices are as described in the table in Problem 1. How would your answer to part e change in this instance? Problems 4 and 5 introduce the more realistic assumption that supply is upward sloping. The important segment in this instance is the high-quality segment of the market because the low-quality segment will certainly be willing to unload their lemons given the blended price that results due to the asymmetric information. As a result, we assume that all lemons will be sold given a market with asymmetric information; the question is, How many of the cherries will be sold under these conditions? Reader's note: Problem 4 is difficult, even with the hints. You may wish to consider as- signing it in two parts: parts a to d on one day, then go over the answers so that student can then solve parts e to g. 3. An assertion is made in the lemons discussion in this chapter that demand may well be backward bending in a market in which quality is unobservable prior to purchase. Consider the following model: demand, X, is a function of price, P, and average quality, A. In particu- lar, X(P, A) = 16000 P-2A4. a. What type of demand function is this? What is the price elasticity of demand and the qual- ity elasticity of demand? Average quality depends on price: A higher price in the market will create a higher average quality level in the market. Let A(P) = 100 (P/[P+ 10,000]). b. What is average quality at P = $0, $5,000, $10,000, $15,000, and $20,000? c. Based on your answer to part b, what can you say about the shape of the average quality function? In particular, fill in the following sentence. Average quality at a(n) rate as price increases. d. What is demand X at P= $5,000, $10,000, $15,000, and $20,000? e. Based on your answer to part d, demand must become backward bending at a price somewhere in what range of prices? In particular, fill in the following sentence. The price must be more than and less than at the point where demand turns from being upward sloping to downward sloping (as price increases). f. This part of Problem 3 requires calculus. Determine the price at which demand turns from being upward sloping to downward sloping (as price increases). Hint. Apply the total derivative discussed in footnote 9. g. This part of Problem 3 requires Excel, but you need not complete part f. Create two graphs: (1) average quality as a function of price in (P, A) space, and (2) demand as a function of price in (X, P) space. Make sure your average quality and demand func- tions have the shapes and hit the (P, A) and (X, P) values you derived in parts a to e above. 1. Suppose the prices in each segment under perfect information are as shown in the table below. Perfect Information Prices Seller's Reservation Price Marketing Clearing Price Lemon: bad Cherry: good $3,000 $8,000 $4,000 $10,000 A reservation price is the lowest price a seller will accept. Also assume that buyers are risk-neutral and therefore are interested only in the average quality of the cars sold in the used car market. The lemons model assumes an equal number of lemons and cherries in the initial analysis in order to simplify calculations. Consider more generally what happens based on different percentages of lemons in the market. a. What percentage of lemons and cherries are sold if the price is above the cherry seller's reservation price of $8,000? What percentage of lemons and cherries are sold if the price is below the cherry seller's reservation price of $8,000? b. Suppose 10 percent of used cars are lemons. What will be the market-clearing price given asymmetric information? What portion of used cars sold will be lemons? c. Suppose 25 percent of used cars are lemons. What will be the market-clearing price given asymmetric information? What portion of used cars sold will be lemons? d. Suppose 50 percent of used cars are lemons. What will be the market-clearing price given asymmetric information? What portion of used cars sold will be lemons? e. Given the reservation and market-clearing prices in the table above, what is the highest proportion of lemons in the used car market, s, that will produce a market equilibrium in which all used cars are sold? What happens if the proportion of lemons in the used car market is higher than s? f. Suppose that, instead of the good used car owners having a reservation price of $8,000, they had a reservation price of $7,000 but all other prices are as described in the table in Problem 1. How would your answer to part e change in this instance? Problems 4 and 5 introduce the more realistic assumption that supply is upward sloping. The important segment in this instance is the high-quality segment of the market because the low-quality segment will certainly be willing to unload their lemons given the blended price that results due to the asymmetric information. As a result, we assume that all lemons will be sold given a market with asymmetric information; the question is, How many of the cherries will be sold under these conditions? Reader's note: Problem 4 is difficult, even with the hints. You may wish to consider as- signing it in two parts: parts a to d on one day, then go over the answers so that student can then solve parts e to g. 3. An assertion is made in the lemons discussion in this chapter that demand may well be backward bending in a market in which quality is unobservable prior to purchase. Consider the following model: demand, X, is a function of price, P, and average quality, A. In particu- lar, X(P, A) = 16000 P-2A4. a. What type of demand function is this? What is the price elasticity of demand and the qual- ity elasticity of demand? Average quality depends on price: A higher price in the market will create a higher average quality level in the market. Let A(P) = 100 (P/[P+ 10,000]). b. What is average quality at P = $0, $5,000, $10,000, $15,000, and $20,000? c. Based on your answer to part b, what can you say about the shape of the average quality function? In particular, fill in the following sentence. Average quality at a(n) rate as price increases. d. What is demand X at P= $5,000, $10,000, $15,000, and $20,000? e. Based on your answer to part d, demand must become backward bending at a price somewhere in what range of prices? In particular, fill in the following sentence. The price must be more than and less than at the point where demand turns from being upward sloping to downward sloping (as price increases). f. This part of Problem 3 requires calculus. Determine the price at which demand turns from being upward sloping to downward sloping (as price increases). Hint. Apply the total derivative discussed in footnote 9. g. This part of Problem 3 requires Excel, but you need not complete part f. Create two graphs: (1) average quality as a function of price in (P, A) space, and (2) demand as a function of price in (X, P) space. Make sure your average quality and demand func- tions have the shapes and hit the (P, A) and (X, P) values you derived in parts a to e above