please answer question 2 and 3 and i will upvote

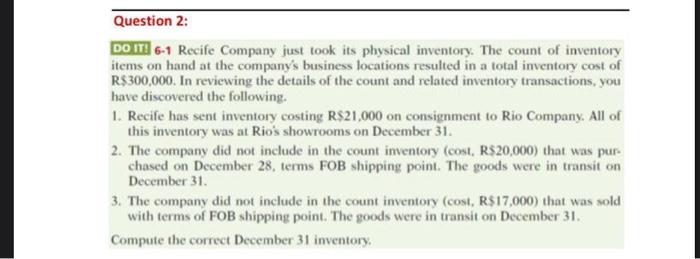

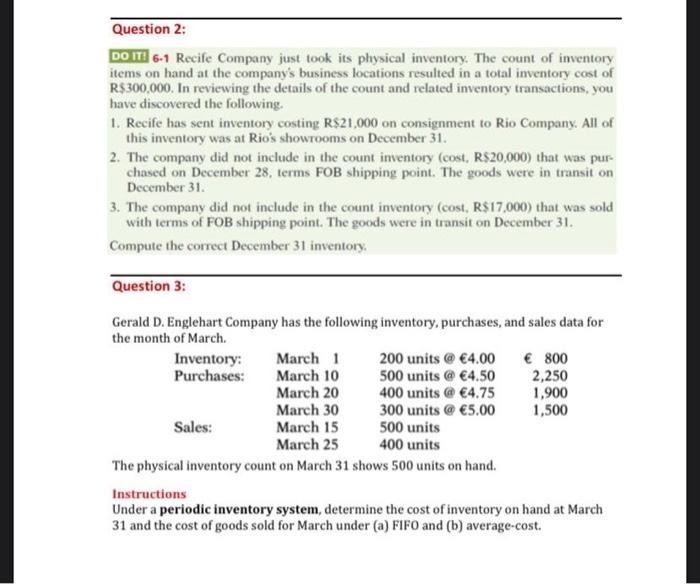

Question 2: DO IT. 6-1 Recife Company just took its physical inventory. The count of inventory items on hand at the company's business locations resulted in a total inventory cost of R$ 300,000. In reviewing the details of the count and related inventory transactions, you have discovered the following. 1. Recife has sent inventory costing R$21,000 on consignment to Rio Company. All of this inventory was at Rio's showrooms on December 31. 2. The company did not include in the count inventory (cost, R$20,000) that was pur chased on December 28, terms FOB shipping point. The goods were in transit on December 31. 3. The company did not include in the count inventory (cost, R$17,000) that was sold with terms of FOB shipping point. The goods were in transit on December 31. Compute the correct December 31 inventory, Question 2: DO ITI 6-1 Recife Company just took its physical inventory. The count of inventory items on hand at the company's business locations resulted in a total inventory cost of R$ 300,000. In reviewing the details of the count and related inventory transactions, you have discovered the following. 1. Recife has sent inventory costing R$21,000 on consignment to Rio Company. All of this inventory was at Rio's showrooms on December 31. 2. The company did not include in the count inventory (cost. R$20,000) that was pur- chased on December 28, terms FOB shipping point. The goods were in transit on December 31. 3. The company did not include in the count inventory (cost, R$17,000) that was sold with terms of FOB shipping point. The goods were in transit on December 31. Compute the correct December 31 inventory Question 3: Gerald D. Englehart Company has the following inventory, purchases, and sales data for the month of March Inventory: March 1 200 units @ 4.00 800 Purchases: March 10 500 units @ 4.50 2,250 March 20 400 units @ 4.75 1,900 March 30 300 units @ 5.00 1,500 Sales: March 15 500 units March 25 400 units The physical inventory count on March 31 shows 500 units on hand. Instructions Under a periodic inventory system, determine the cost of inventory on hand at March 31 and the cost of goods sold for March under (a) FIFO and (b) average-cost