Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 1 and question 2. Thanks! Question 1 ( 5 marks, suggested time 4 minutes) Engineering Ca. purchased equipment at a cost of

Please answer question 1 and question 2. Thanks!

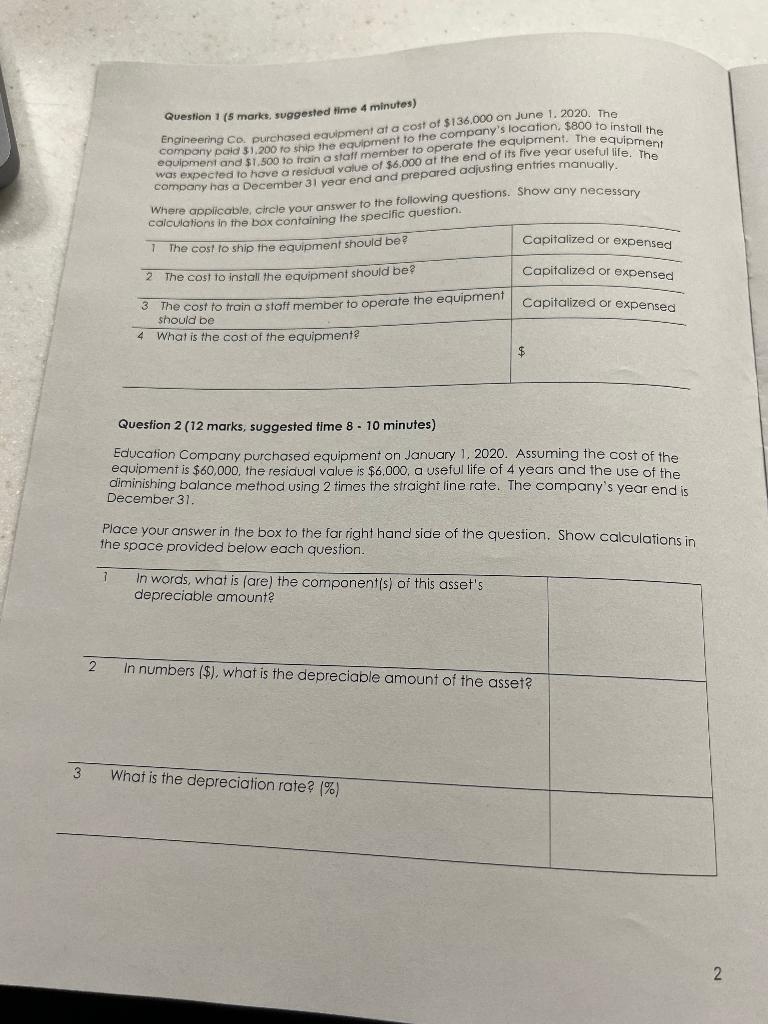

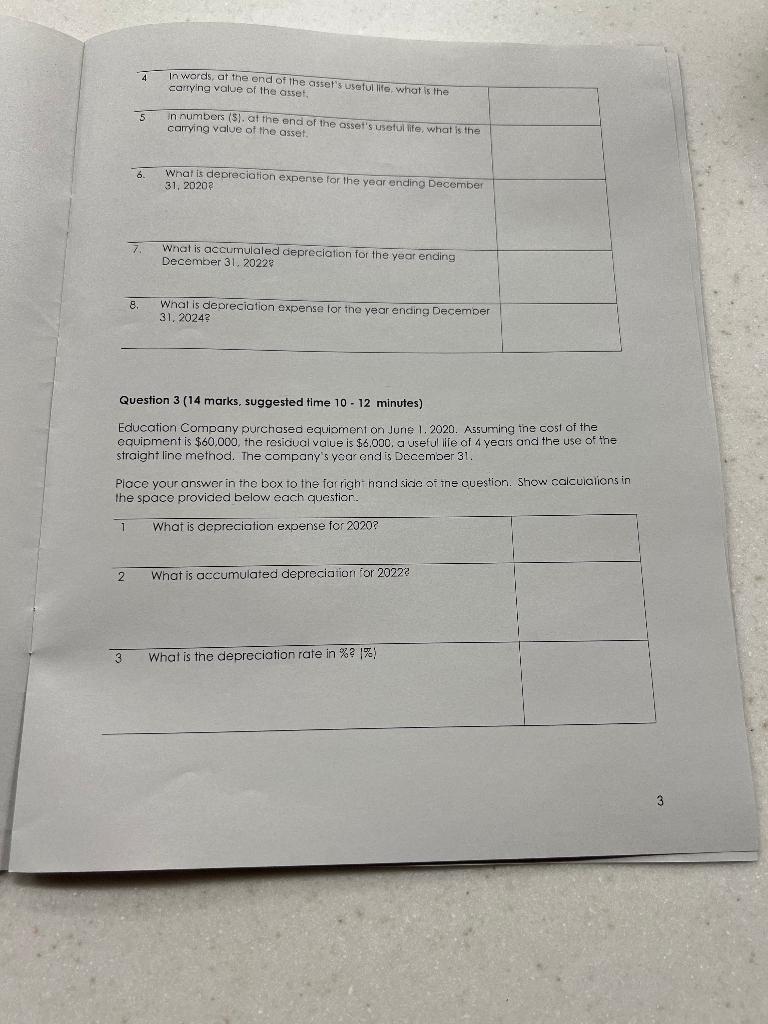

Question 1 ( 5 marks, suggested time 4 minutes) Engineering Ca. purchased equipment at a cost of $136.000 on June 1. 2020. The company paid \$1,200 to ship the equipment to the company's location, $800 to install the equipment and \$1.500 to froin a siall member to operate the equipment. The equipment was expected to hove a residual value of $6,000 at the end of its five year useful life. The compary has a December 31 year end and prepared adjusting entries manually. Where applicable, circle your answer to the following questions. Show any necessary Question 2 (12 marks, suggested fime 8 - 10 minutes) Education Company purchased equipment on January 1, 2020. Assuming the cost of the equipment is $60,000, the residual value is $6,000, a useful life of 4 years and the use of the diminishing balance method using 2 times the straight line rate. The company's year end is December 31 . Place your answer in the box to the far right hand side of the question. Show calculations in the space provided below each question. Question 3 (14 marks, suggested time 1012 minutes) Education Company purchosed equioment on June 1. 2020 . Assuming the cost of the oquipment is $60,000, the residual va ue is $6,000, a useful life of 4 years and the use of the straight line method. The company's yoar end is December 31 . Place your answer in the box to the far righ hand side of the ovestion. Show calculalions in the space provided below each question. Question 1 ( 5 marks, suggested time 4 minutes) Engineering Ca. purchased equipment at a cost of $136.000 on June 1. 2020. The company paid \$1,200 to ship the equipment to the company's location, $800 to install the equipment and \$1.500 to froin a siall member to operate the equipment. The equipment was expected to hove a residual value of $6,000 at the end of its five year useful life. The compary has a December 31 year end and prepared adjusting entries manually. Where applicable, circle your answer to the following questions. Show any necessary Question 2 (12 marks, suggested fime 8 - 10 minutes) Education Company purchased equipment on January 1, 2020. Assuming the cost of the equipment is $60,000, the residual value is $6,000, a useful life of 4 years and the use of the diminishing balance method using 2 times the straight line rate. The company's year end is December 31 . Place your answer in the box to the far right hand side of the question. Show calculations in the space provided below each question. Question 3 (14 marks, suggested time 1012 minutes) Education Company purchosed equioment on June 1. 2020 . Assuming the cost of the oquipment is $60,000, the residual va ue is $6,000, a useful life of 4 years and the use of the straight line method. The company's yoar end is December 31 . Place your answer in the box to the far righ hand side of the ovestion. Show calculalions in the space provided below eachStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started