Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer problems 1-4 and write the complete solution. 1. The delivered-equipment cost for a petroleum refining plant is expected to be P20 million. If

please answer problems 1-4 and write the complete solution.

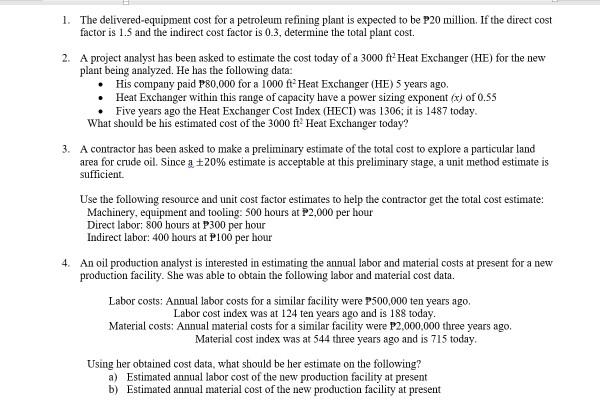

1. The delivered-equipment cost for a petroleum refining plant is expected to be P20 million. If the direct cost factor is 1.5 and the indirect cost factor is 0.3, determine the total plant cost. 2. A project analyst has been asked to estimate the cost today of a 3000 ft-Heat Exchanger (HE) for the new plant being analyzed. He has the following data: His company paid P80,000 for a 1000 ft Heat Exchanger (HE) 5 years ago Heat Exchanger within this range of capacity have a power sizing exponent (x) of 0.55 Five years ago the Heat Exchanger Cost Index (HECI) was 1306; it is 1487 today. What should be his estimated cost of the 3000 ft- Heat Exchanger today? 3. A contractor has been asked to make a preliminary estimate of the total cost to explore a particular land area for crude oil. Since a 20% estimate is acceptable at this preliminary stage, a unit method estimate is sufficient. Use the following resource and unit cost factor estimates to help the contractor get the total cost estimate: Machinery, equipment and tooling: 500 hours at P2,000 per hour Direct labor: 800 hours at P300 per hour Indirect labor: 400 hours at P100 per hour 4. An oil production analyst is interested in estimating the annual labor and material costs at present for a new production facility. She was able to obtain the following labor and material cost data. Labor costs: Annual labor costs for a similar facility were P500,000 ten years ago Labor cost index was at 124 ten years ago and is 188 today. Material costs: Annual material costs for a similar facility were P2,000,000 three years ago, Material cost index was at 544 three years ago and is 715 today. Using her obtained cost data, what should be her estimate on the following? a) Estimated annual labor cost of the new production facility at present b) Estimated annual material cost of the new production facility at presentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started