Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 2 1. A) Describe briefly each of the following measures, and B) Calculate the current yield (cy), the yield to maturity (ytm),

Please answer question 2

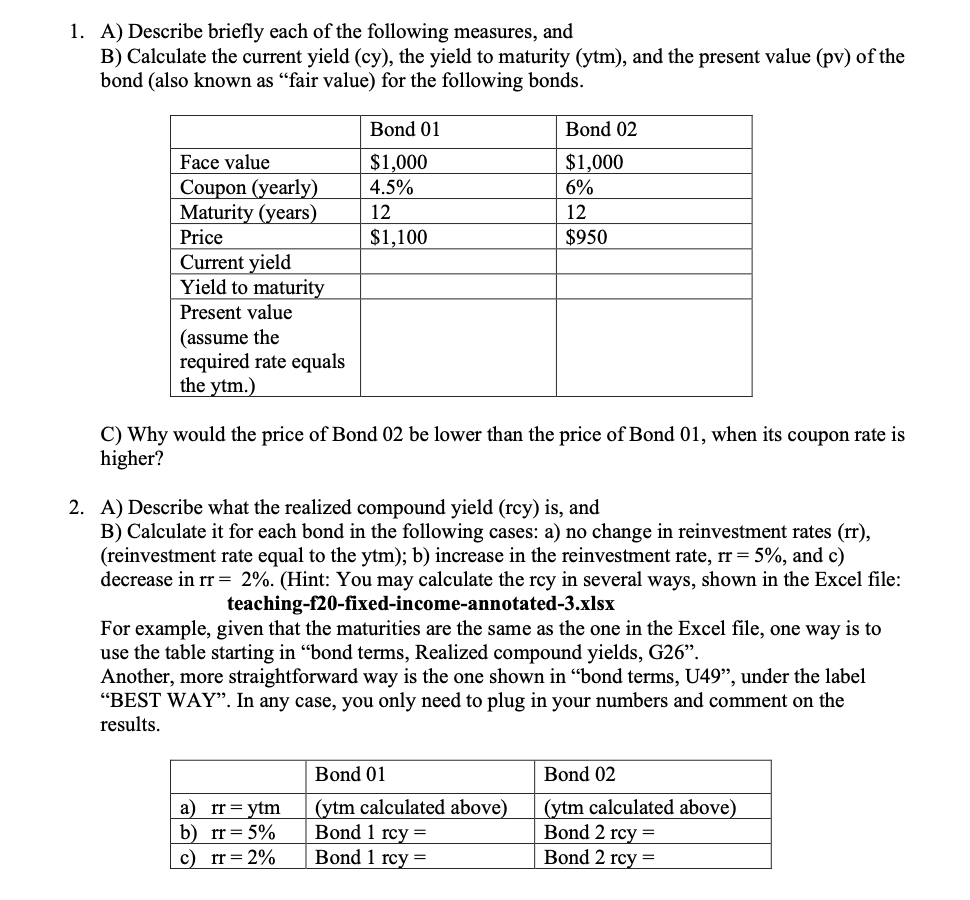

1. A) Describe briefly each of the following measures, and B) Calculate the current yield (cy), the yield to maturity (ytm), and the present value (pv) of the bond (also known as "fair value) for the following bonds. Bond 01 $1,000 4.5% 12 $1,100 Bond 02 $1,000 6% 12 $950 Face value Coupon (yearly) Maturity (years) Price Current yield Yield to maturity Present value (assume the required rate equals the ytm.) C) Why would the price of Bond 02 be lower than the price of Bond 01, when its coupon rate is higher? 2. A) Describe what the realized compound yield (rcy) is, and B) Calculate it for each bond in the following cases: a) no change in reinvestment rates (rr), (reinvestment rate equal to the ytm); b) increase in the reinvestment rate, rr = 5%, and c) decrease in rr= 2%. (Hint: You may calculate the rcy in several ways, shown in the Excel file: teaching-f20-fixed-income-annotated-3.xlsx For example, given that the maturities are the same as the one in the Excel file, one way is to use the table starting in bond terms, Realized compound yields, G26. Another, more straightforward way is the one shown in "bond terms, U49", under the label BEST WAY. In any case, you only need to plug in your numbers and comment on the results. a) rr = ytm b) rr = 5% c) rr= 2% Bond 01 (ytm calculated above) Bond 1 rcy = Bond 1 rcy = Bond 02 (ytm calculated above) Bond 2 rcy = Bond 2 rcy =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started