Answered step by step

Verified Expert Solution

Question

1 Approved Answer

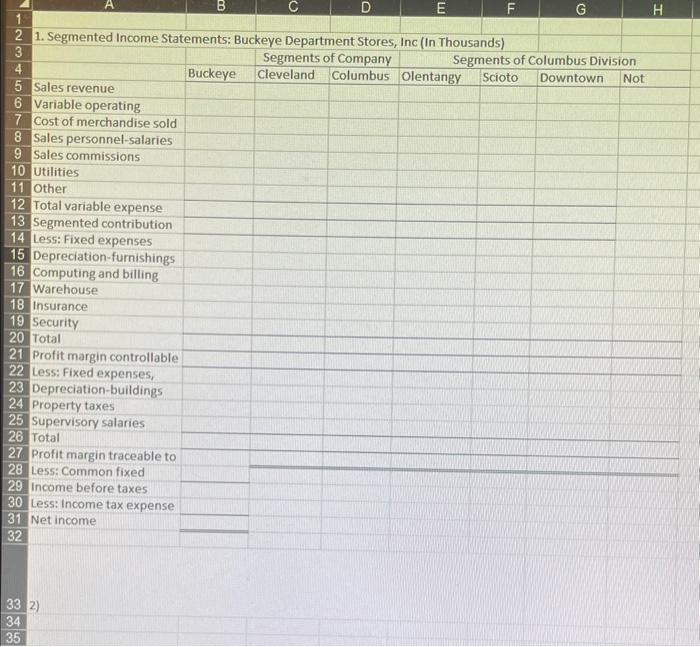

please answer question 1 using the template in picture 3 Problem 12-45 Prepare Segmented Income Statement; Contribution-Margin Format; Retail ( (1) LO 12-5) Buckeye Department

please answer question 1 using the template in picture 3

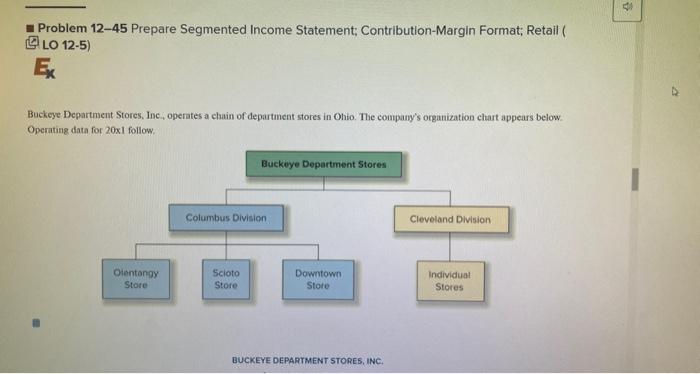

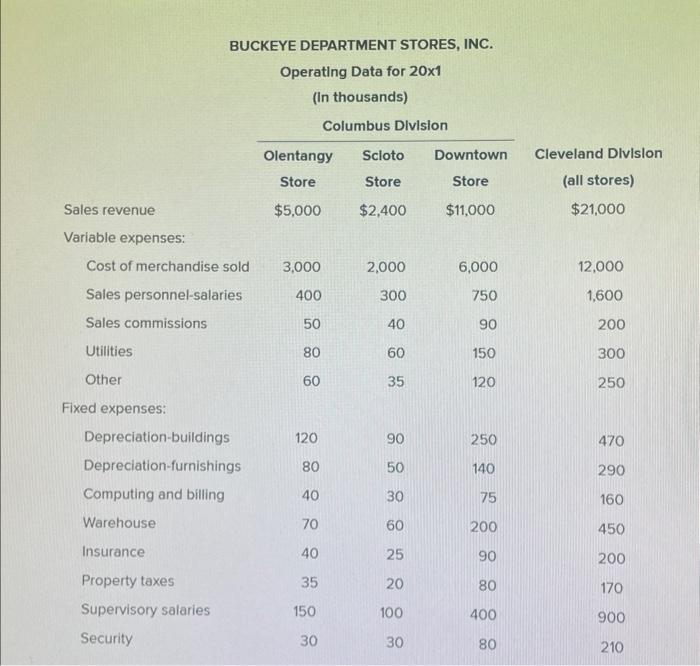

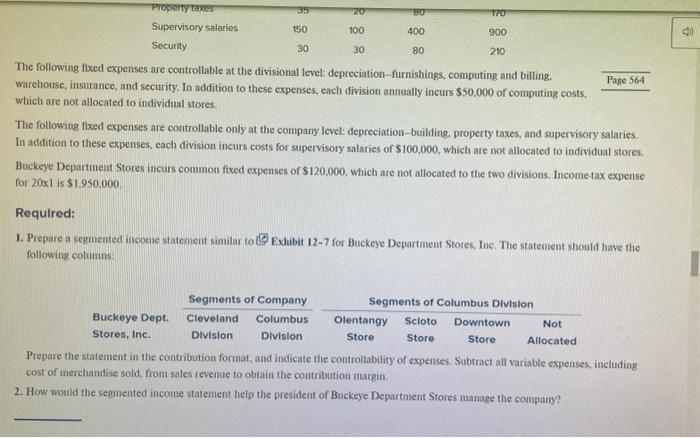

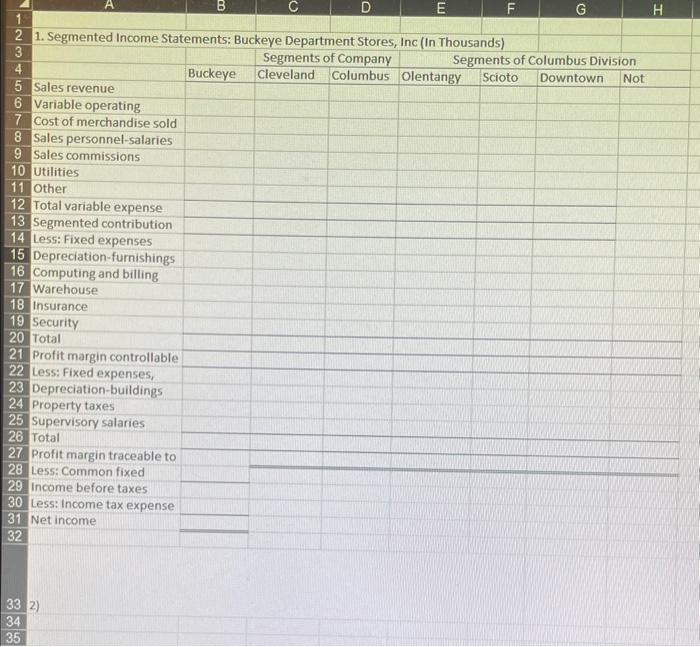

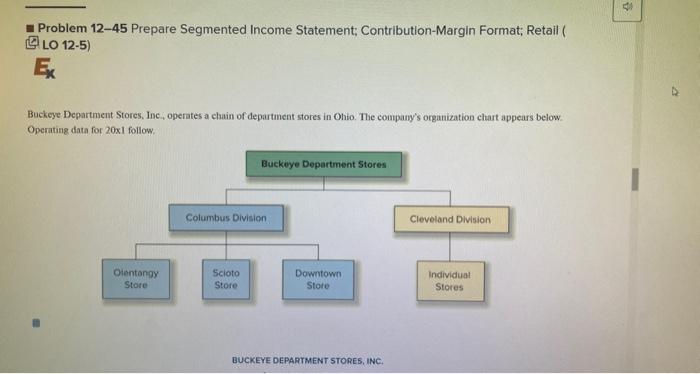

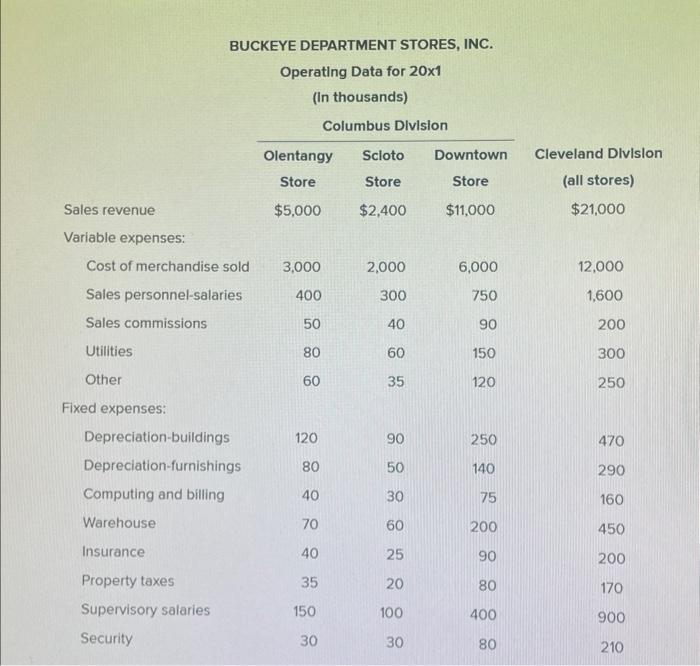

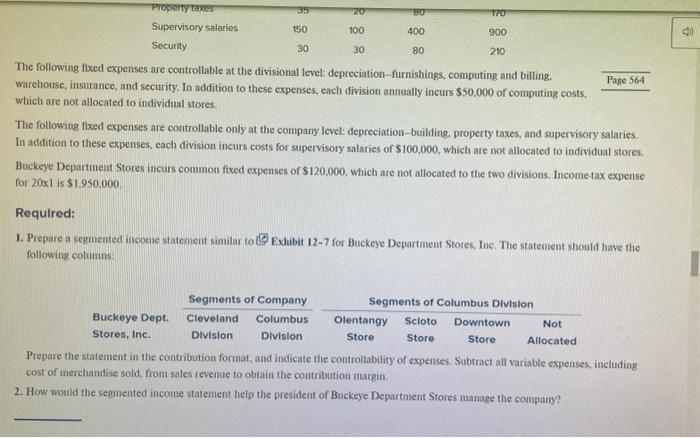

Problem 12-45 Prepare Segmented Income Statement; Contribution-Margin Format; Retail ( (1) LO 12-5) Buckeye Department Stores, Inc, operates a chuin of department stores in Ohio. The conpany's organization chart appears below. Operating data for 20x I follow. BUCKEVE DEPARTMENT STORES, INC. BUCKEYE DEPARTMENT STORES, INC. Operating Data for 201 (In thousands) Columbus Division Variable expenses: CostofmerchandisesoldSalespersonnel-salariesSalescommissionsUtilitiesOther3,0004005080602,0003004060356,0007509015012012,0001,600200300250 Fixed expenses: Depreciation-buildingsDepreciation-furnishingsComputingandbillingWarehouseInsurancePropertytaxesSupervisorysalariesSecurity1208040704035150309050306025201003025014075200908040080470290160450200170900210 The following fixed expenses are controllable at the divisional level: depreciation-furnishings, computing and billing. warehouse, insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs, which are not allocated to individual stores. The following fixed expenses are controllable only at the company level: depreciation-building. property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $100,000, which are not allocated to individual stores. Buckeye Department Stores incurs common fixed expenses of $120,000. which are not allocated to the two divisions. Income-tax expense for 20x1 is $1,950,000 Requlred: 1. Prepare a segmented income statement similar to () Exhibit 12-7 for Buckeye Department Stores, Inc. The statement should have the following columes: Prepare the statement in the contribution format, and indicate the controllability of expenses, Subtract all variable expenses. ineluding cost of mercliandise sold, from sales reveme to obtain the contribution margin. 2. How would the segmented income statement help the president of Buckeye Department Stores manage the company? 1. Segmented Income Statements: Buckeye Department Stores, Inc (In Thousands) 3433

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started