Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 1 In the word file: include answers to all of the questions 1,2,3,4,5,6 below In the excel file: include a proforma for

Please answer question 1

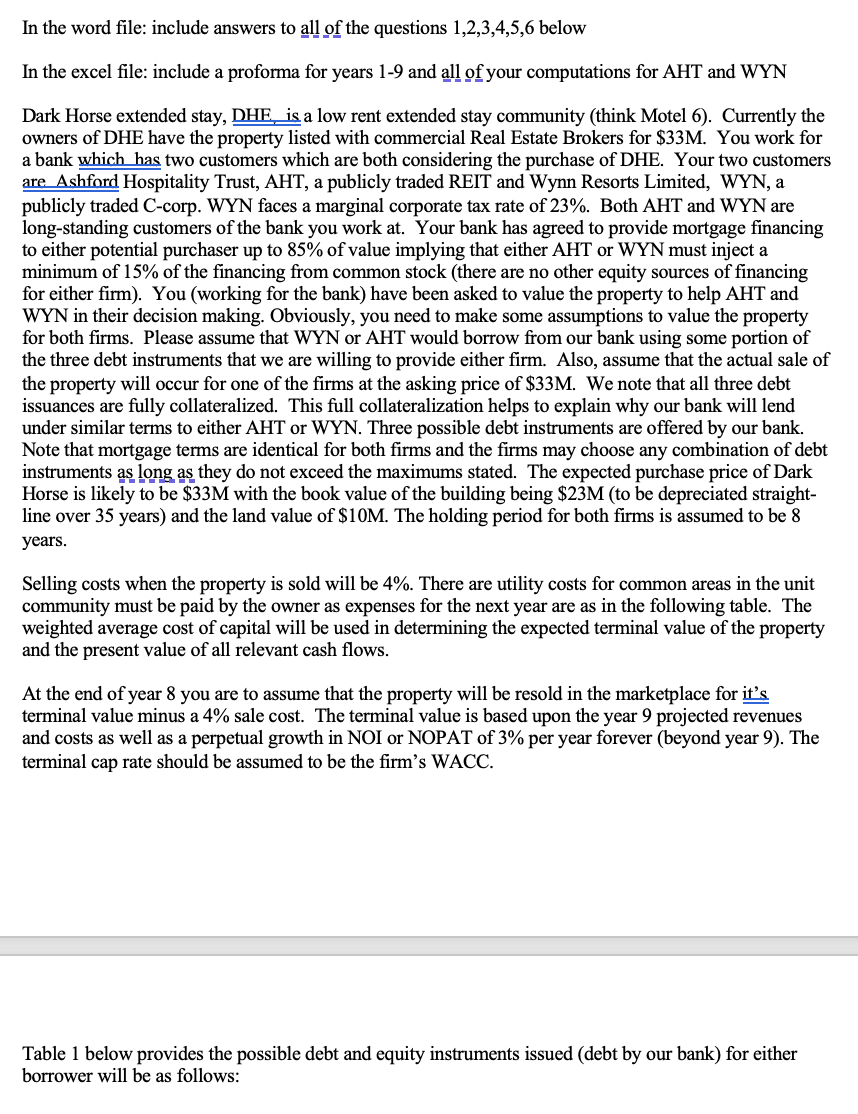

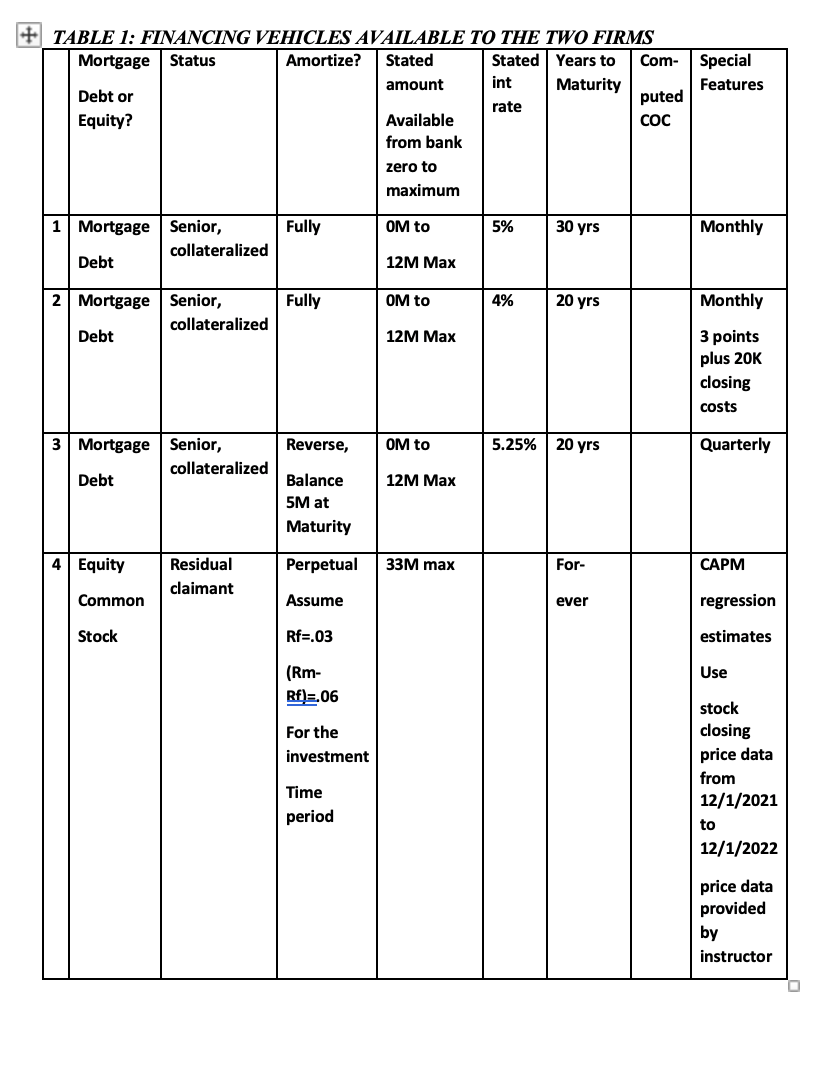

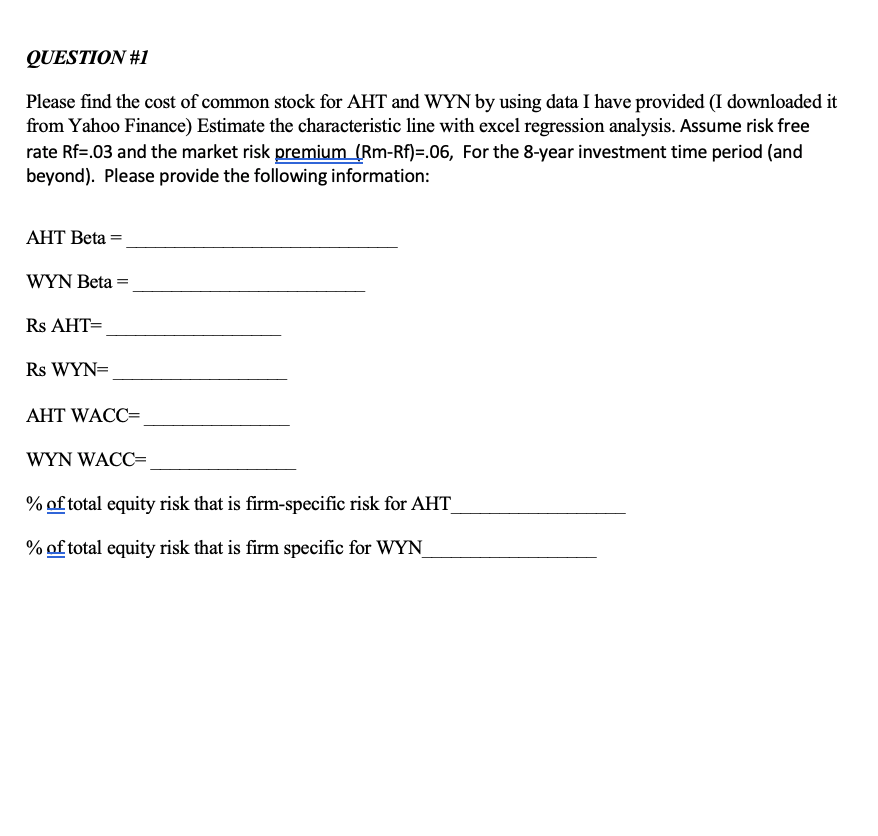

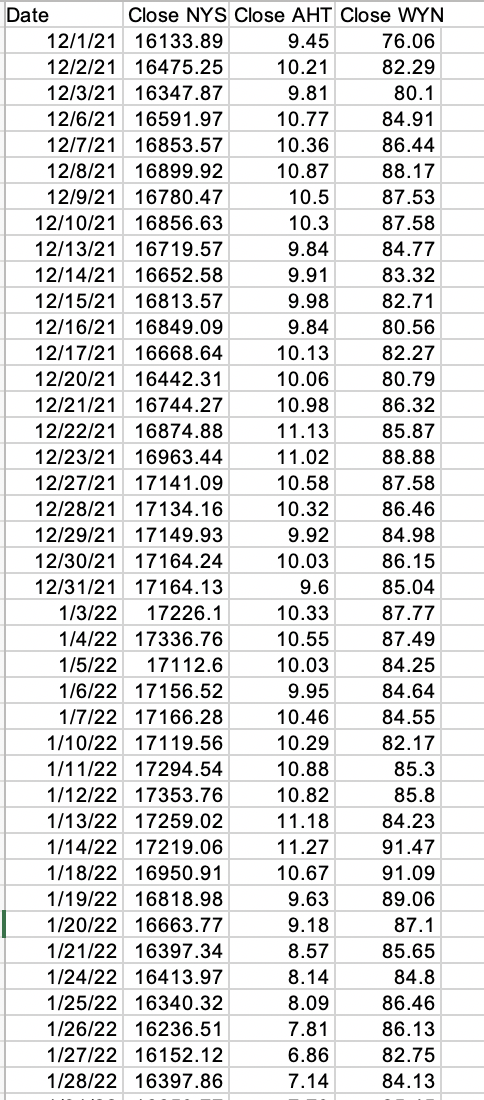

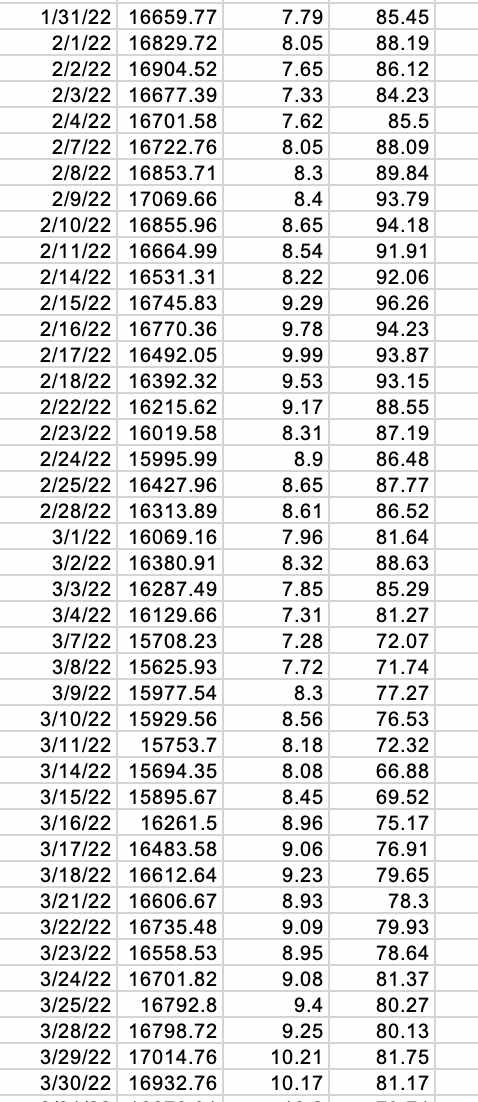

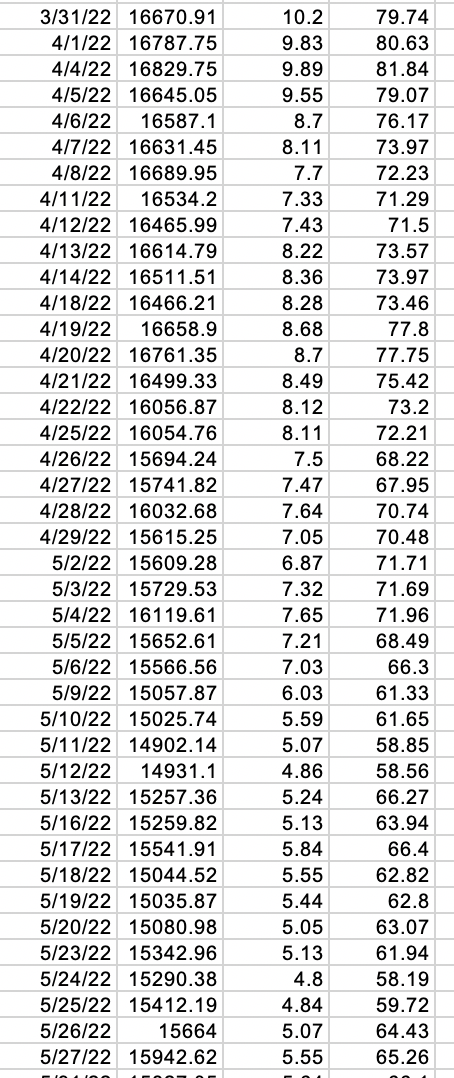

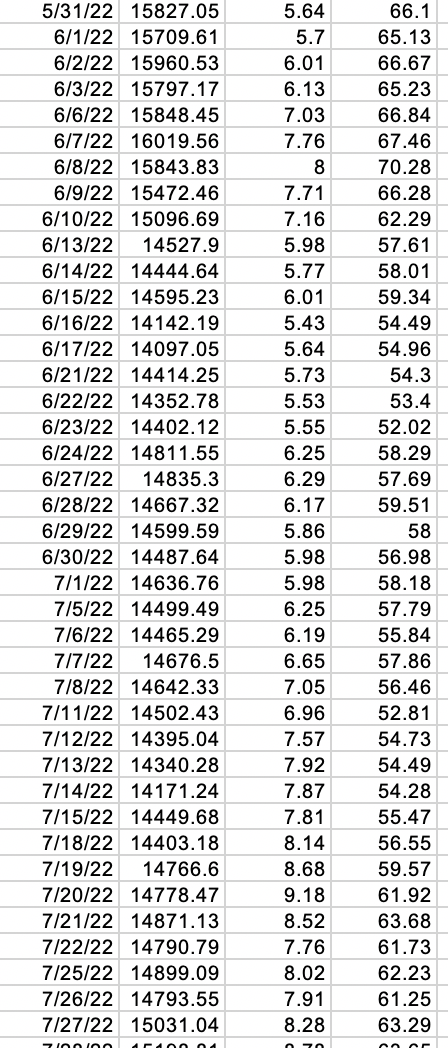

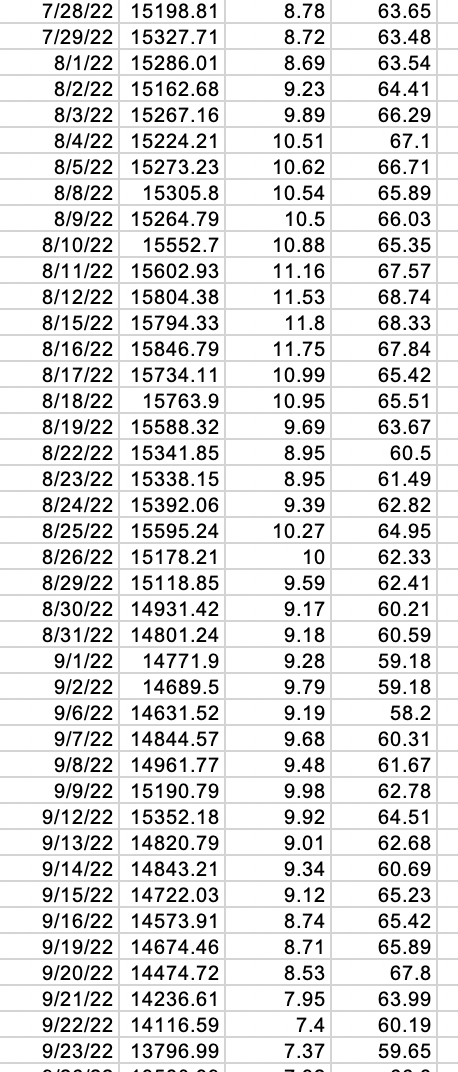

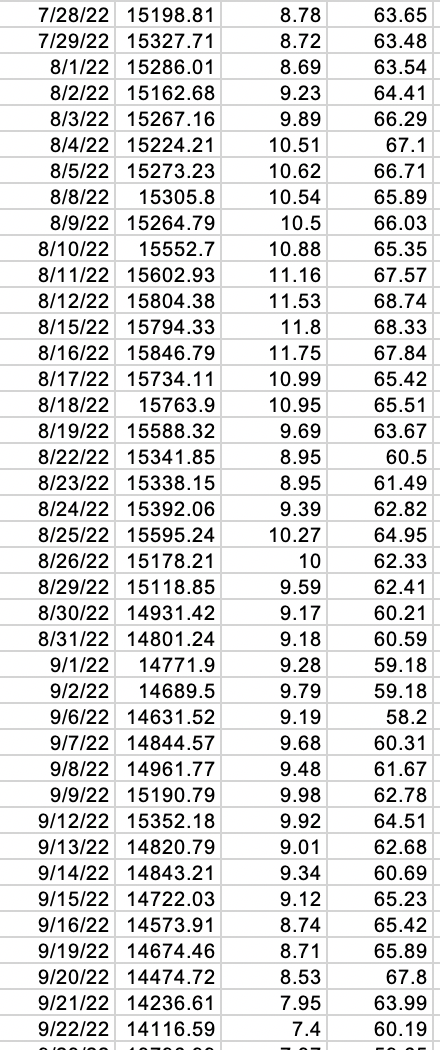

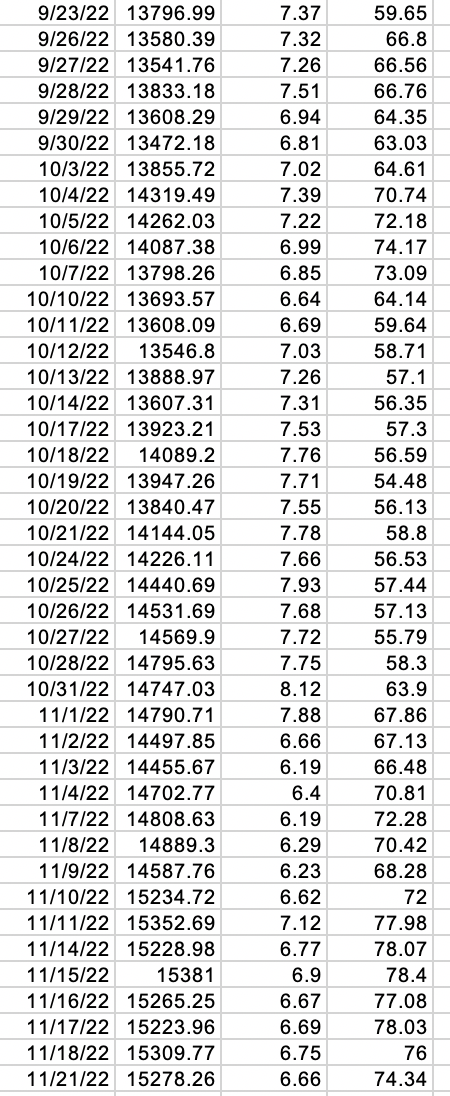

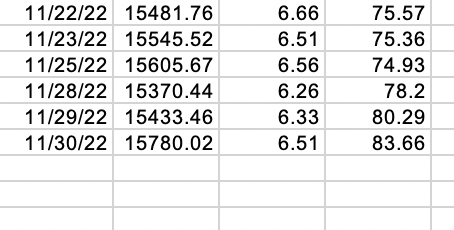

In the word file: include answers to all of the questions 1,2,3,4,5,6 below In the excel file: include a proforma for years 19 and all of your computations for AHT and WYN owners of DHE have the property listed with commercial Real Estate Brokers for $33M. You work for a bank which has two customers which are both considering the purchase of DHE. Your two customers are Ashford Hospitality Trust, AHT, a publicly traded REIT and Wynn Resorts Limited, WYN, a publicly traded C-corp. WYN faces a marginal corporate tax rate of 23%. Both AHT and WYN are long-standing customers of the bank you work at. Your bank has agreed to provide mortgage financing to either potential purchaser up to 85% of value implying that either AHT or WYN must inject a minimum of 15% of the financing from common stock (there are no other equity sources of financing for either firm). You (working for the bank) have been asked to value the property to help AHT and WYN in their decision making. Obviously, you need to make some assumptions to value the property for both firms. Please assume that WYN or AHT would borrow from our bank using some portion of the three debt instruments that we are willing to provide either firm. Also, assume that the actual sale of the property will occur for one of the firms at the asking price of $33M. We note that all three debt issuances are fully collateralized. This full collateralization helps to explain why our bank will lend under similar terms to either AHT or WYN. Three possible debt instruments are offered by our bank. Note that mortgage terms are identical for both firms and the firms may choose any combination of debt instruments as long as they do not exceed the maximums stated. The expected purchase price of Dark Horse is likely to be $33M with the book value of the building being $23M (to be depreciated straightline over 35 years) and the land value of $10M. The holding period for both firms is assumed to be 8 years. Selling costs when the property is sold will be 4%. There are utility costs for common areas in the unit community must be paid by the owner as expenses for the next year are as in the following table. The weighted average cost of capital will be used in determining the expected terminal value of the property and the present value of all relevant cash flows. At the end of year 8 you are to assume that the property will be resold in the marketplace for id's terminal value minus a 4% sale cost. The terminal value is based upon the year 9 projected revenues and costs as well as a perpetual growth in NOI or NOPAT of 3% per year forever (beyond year 9 ). The terminal cap rate should be assumed to be the firm's WACC. Table 1 below provides the possible debt and equity instruments issued (debt by our bank) for either borrower will be as follows: TABLE 1: FINANCING VEHICLES AVAILABLE TO THE TWO FIRMS QUESTION\#I Please find the cost of common stock for AHT and WYN by using data I have provided (I downloaded it from Yahoo Finance) Estimate the characteristic line with excel regression analysis. Assume risk free rate Rf=.03 and the market risk premium ( RmRf)=.06, For the 8-year investment time period (and beyond). Please provide the following information: AHT Beta = WYN Beta = Rs AHT= Rs WYN= AHT WACC = WYN WACC = % of total equity risk that is firm-specific risk for AHT \begin{tabular}{|r|r|r|r|} \hline Date & Close NYS & Close AT & Close WY \\ \hline 12/1/21 & 16133.89 & 9.45 & 76.06 \\ \hline 12/2/21 & 16475.25 & 10.21 & 82.29 \\ \hline 12/3/21 & 16347.87 & 9.81 & 80.1 \\ \hline 12/6/21 & 16591.97 & 10.77 & 84.91 \\ \hline 12/7/21 & 16853.57 & 10.36 & 86.44 \\ \hline 12/8/21 & 16899.92 & 10.87 & 88.17 \\ \hline 12/9/21 & 16780.47 & 10.5 & 87.53 \\ \hline 12/10/21 & 16856.63 & 10.3 & 87.58 \\ \hline 12/13/21 & 16719.57 & 9.84 & 84.77 \\ \hline 12/14/21 & 16652.58 & 9.91 & 83.32 \\ \hline 12/15/21 & 16813.57 & 9.98 & 82.71 \\ \hline 12/16/21 & 16849.09 & 9.84 & 80.56 \\ \hline 12/17/21 & 16668.64 & 10.13 & 82.27 \\ \hline 12/20/21 & 16442.31 & 10.06 & 80.79 \\ \hline 12/21/21 & 16744.27 & 10.98 & 86.32 \\ \hline 12/22/21 & 16874.88 & 11.13 & 85.87 \\ \hline 12/23/21 & 16963.44 & 11.02 & 88.88 \\ \hline 12/27/21 & 17141.09 & 10.58 & 87.58 \\ \hline 12/28/21 & 17134.16 & 10.32 & 86.46 \\ \hline 12/29/21 & 17149.93 & 9.92 & 84.98 \\ \hline 12/30/21 & 17164.24 & 10.03 & 86.15 \\ \hline 12/31/21 & 17164.13 & 9.6 & 85.04 \\ \hline 1/3/22 & 17226.1 & 10.33 & 87.77 \\ \hline 1/4/22 & 17336.76 & 10.55 & 87.49 \\ \hline 1/5/22 & 17112.6 & 10.03 & 84.25 \\ \hline 1/6/22 & 17156.52 & 9.95 & 84.64 \\ \hline 1/7/22 & 17166.28 & 10.46 & 84.55 \\ \hline 1/10/22 & 17119.56 & 10.29 & 82.17 \\ \hline 1/11/22 & 17294.54 & 10.88 & 85.3 \\ \hline 1/12/22 & 17353.76 & 10.82 & 85.8 \\ \hline 1/13/22 & 17259.02 & 11.18 & 84.23 \\ \hline 1/14/22 & 17219.06 & 11.27 & 91.47 \\ \hline 1/18/22 & 16950.91 & 10.67 & 91.09 \\ \hline 1/19/22 & 16818.98 & 9.63 & 89.06 \\ \hline 1/20/22 & 16663.77 & 9.18 & 87.1 \\ \hline 1/23 & 16397.34 & 8.57 & 85.65 \\ \hline 1/2.97 & 8.14 & 84.8 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 5/31/22 & 15827.05 & 5.64 & 66.1 \\ \hline 6/1/22 & 15709.61 & 5.7 & 65.13 \\ \hline 6/2/22 & 15960.53 & 6.01 & 66.67 \\ \hline 6/3/22 & 15797.17 & 6.13 & 65.23 \\ \hline 6/6/22 & 15848.45 & 7.03 & 66.84 \\ \hline 6/7/22 & 16019.56 & 7.76 & 67.46 \\ \hline 6/8/22 & 15843.83 & 8 & 70.28 \\ \hline 6/9/22 & 15472.46 & 7.71 & 66.28 \\ \hline 6/10/22 & 15096.69 & 7.16 & 62.29 \\ \hline 6/13/22 & 14527.9 & 5.98 & 57.61 \\ \hline 6/14/22 & 14444.64 & 5.77 & 58.01 \\ \hline 6/15/22 & 14595.23 & 6.01 & 59.34 \\ \hline 6/16/22 & 14142.19 & 5.43 & 54.49 \\ \hline 6/17/22 & 14097.05 & 5.64 & 54.96 \\ \hline 6/21/22 & 14414.25 & 5.73 & 54.3 \\ \hline 6/22/22 & 14352.78 & 5.53 & 53.4 \\ \hline 6/23/22 & 14402.12 & 5.55 & 52.02 \\ \hline 6/24/22 & 14811.55 & 6.25 & 58.29 \\ \hline 6/27/22 & 14835.3 & 6.29 & 57.69 \\ \hline 6/28/22 & 14667.32 & 6.17 & 59.51 \\ \hline 6/29/22 & 14599.59 & 5.86 & 58 \\ \hline 7/27/22 & 15031.04 & 8.28 & 63.29 \\ \hline 7/21/21/22 & 1487 \\ \hline 7/22 & 14487.64 & 5.98 & 56.98 \\ \hline 7/1/22 & 14636.76 & 5.98 & 58.18 \\ \hline 7/5/22 & 14499.49 & 6.25 & 57.79 \\ \hline 7/6/22 & 14465.29 & 6.19 & 55.84 \\ \hline 7/7/22 & 14676.5 & 6.65 & 57.86 \\ \hline 7/8/22 & 14642.33 & 7.05 & 56.46 \\ \hline 7/11/22 & 14502.43 & 6.96 & 52.81 \\ \hline 7/12/22 & 14395.04 & 7.57 & 54.73 \\ \hline 7/13/22 & 14340.28 & 7.92 & 54.49 \\ \hline 7/14/22 & 14171.24 & 7.87 & 54.28 \\ \hline 7/15/22 & 14449.68 & 7.81 & 55.47 \\ \hline 7/18/22 & 14403.18 & 8.14 & 56.55 \\ \hline 7/19/22 & 14766.6 & 8.68 & 59.57 \\ \hline 7/2018 & 14778.47 & 9.18 & 61.92 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 7/28/22 & 15198.81 & 8.78 & 63.65 \\ \hline 7/29/22 & 15327.71 & 8.72 & 63.48 \\ \hline 8/1/22 & 15286.01 & 8.69 & 63.54 \\ \hline 8/2/22 & 15162.68 & 9.23 & 64.41 \\ \hline 8/3/22 & 15267.16 & 9.89 & 66.29 \\ \hline 8/4/22 & 15224.21 & 10.51 & 67.1 \\ \hline 8/5/22 & 15273.23 & 10.62 & 66.71 \\ \hline 8/8/22 & 15305.8 & 10.54 & 65.89 \\ \hline 8/9/22 & 15264.79 & 10.5 & 66.03 \\ \hline 8/10/22 & 15552.7 & 10.88 & 65.35 \\ \hline 8/11/22 & 15602.93 & 11.16 & 67.57 \\ \hline 8/12/22 & 15804.38 & 11.53 & 68.74 \\ \hline 8/15/22 & 15794.33 & 11.8 & 68.33 \\ \hline 8/16/22 & 15846.79 & 11.75 & 67.84 \\ \hline 8/17/22 & 15734.11 & 10.99 & 65.42 \\ \hline 8/18/22 & 15763.9 & 10.95 & 65.51 \\ \hline 8/19/22 & 15588.32 & 9.69 & 63.67 \\ \hline 8/22/22 & 15341.85 & 8.95 & 60.5 \\ \hline 8/23/22 & 15338.15 & 8.95 & 61.49 \\ \hline 8/24/22 & 15392.06 & 9.39 & 62.82 \\ \hline 8/25/22 & 15595.24 & 10.27 & 64.95 \\ \hline 8/26/22 & 15178.21 & 10 & 62.33 \\ \hline 8/22/22 & 14116.59 & 7.4 & 60.19 \\ \hline 9/29/22 & 15118.85 & 9.59 & 62.41 \\ \hline 8/30/22 & 14931.42 & 9.17 & 60.21 \\ \hline 8/31/22 & 14801.24 & 9.18 & 60.59 \\ \hline 9/1/22 & 14771.9 & 9.28 & 59.18 \\ \hline 9/2/22 & 14689.5 & 9.79 & 59.18 \\ \hline 9/6/22 & 14631.52 & 9.19 & 58.2 \\ \hline 9/7/22 & 14844.57 & 9.68 & 60.31 \\ \hline 9/8/22 & 14961.77 & 9.48 & 61.67 \\ \hline 9/9/22 & 15190.79 & 9.98 & 62.78 \\ \hline 9/12/22 & 15352.18 & 9.92 & 64.51 \\ \hline 9/13/22 & 14820.79 & 9.01 & 62.68 \\ \hline 9/14/22 & 14843.21 & 9.34 & 60.69 \\ \hline & 14673.91 & 8.74 & 65.42 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 11/22/22 & 15481.76 & 6.66 & 75.57 \\ \hline 11/23/22 & 15545.52 & 6.51 & 75.36 \\ \hline 11/25/22 & 15605.67 & 6.56 & 74.93 \\ \hline 11/28/22 & 15370.44 & 6.26 & 78.2 \\ \hline 11/29/22 & 15433.46 & 6.33 & 80.29 \\ \hline 11/30/22 & 15780.02 & 6.51 & 83.66 \\ \hline \end{tabular} In the word file: include answers to all of the questions 1,2,3,4,5,6 below In the excel file: include a proforma for years 19 and all of your computations for AHT and WYN owners of DHE have the property listed with commercial Real Estate Brokers for $33M. You work for a bank which has two customers which are both considering the purchase of DHE. Your two customers are Ashford Hospitality Trust, AHT, a publicly traded REIT and Wynn Resorts Limited, WYN, a publicly traded C-corp. WYN faces a marginal corporate tax rate of 23%. Both AHT and WYN are long-standing customers of the bank you work at. Your bank has agreed to provide mortgage financing to either potential purchaser up to 85% of value implying that either AHT or WYN must inject a minimum of 15% of the financing from common stock (there are no other equity sources of financing for either firm). You (working for the bank) have been asked to value the property to help AHT and WYN in their decision making. Obviously, you need to make some assumptions to value the property for both firms. Please assume that WYN or AHT would borrow from our bank using some portion of the three debt instruments that we are willing to provide either firm. Also, assume that the actual sale of the property will occur for one of the firms at the asking price of $33M. We note that all three debt issuances are fully collateralized. This full collateralization helps to explain why our bank will lend under similar terms to either AHT or WYN. Three possible debt instruments are offered by our bank. Note that mortgage terms are identical for both firms and the firms may choose any combination of debt instruments as long as they do not exceed the maximums stated. The expected purchase price of Dark Horse is likely to be $33M with the book value of the building being $23M (to be depreciated straightline over 35 years) and the land value of $10M. The holding period for both firms is assumed to be 8 years. Selling costs when the property is sold will be 4%. There are utility costs for common areas in the unit community must be paid by the owner as expenses for the next year are as in the following table. The weighted average cost of capital will be used in determining the expected terminal value of the property and the present value of all relevant cash flows. At the end of year 8 you are to assume that the property will be resold in the marketplace for id's terminal value minus a 4% sale cost. The terminal value is based upon the year 9 projected revenues and costs as well as a perpetual growth in NOI or NOPAT of 3% per year forever (beyond year 9 ). The terminal cap rate should be assumed to be the firm's WACC. Table 1 below provides the possible debt and equity instruments issued (debt by our bank) for either borrower will be as follows: TABLE 1: FINANCING VEHICLES AVAILABLE TO THE TWO FIRMS QUESTION\#I Please find the cost of common stock for AHT and WYN by using data I have provided (I downloaded it from Yahoo Finance) Estimate the characteristic line with excel regression analysis. Assume risk free rate Rf=.03 and the market risk premium ( RmRf)=.06, For the 8-year investment time period (and beyond). Please provide the following information: AHT Beta = WYN Beta = Rs AHT= Rs WYN= AHT WACC = WYN WACC = % of total equity risk that is firm-specific risk for AHT \begin{tabular}{|r|r|r|r|} \hline Date & Close NYS & Close AT & Close WY \\ \hline 12/1/21 & 16133.89 & 9.45 & 76.06 \\ \hline 12/2/21 & 16475.25 & 10.21 & 82.29 \\ \hline 12/3/21 & 16347.87 & 9.81 & 80.1 \\ \hline 12/6/21 & 16591.97 & 10.77 & 84.91 \\ \hline 12/7/21 & 16853.57 & 10.36 & 86.44 \\ \hline 12/8/21 & 16899.92 & 10.87 & 88.17 \\ \hline 12/9/21 & 16780.47 & 10.5 & 87.53 \\ \hline 12/10/21 & 16856.63 & 10.3 & 87.58 \\ \hline 12/13/21 & 16719.57 & 9.84 & 84.77 \\ \hline 12/14/21 & 16652.58 & 9.91 & 83.32 \\ \hline 12/15/21 & 16813.57 & 9.98 & 82.71 \\ \hline 12/16/21 & 16849.09 & 9.84 & 80.56 \\ \hline 12/17/21 & 16668.64 & 10.13 & 82.27 \\ \hline 12/20/21 & 16442.31 & 10.06 & 80.79 \\ \hline 12/21/21 & 16744.27 & 10.98 & 86.32 \\ \hline 12/22/21 & 16874.88 & 11.13 & 85.87 \\ \hline 12/23/21 & 16963.44 & 11.02 & 88.88 \\ \hline 12/27/21 & 17141.09 & 10.58 & 87.58 \\ \hline 12/28/21 & 17134.16 & 10.32 & 86.46 \\ \hline 12/29/21 & 17149.93 & 9.92 & 84.98 \\ \hline 12/30/21 & 17164.24 & 10.03 & 86.15 \\ \hline 12/31/21 & 17164.13 & 9.6 & 85.04 \\ \hline 1/3/22 & 17226.1 & 10.33 & 87.77 \\ \hline 1/4/22 & 17336.76 & 10.55 & 87.49 \\ \hline 1/5/22 & 17112.6 & 10.03 & 84.25 \\ \hline 1/6/22 & 17156.52 & 9.95 & 84.64 \\ \hline 1/7/22 & 17166.28 & 10.46 & 84.55 \\ \hline 1/10/22 & 17119.56 & 10.29 & 82.17 \\ \hline 1/11/22 & 17294.54 & 10.88 & 85.3 \\ \hline 1/12/22 & 17353.76 & 10.82 & 85.8 \\ \hline 1/13/22 & 17259.02 & 11.18 & 84.23 \\ \hline 1/14/22 & 17219.06 & 11.27 & 91.47 \\ \hline 1/18/22 & 16950.91 & 10.67 & 91.09 \\ \hline 1/19/22 & 16818.98 & 9.63 & 89.06 \\ \hline 1/20/22 & 16663.77 & 9.18 & 87.1 \\ \hline 1/23 & 16397.34 & 8.57 & 85.65 \\ \hline 1/2.97 & 8.14 & 84.8 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 5/31/22 & 15827.05 & 5.64 & 66.1 \\ \hline 6/1/22 & 15709.61 & 5.7 & 65.13 \\ \hline 6/2/22 & 15960.53 & 6.01 & 66.67 \\ \hline 6/3/22 & 15797.17 & 6.13 & 65.23 \\ \hline 6/6/22 & 15848.45 & 7.03 & 66.84 \\ \hline 6/7/22 & 16019.56 & 7.76 & 67.46 \\ \hline 6/8/22 & 15843.83 & 8 & 70.28 \\ \hline 6/9/22 & 15472.46 & 7.71 & 66.28 \\ \hline 6/10/22 & 15096.69 & 7.16 & 62.29 \\ \hline 6/13/22 & 14527.9 & 5.98 & 57.61 \\ \hline 6/14/22 & 14444.64 & 5.77 & 58.01 \\ \hline 6/15/22 & 14595.23 & 6.01 & 59.34 \\ \hline 6/16/22 & 14142.19 & 5.43 & 54.49 \\ \hline 6/17/22 & 14097.05 & 5.64 & 54.96 \\ \hline 6/21/22 & 14414.25 & 5.73 & 54.3 \\ \hline 6/22/22 & 14352.78 & 5.53 & 53.4 \\ \hline 6/23/22 & 14402.12 & 5.55 & 52.02 \\ \hline 6/24/22 & 14811.55 & 6.25 & 58.29 \\ \hline 6/27/22 & 14835.3 & 6.29 & 57.69 \\ \hline 6/28/22 & 14667.32 & 6.17 & 59.51 \\ \hline 6/29/22 & 14599.59 & 5.86 & 58 \\ \hline 7/27/22 & 15031.04 & 8.28 & 63.29 \\ \hline 7/21/21/22 & 1487 \\ \hline 7/22 & 14487.64 & 5.98 & 56.98 \\ \hline 7/1/22 & 14636.76 & 5.98 & 58.18 \\ \hline 7/5/22 & 14499.49 & 6.25 & 57.79 \\ \hline 7/6/22 & 14465.29 & 6.19 & 55.84 \\ \hline 7/7/22 & 14676.5 & 6.65 & 57.86 \\ \hline 7/8/22 & 14642.33 & 7.05 & 56.46 \\ \hline 7/11/22 & 14502.43 & 6.96 & 52.81 \\ \hline 7/12/22 & 14395.04 & 7.57 & 54.73 \\ \hline 7/13/22 & 14340.28 & 7.92 & 54.49 \\ \hline 7/14/22 & 14171.24 & 7.87 & 54.28 \\ \hline 7/15/22 & 14449.68 & 7.81 & 55.47 \\ \hline 7/18/22 & 14403.18 & 8.14 & 56.55 \\ \hline 7/19/22 & 14766.6 & 8.68 & 59.57 \\ \hline 7/2018 & 14778.47 & 9.18 & 61.92 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 7/28/22 & 15198.81 & 8.78 & 63.65 \\ \hline 7/29/22 & 15327.71 & 8.72 & 63.48 \\ \hline 8/1/22 & 15286.01 & 8.69 & 63.54 \\ \hline 8/2/22 & 15162.68 & 9.23 & 64.41 \\ \hline 8/3/22 & 15267.16 & 9.89 & 66.29 \\ \hline 8/4/22 & 15224.21 & 10.51 & 67.1 \\ \hline 8/5/22 & 15273.23 & 10.62 & 66.71 \\ \hline 8/8/22 & 15305.8 & 10.54 & 65.89 \\ \hline 8/9/22 & 15264.79 & 10.5 & 66.03 \\ \hline 8/10/22 & 15552.7 & 10.88 & 65.35 \\ \hline 8/11/22 & 15602.93 & 11.16 & 67.57 \\ \hline 8/12/22 & 15804.38 & 11.53 & 68.74 \\ \hline 8/15/22 & 15794.33 & 11.8 & 68.33 \\ \hline 8/16/22 & 15846.79 & 11.75 & 67.84 \\ \hline 8/17/22 & 15734.11 & 10.99 & 65.42 \\ \hline 8/18/22 & 15763.9 & 10.95 & 65.51 \\ \hline 8/19/22 & 15588.32 & 9.69 & 63.67 \\ \hline 8/22/22 & 15341.85 & 8.95 & 60.5 \\ \hline 8/23/22 & 15338.15 & 8.95 & 61.49 \\ \hline 8/24/22 & 15392.06 & 9.39 & 62.82 \\ \hline 8/25/22 & 15595.24 & 10.27 & 64.95 \\ \hline 8/26/22 & 15178.21 & 10 & 62.33 \\ \hline 8/22/22 & 14116.59 & 7.4 & 60.19 \\ \hline 9/29/22 & 15118.85 & 9.59 & 62.41 \\ \hline 8/30/22 & 14931.42 & 9.17 & 60.21 \\ \hline 8/31/22 & 14801.24 & 9.18 & 60.59 \\ \hline 9/1/22 & 14771.9 & 9.28 & 59.18 \\ \hline 9/2/22 & 14689.5 & 9.79 & 59.18 \\ \hline 9/6/22 & 14631.52 & 9.19 & 58.2 \\ \hline 9/7/22 & 14844.57 & 9.68 & 60.31 \\ \hline 9/8/22 & 14961.77 & 9.48 & 61.67 \\ \hline 9/9/22 & 15190.79 & 9.98 & 62.78 \\ \hline 9/12/22 & 15352.18 & 9.92 & 64.51 \\ \hline 9/13/22 & 14820.79 & 9.01 & 62.68 \\ \hline 9/14/22 & 14843.21 & 9.34 & 60.69 \\ \hline & 14673.91 & 8.74 & 65.42 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline 11/22/22 & 15481.76 & 6.66 & 75.57 \\ \hline 11/23/22 & 15545.52 & 6.51 & 75.36 \\ \hline 11/25/22 & 15605.67 & 6.56 & 74.93 \\ \hline 11/28/22 & 15370.44 & 6.26 & 78.2 \\ \hline 11/29/22 & 15433.46 & 6.33 & 80.29 \\ \hline 11/30/22 & 15780.02 & 6.51 & 83.66 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started