Please answer qUESTION 1 AND QUESTION 2 in detail the calculation tqvm etc

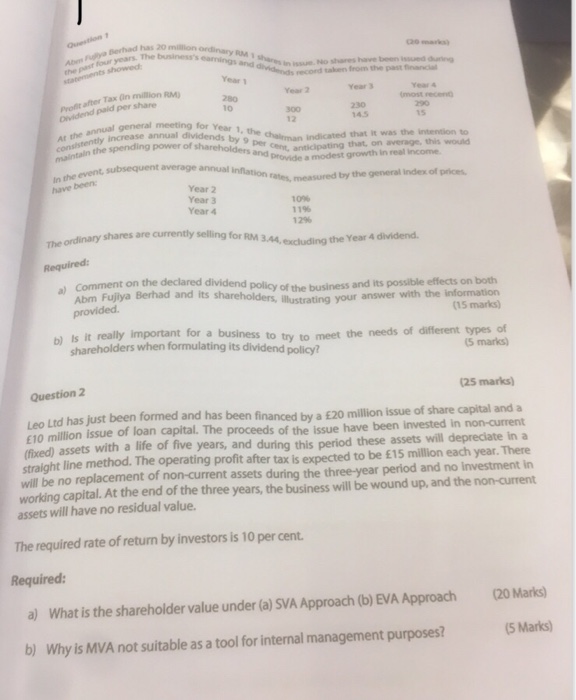

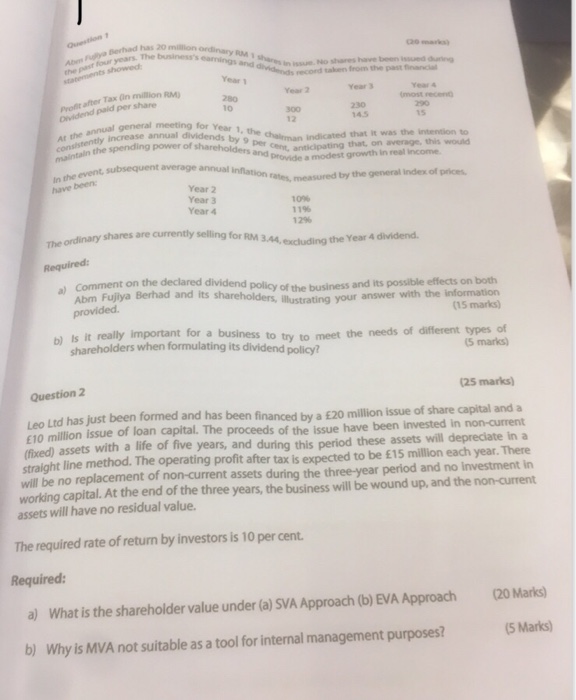

20 The business's A Fya Berhad the past our Question has 20 million ordinary M 1 o mar in issue. No shares have been issued during record taken from the past finarcial showed Year 1 Year 2 Year 3 Year 4 280 Ovidend pald per share At the annusal general maintain the spending Profit after Tax On million most recen increase annual dividends by hs chaliman indicated that it was the intention s power of shareholders ang en anbiopating tia on swerage this woud meeting for Year 1, the chaiman indicated 300 12 230 14.5 290 15 9 percent average, this ind provide a modest growth in real income event, subsequent average annual rates, measured by the general Index of prices have been Year 2 Year 3 Year 4 10% 11% 12% shares are currently selling for RM 3,.44, excluding the Year A on the declared dividend policy of the business ad and its shareholders, lustrating your and its possible effects on both Abm Fuen Abm Fujlya Berhad illustrating your answer with the information (15 marks) b) is it really important for a business to try to meet the shareholders when formulating its dividend policy? 5 marks) Question 2 (25 marks) Leo Ltd has just been formed and has been financed by a 20 million issue of share capital and a E10 million issue of loan capital. The proceeds of the issue (fixed) assets with a life of five years, and during this period these assets will depreciate in a straight line method. The operating profit after tax is expected to be 15 million each year. There will be no replacement of non-current assets during the three-year period and no Investment in working capital. At the end of the three years, the business will be wound up, and the non-current have been invested in non-current assets will have no residual value. The required rate of return by investors is 10 per cent Required: a) What is the shareholder value under (a) SVA Approach (b) EVA Approach (20 Marks) b) Why is MVA not suitable as a tool for internal management purposes? (5 Marks) 20 The business's A Fya Berhad the past our Question has 20 million ordinary M 1 o mar in issue. No shares have been issued during record taken from the past finarcial showed Year 1 Year 2 Year 3 Year 4 280 Ovidend pald per share At the annusal general maintain the spending Profit after Tax On million most recen increase annual dividends by hs chaliman indicated that it was the intention s power of shareholders ang en anbiopating tia on swerage this woud meeting for Year 1, the chaiman indicated 300 12 230 14.5 290 15 9 percent average, this ind provide a modest growth in real income event, subsequent average annual rates, measured by the general Index of prices have been Year 2 Year 3 Year 4 10% 11% 12% shares are currently selling for RM 3,.44, excluding the Year A on the declared dividend policy of the business ad and its shareholders, lustrating your and its possible effects on both Abm Fuen Abm Fujlya Berhad illustrating your answer with the information (15 marks) b) is it really important for a business to try to meet the shareholders when formulating its dividend policy? 5 marks) Question 2 (25 marks) Leo Ltd has just been formed and has been financed by a 20 million issue of share capital and a E10 million issue of loan capital. The proceeds of the issue (fixed) assets with a life of five years, and during this period these assets will depreciate in a straight line method. The operating profit after tax is expected to be 15 million each year. There will be no replacement of non-current assets during the three-year period and no Investment in working capital. At the end of the three years, the business will be wound up, and the non-current have been invested in non-current assets will have no residual value. The required rate of return by investors is 10 per cent Required: a) What is the shareholder value under (a) SVA Approach (b) EVA Approach (20 Marks) b) Why is MVA not suitable as a tool for internal management purposes