Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question 17.30. question 17.29 is for reference. 17.29 An asset was acquired by Hugo and Sons with the following values. first cost a

please answer question 17.30. question 17.29 is for reference.

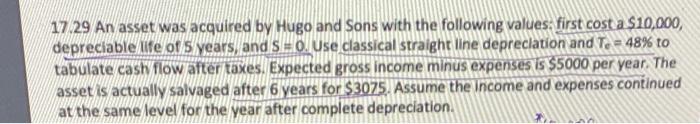

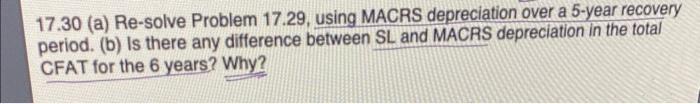

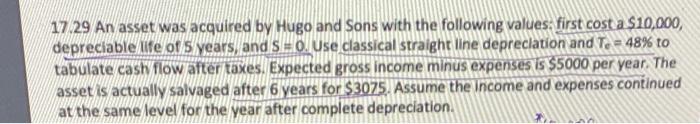

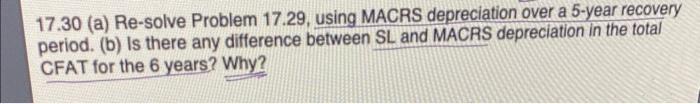

17.29 An asset was acquired by Hugo and Sons with the following values. first cost a $10,000, depreciable life of 5 years, and S=0. Use classical straight line depreciation and Tc=48% to tabulate cash flow after taxes. Expected gross income minus expenses is $5000 per year. The asset is actually salvaged after 6 years for $3075. Assume the income and expenses continued at the same level for the year after complete depreciation. 17.30 (a) Re-solve Problem 17.29, using MACRS depreciation over a 5-year recovery period. (b) Is there any difference between SL and MACRS depreciation in the total CFAT for the 6 years? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started