Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer Problem 7. Nathan and Kylie Morse have invested $500,000 in N&K's Place. Their projected costs and activities are as follows: Variable costs =

Please Answer Problem 7.

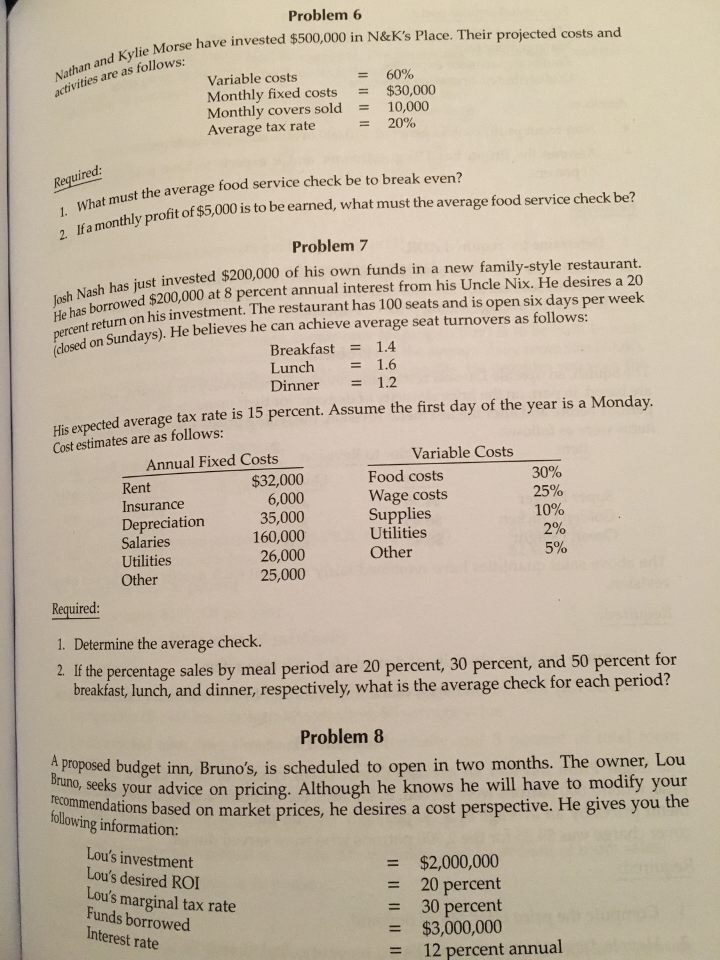

Nathan and Kylie Morse have invested $500,000 in N&K's Place. Their projected costs and activities are as follows: Variable costs = 6% Monthly fixed costs = $30,000 Monthly covers sold = 10,000 Average tax rate = 20% Required: What must the average food service check be to break even? If a monthly profit of $5,000 is to be earned, what must the average food service check be? Josh Nash has just invested $200,000 of his funds in a new family-style restaurant. He has borrowed $200,000 at 8 percent annual interest from his Uncle Nix. He desires a 20 percent return on his investment. The restaurant has 100 seats and is open six days per week (closed on Sundays). He believes he can achieve average seat turnovers as follows: Breakfast = 1.4 Lunch = 1.6 Dinner = 1.2 His expected average tax rate is 15 percent. Assume the first day of the year is a Monday. Cost estimates are as follows: Required: 1. Determine the average check. 2. If the percentage sales by meal period are 20 percent, 30 percent, and 50 percent for breakfast, lunch, and dinner, respectively, what is the average check for each period? A Proposed budget inn, Bruno's, is scheduled to open in two months. The owner, Lou Bruno, seeks your advice on pricing. Although he knows he will have to modify your recommendations based on market prices, he desires a cost perspective. He gives you the information: Lou's investment = $2,000,000 Lou's desired ROI = 20 percent Lou's marginal tax rate = 30 percent Funds borrowed = $3,000,000 Interest rate = 12 percent annualStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started