Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question #11 and #12 thanks please show all the work, not in excel PART B: SHORT ANSWER. Answer in the space provided. You

please answer question #11 and #12 thanks

please show all the work, not in excel

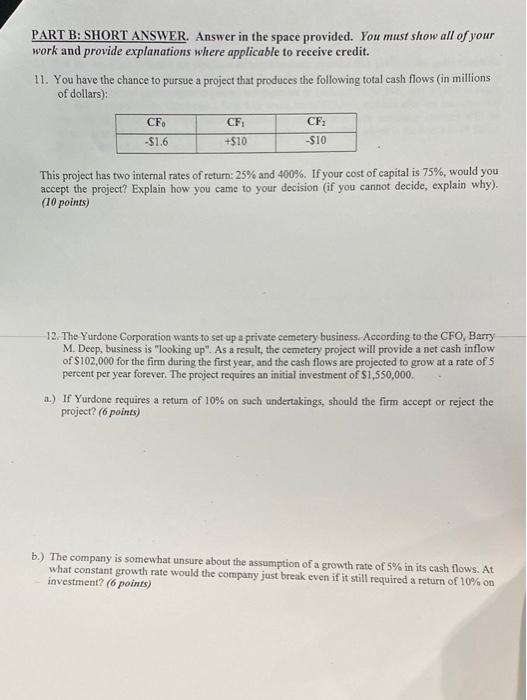

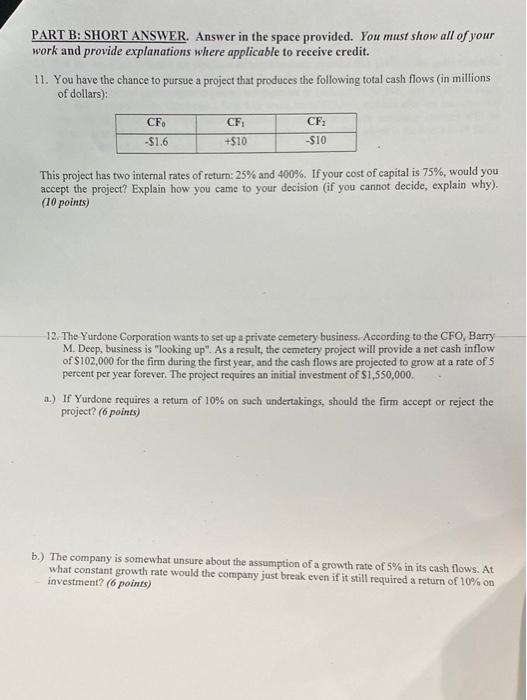

PART B: SHORT ANSWER. Answer in the space provided. You must show all of your work and provide explanations where applicable to receive credit. 11. You have the chance to pursue a project that produces the following total cash flows (in millions of dollars): CF CF CF, -$10 -$1.6 +$10 This project has two internal rates of return: 25% and 400%. If your cost of capital is 75%, would you accept the project? Explain how you came to your decision (if you cannot decide, explain why). (10 points) 3 12. The Yurdone Corporation wants to set up a private cemetery business According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $102,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 5 percent per year forever. The project requires an initial investment of $1,550,000. a.) If Yurdone requires a return of 10% on such undertakings, should the firm accept or reject the project? (6 points) b.) The company is somewhat unsure about the assumption of a growth rate of 5% in its cash flows. At what constant growth rate would the company just break even if it still required a return of 10% on investment? (6 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started