Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer Problem 3.3. Show work. Thanks. 002 - Book - Financial and Managerial Accounting - 16th Ed (2012) -.. 165 / 1265 92% +

Please Answer Problem 3.3. Show work. Thanks.

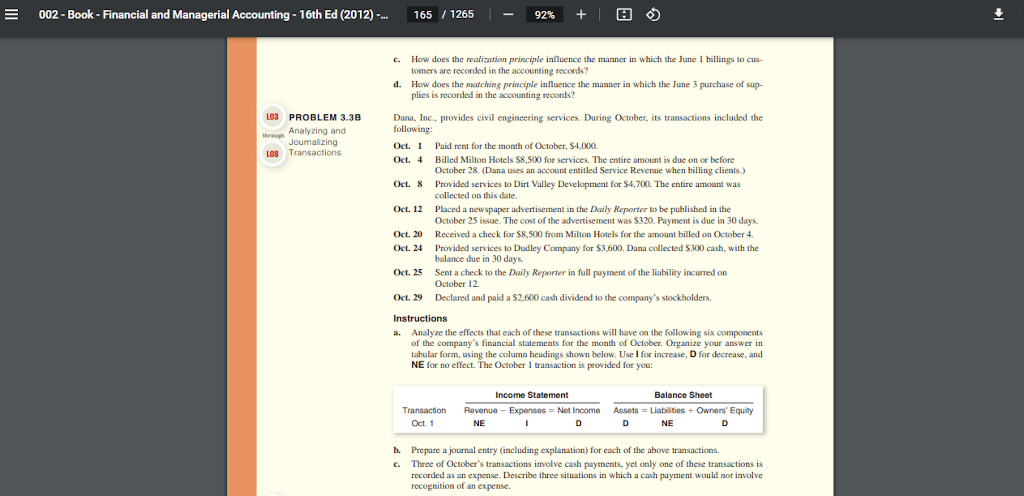

002 - Book - Financial and Managerial Accounting - 16th Ed (2012) -.. 165 / 1265 92% + | O + c. L03 PROBLEM 3.3B Analyzing and Joumalizing LOB Transactions How does the realisation principle influence the manner in which the June 1 billing to cus- tomers are recorded in the accounting records? d. How does the matching principle influence the manner in which the June 3 purchase of sup- plies is recorded in the accounting records? Dana, Inc., provides civil engineering services. During October, its transactions included the following: Oct. 1 Paid rent for the month of October, S4,000. Oct. 4 Billed Milton Hotels $8,500 for services. The entire amount is due on or before October 28. (Dana uses an account entitled Service Revenue when billing clients.) Oct. Provided services to Dirt Valley Development for $4,700. The entire amount was collected on this date. Oct. 12 Placed a newspaper advertisement in the Daily Reporter to be published in the October 25 issue. The cost of the advertisement was $320. Payment is due in 30 days. Oct. 20 Received a check for $8,500 from Milton Hotels for the amount billed on October 4. Oct. 24 Provided services to Dudley Company for $3,600. Dana collected $300 cash, with the balance due in 30 days Oct. 25 Sent a check to the Daily Reporter in full payment of the liability incurred on October 12. Oct. 29 Declared and paid a $2,000 cash dividend to the company's stockholders. a $ Instructions a. Analyze the effects that each of these transactions will have on the following six components of the company's financial statements for the month of October. Organize your answer in tabular form, using the column headings shown below. Use I for increase, D for decrease, and NE for no effect. The October I transaction is provided for you: Transaction Oct. 1 Income Statement Balance Sheet Revenue - Expenses Net Income Assets = Liabilities + Owners' Equity NE D NE 1 D D b. Prepare a journal entry (including explanation) for each of the above transactions c. Three of October's transactions involve cash payments, yet only one of these transactions is recorded as an expense. Describe three situations in which a cash payment would not involve recognition of an expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started