Answered step by step

Verified Expert Solution

Question

1 Approved Answer

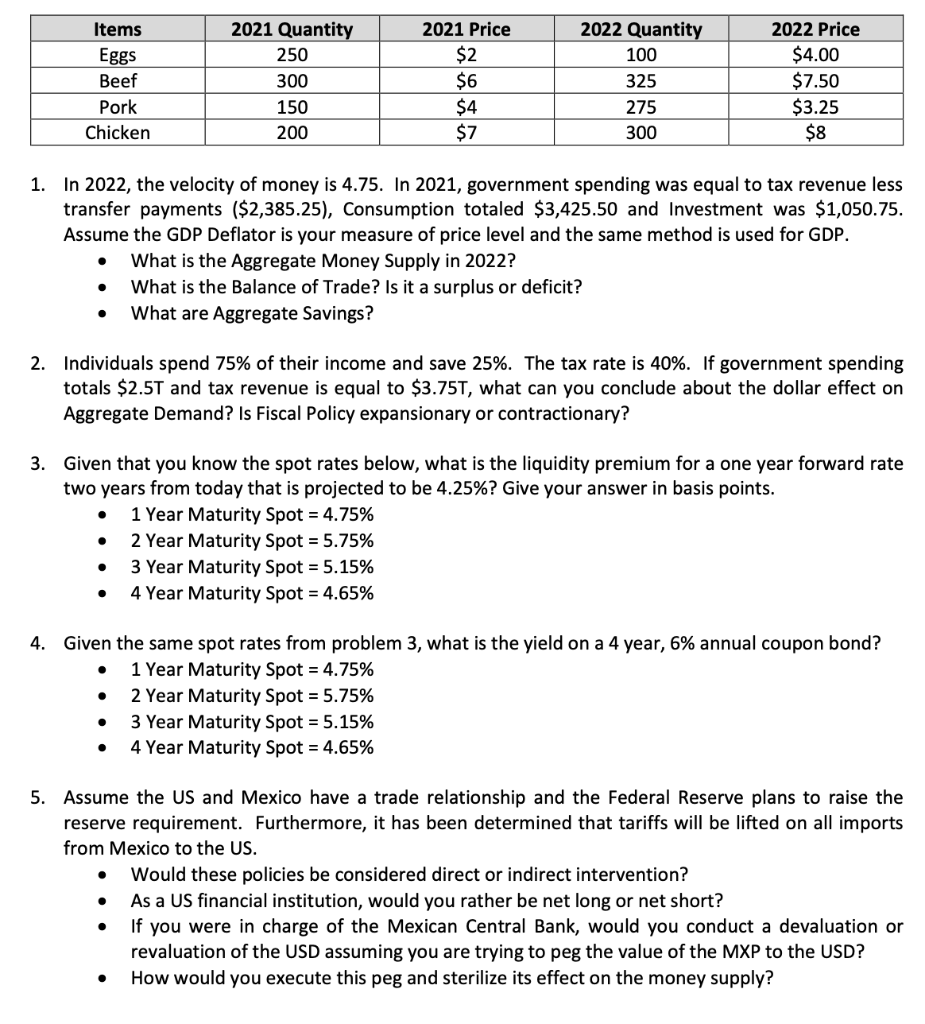

PLEASE ANSWER QUESTION 2 1. In 2022 , the velocity of money is 4.75. In 2021, government spending was equal to tax revenue less transfer

PLEASE ANSWER QUESTION 2

1. In 2022 , the velocity of money is 4.75. In 2021, government spending was equal to tax revenue less transfer payments ($2,385.25), Consumption totaled $3,425.50 and Investment was $1,050.75. Assume the GDP Deflator is your measure of price level and the same method is used for GDP. - What is the Aggregate Money Supply in 2022? - What is the Balance of Trade? Is it a surplus or deficit? - What are Aggregate Savings? 2. Individuals spend 75% of their income and save 25%. The tax rate is 40%. If government spending totals $2.5T and tax revenue is equal to $3.75T, what can you conclude about the dollar effect on Aggregate Demand? Is Fiscal Policy expansionary or contractionary? 3. Given that you know the spot rates below, what is the liquidity premium for a one year forward rate two years from today that is projected to be 4.25% ? Give your answer in basis points. - 1 Year Maturity Spot =4.75% - 2 Year Maturity Spot =5.75% - 3 Year Maturity Spot =5.15% - 4 Year Maturity Spot =4.65% 4. Given the same spot rates from problem 3, what is the yield on a 4 year, 6% annual coupon bond? - 1 Year Maturity Spot =4.75% - 2 Year Maturity Spot =5.75% - 3 Year Maturity Spot =5.15% - 4 Year Maturity Spot =4.65% 5. Assume the US and Mexico have a trade relationship and the Federal Reserve plans to raise the reserve requirement. Furthermore, it has been determined that tariffs will be lifted on all imports from Mexico to the US. - Would these policies be considered direct or indirect intervention? - As a US financial institution, would you rather be net long or net short? - If you were in charge of the Mexican Central Bank, would you conduct a devaluation or revaluation of the USD assuming you are trying to peg the value of the MXP to the USD? - How would you execute this peg and sterilize its effect on the money supplyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started