Answered step by step

Verified Expert Solution

Question

1 Approved Answer

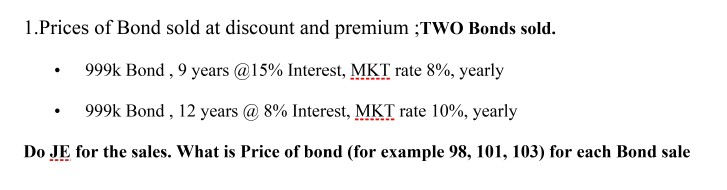

please answer QUESTION: 1 and 2. (handwritten scanned) 1. Prices of Bond sold at discount and premium ;TWO Bonds sold. 999k Bond , 9 years

please answer QUESTION: 1 and 2.

(handwritten scanned)

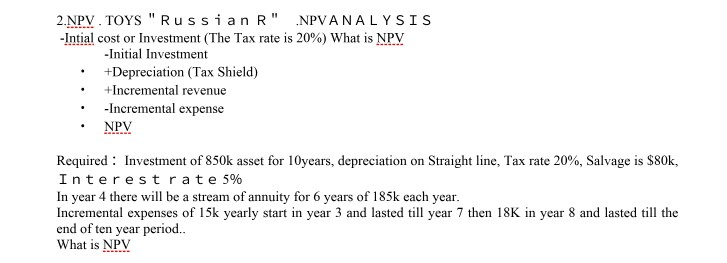

1. Prices of Bond sold at discount and premium ;TWO Bonds sold. 999k Bond , 9 years @15% Interest, MKT rate 8%, yearly . 999k Bond , 12 years @ 8% Interest, MKT rate 10%, yearly Do JE for the sales. What is Price of bond (for example 98, 101, 103) for each Bond sale 2.NPV. TOYS "Russian R" NPVANALYSIS -Intial cost or Investment (The Tax rate is 20%) What is NPV -Initial Investment +Depreciation (Tax Shield) +Incremental revenue Incremental expense NPV Required : Investment of 850k asset for 10years, depreciation on Straight line, Tax rate 20%, Salvage is $80k, Interest rate 5% In year 4 there will be a stream of annuity for 6 years of 185k each year. Incremental expenses of 15k yearly start in year 3 and lasted till year 7 then 18K in year 8 and lasted till the end of ten year period.. What is NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started