Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question 1 part ii. and question 2 part iv. (draw the profit/loss diagrams) ART II 1. Consider a call option on the euro

please answer question 1 part ii. and question 2 part iv. (draw the profit/loss diagrams)

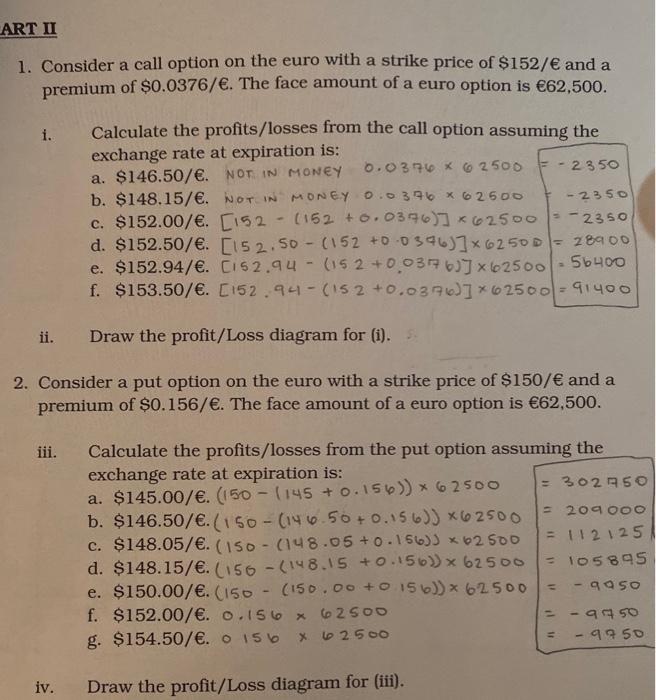

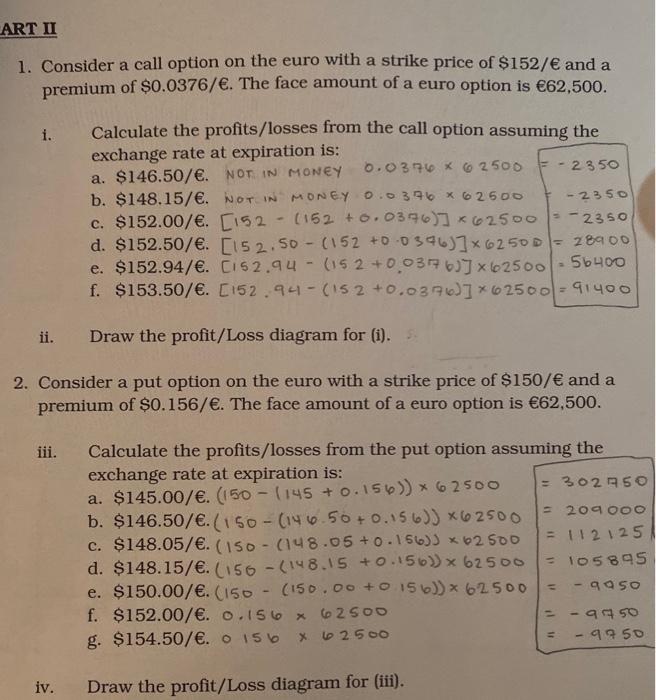

ART II 1. Consider a call option on the euro with a strike price of $152/ and a premium of $0.0376/. The face amount of a euro option is 62,500. i. Calculate the profits/losses from the call option assuming the exchange rate at expiration is: a. $146.50/. NOT IN MONEY 0.0376 * 62500 - 2 350 b. $148.15/. NOT IN MONEY 0.0396 X 62600 -2350 c. $152.00/. [152 - (152 +0.0376)] *62500-2350 d. $152.50/. [152.50 - (152 +0.0396)]*6250D = 28900 e. $152.94/. C162.94 - (152 +0.0377633x62500 56400 f. $153.50/. [152.94- (152 +0.0376]*62500 - 91400 ii. Draw the profit/Loss diagram for (i). 2. Consider a put option on the euro with a strike price of $150/ and a premium of $0.156/. The face amount of a euro option is 62,500. iii. Calculate the profits/losses from the put option assuming the exchange rate at expiration is: 302A50 a. $145.00/. (150 - (145 + 0.15)) x 6 2500 b. $146.50/.(150 - (146.50 +0.156)) X62500 - 209000 c. $148.05/. (150 - (148.05 +0.156)) x62500 = 11 2125 d. $148.15/.(150 -(148.15 +0.156)) x 62500 = 105895 e. $150.00/.(150 - (150.00 +0.156)) * 62500 - gaso f. $152.00/. 0.156 * 62500 --9950 g. $154.50/. O 156 x 6 2 500 -9750 iv. Draw the profit/Loss diagram for (iii)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started