Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer Q5 with the explanation. Thank you! Q2. An investor is planning a $100 million short-term investment and is going to choose among two

Please answer Q5 with the explanation. Thank you!

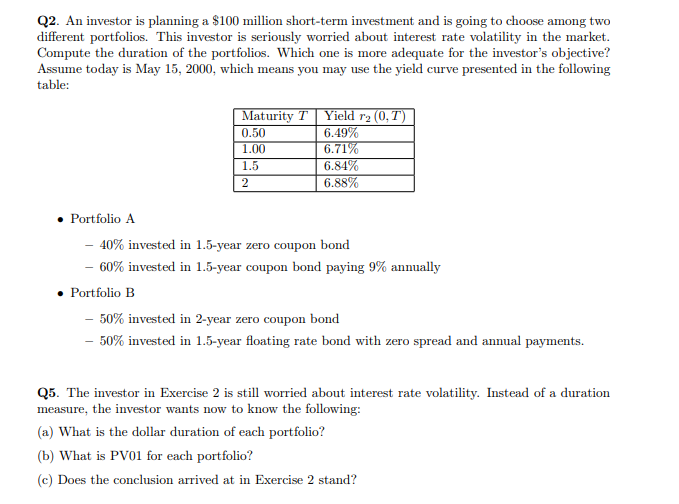

Q2. An investor is planning a $100 million short-term investment and is going to choose among two different portfolios. This investor is seriously worried about interest rate volatility in the market. Compute the duration of the portfolios. Which one is more adequate for the investor's objective? Assume today is May 15, 2000, which means you may use the yield curve presented in the following table: Maturity T Yield r2 (0,T) 0.50 6.49% 1.00 6.71% 1.5 6.84% 2 6.88% Portfolio A - 40% invested in 1.5-year zero coupon bond - 60% invested in 1.5-year coupon bond paying 9% annually Portfolio B 50% invested in 2-year zero coupon bond 50% invested in 1.5-year floating rate bond with zero spread and annual payments. Q5. The investor in Exercise 2 is still worried about interest rate volatility. Instead of a duration measure, the investor wants now to know the following: (a) What is the dollar duration of each portfolio? (b) What is PV01 for each portfolio? (c) Does the conclusion arrived at in Exercise 2 stand? Q2. An investor is planning a $100 million short-term investment and is going to choose among two different portfolios. This investor is seriously worried about interest rate volatility in the market. Compute the duration of the portfolios. Which one is more adequate for the investor's objective? Assume today is May 15, 2000, which means you may use the yield curve presented in the following table: Maturity T Yield r2 (0,T) 0.50 6.49% 1.00 6.71% 1.5 6.84% 2 6.88% Portfolio A - 40% invested in 1.5-year zero coupon bond - 60% invested in 1.5-year coupon bond paying 9% annually Portfolio B 50% invested in 2-year zero coupon bond 50% invested in 1.5-year floating rate bond with zero spread and annual payments. Q5. The investor in Exercise 2 is still worried about interest rate volatility. Instead of a duration measure, the investor wants now to know the following: (a) What is the dollar duration of each portfolio? (b) What is PV01 for each portfolio? (c) Does the conclusion arrived at in Exercise 2 standStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started