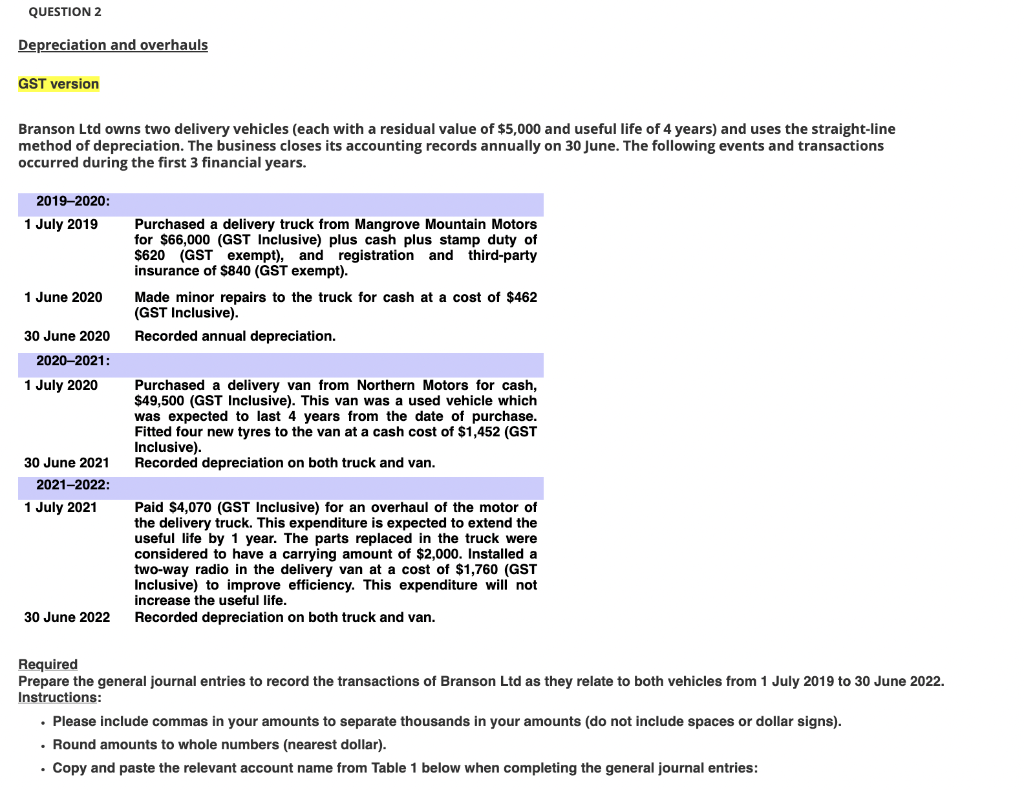

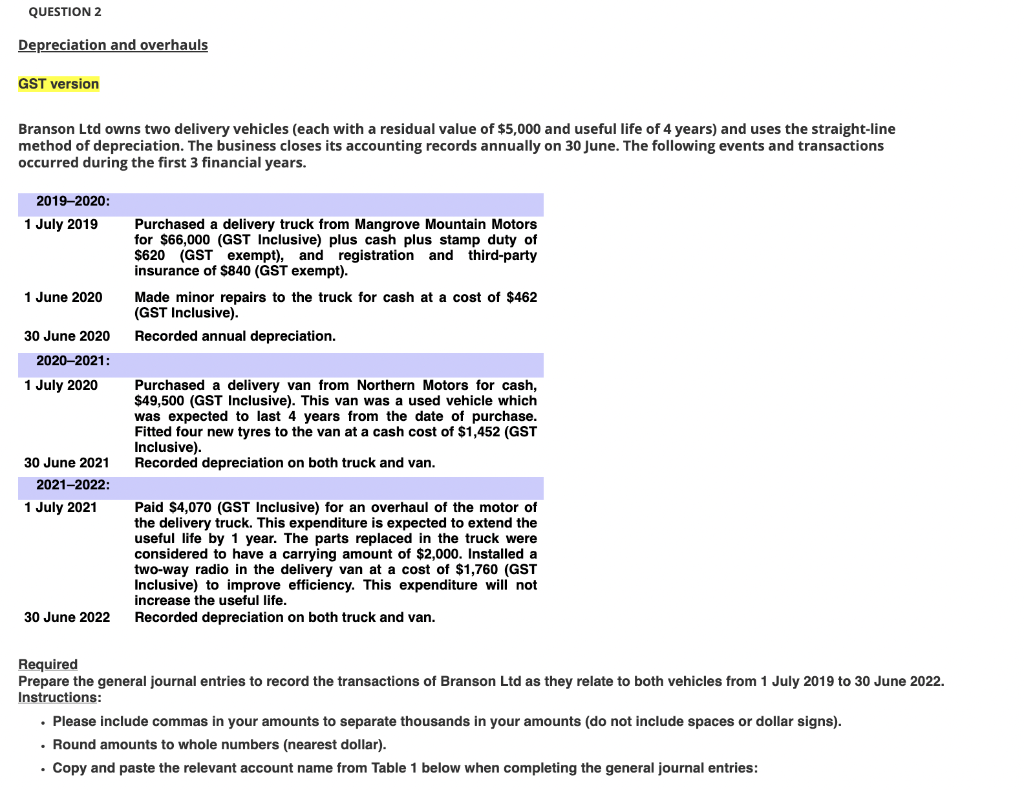

Please answer question 2 below and show any working out. GST is 10% (Goods and Services tax). Account names provided in the table to use in journal entries

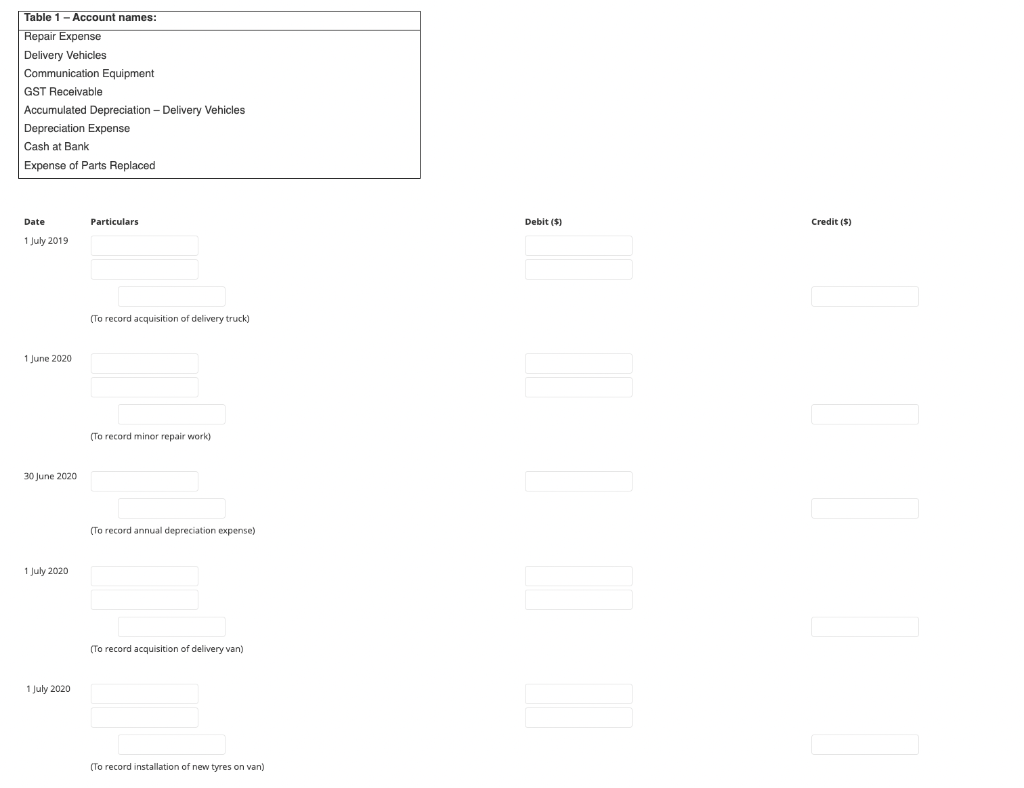

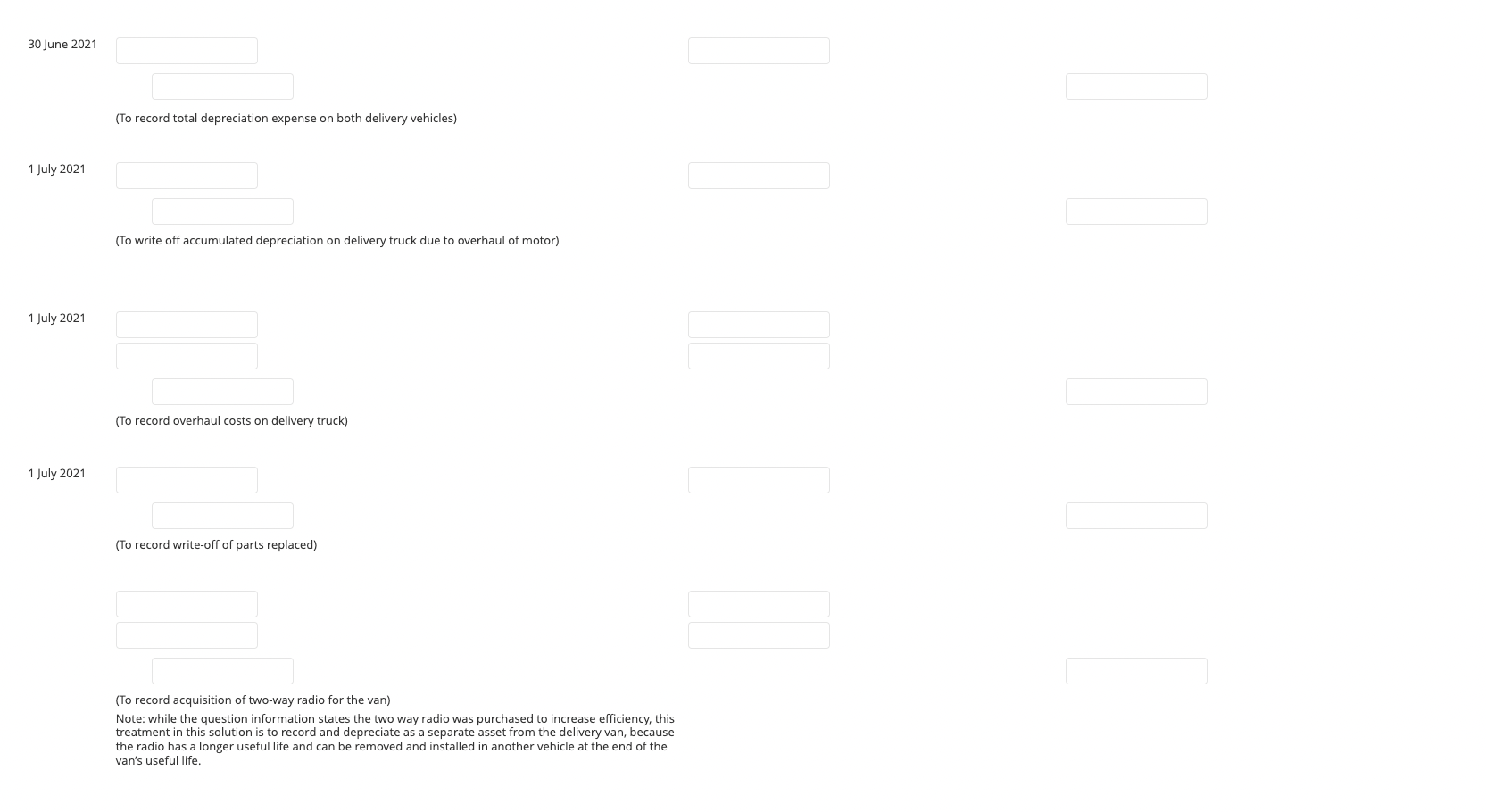

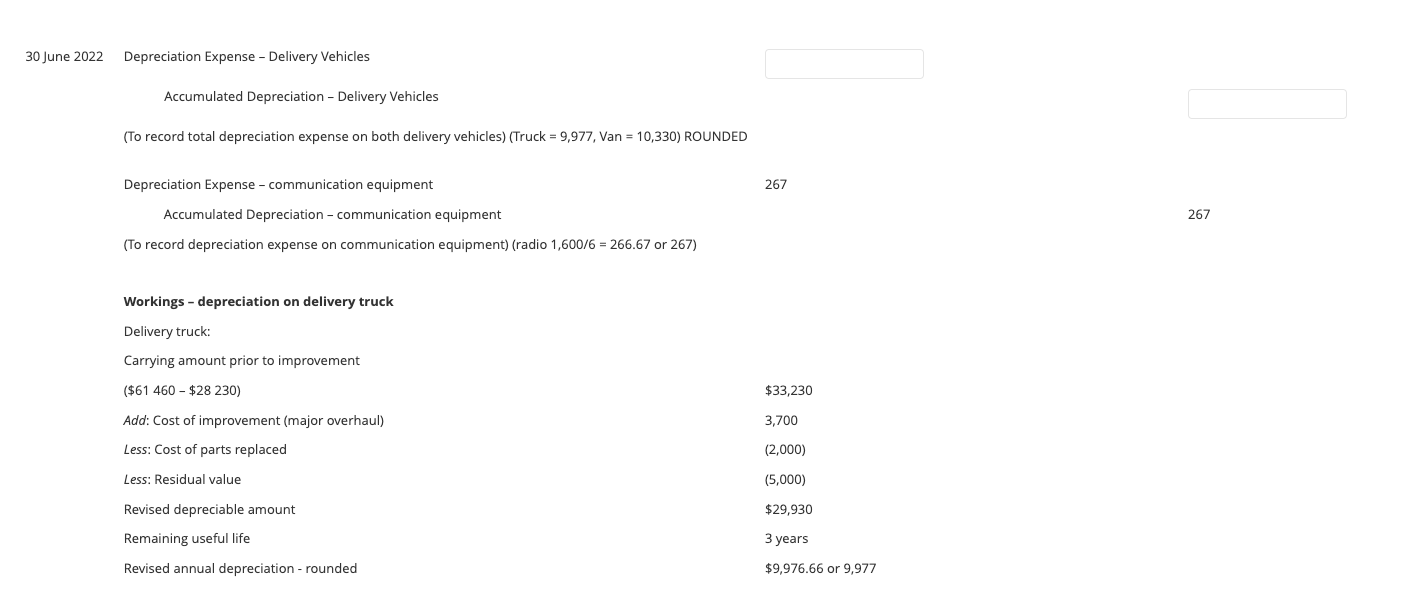

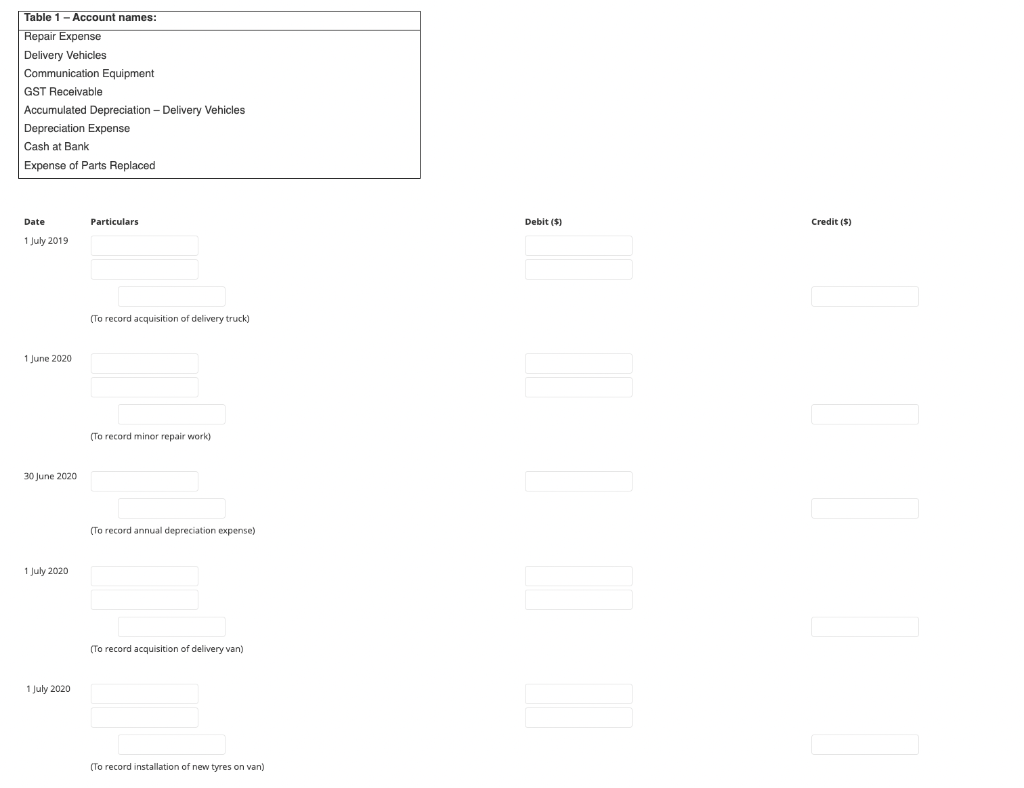

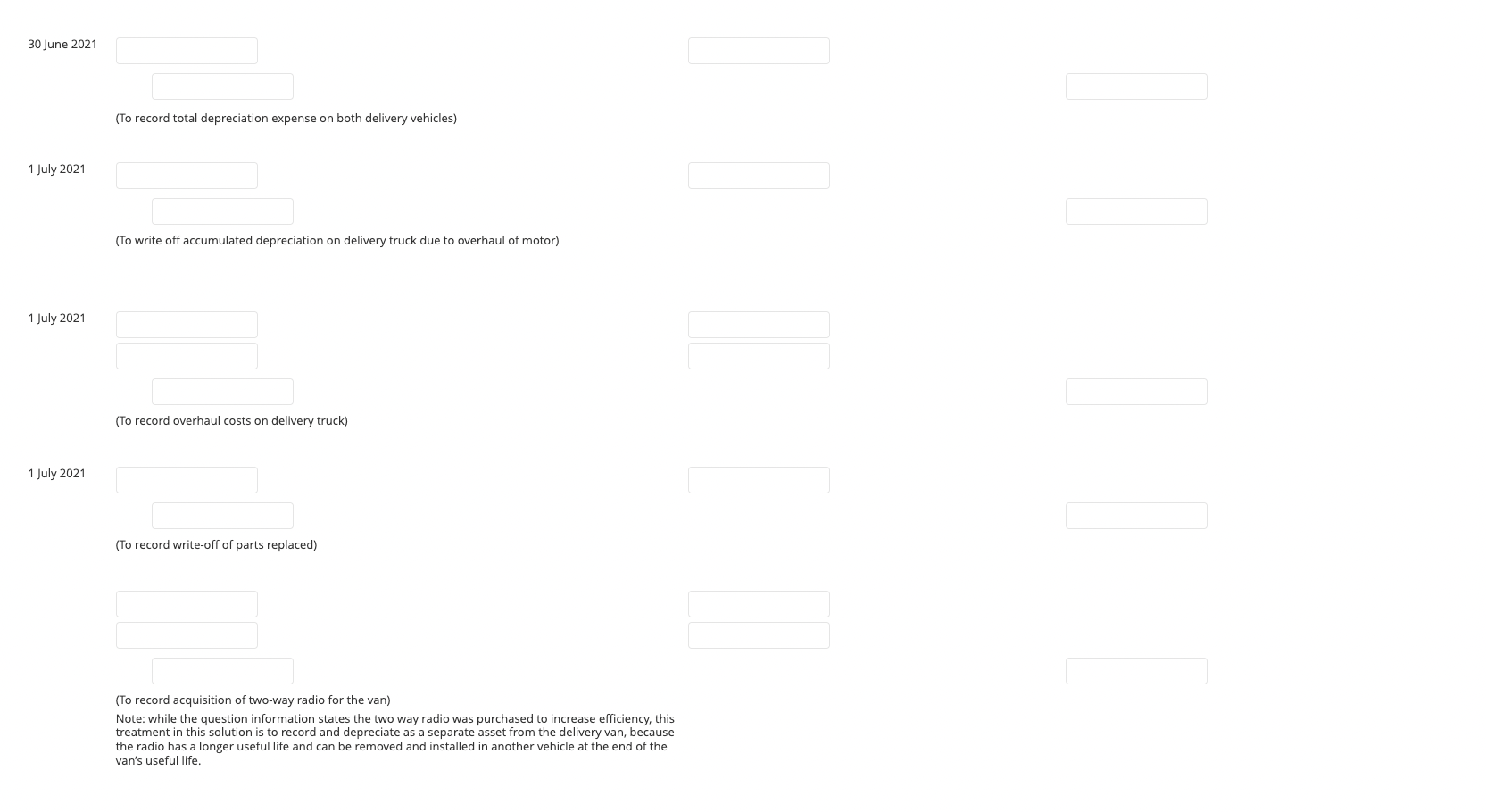

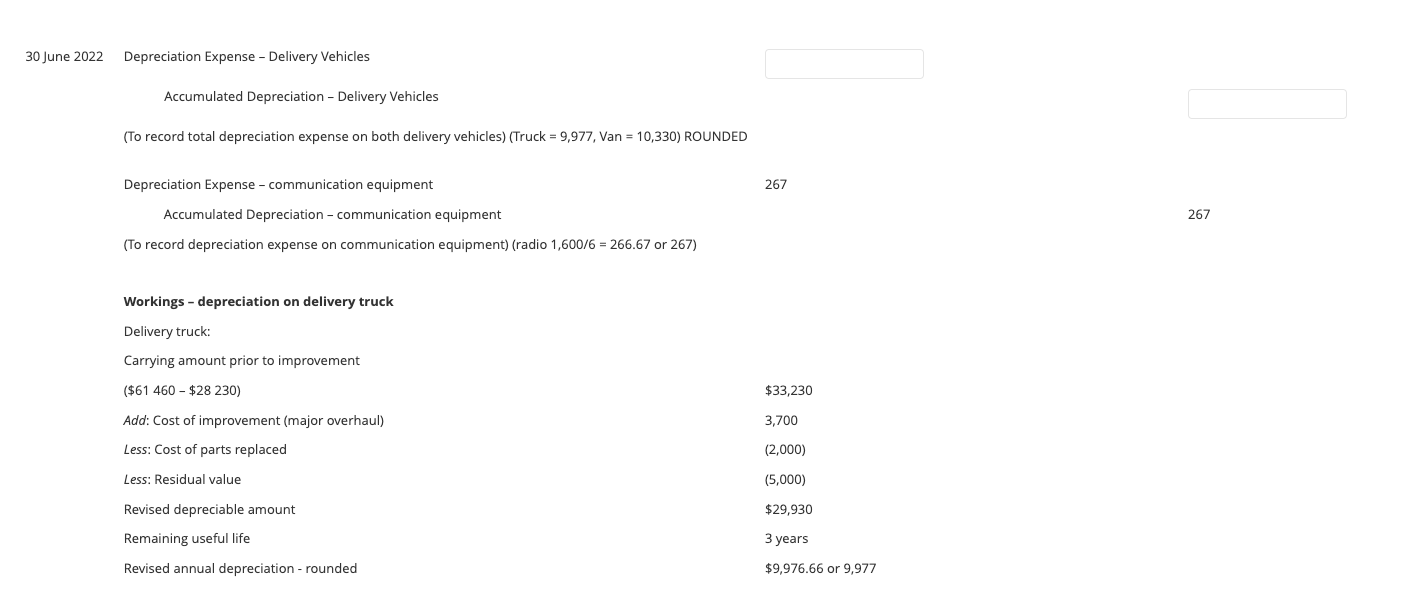

Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial vears. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). - Copy and paste the relevant account name from Table 1 below when completing the general journal entries: \begin{tabular}{|l|} \hline Table 1 - Account names: \\ \hline Repair Expense \\ Delivery Vehicles \\ Communication Equipment \\ GST Receivable \\ Accumulated Depreciation - Delivery Vehicles \\ Depreciation Expense \\ Cash at Bank \\ Expense of Parts Replaced \\ \hline \end{tabular} (To record acquisition of delivery truck) 1 June 2020 (To record minor repair work) 30 June 2020 (To record annual depreciation expense) 1 july 2020 (To record acquisition of delivery van) 1 july 2020 (To record installation of new tyres on van) 30 June 2021 (To record total depreciation expense on both delivery vehicles) 1 July 2021 (To write off accumulated depreciation on delivery truck due to overhaul of motor) 1 July 2021 (To record overhaul costs on delivery truck) 1 July 2021 (To record write-off of parts replaced) (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life. 30 June 2022 Depreciation Expense - Delivery Vehicles Accumulated Depreciation - Delivery Vehicles (To record total depreciation expense on both delivery vehicles) (Truck =9,977, Van =10,330 ) ROUNDED Depreciation Expense - communication equipment Accumulated Depreciation - communication equipment (To record depreciation expense on communication equipment) (radio 1,600/6 = 266.67 or 267) Workings - depreciation on delivery truck Delivery truck: Carrying amount prior to improvement ($61460-$28230)Add:Costofimprovement(majoroverhaul)Less:CostofpartsreplacedLess:Residualvalue$33,2303,700(2,000)(5,000) Revised depreciable amount $29,930 Remaining useful life 3 years Revised annual depreciation - rounded $9,976.66 or 9,977 Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial vears. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). - Copy and paste the relevant account name from Table 1 below when completing the general journal entries: \begin{tabular}{|l|} \hline Table 1 - Account names: \\ \hline Repair Expense \\ Delivery Vehicles \\ Communication Equipment \\ GST Receivable \\ Accumulated Depreciation - Delivery Vehicles \\ Depreciation Expense \\ Cash at Bank \\ Expense of Parts Replaced \\ \hline \end{tabular} (To record acquisition of delivery truck) 1 June 2020 (To record minor repair work) 30 June 2020 (To record annual depreciation expense) 1 july 2020 (To record acquisition of delivery van) 1 july 2020 (To record installation of new tyres on van) 30 June 2021 (To record total depreciation expense on both delivery vehicles) 1 July 2021 (To write off accumulated depreciation on delivery truck due to overhaul of motor) 1 July 2021 (To record overhaul costs on delivery truck) 1 July 2021 (To record write-off of parts replaced) (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life. 30 June 2022 Depreciation Expense - Delivery Vehicles Accumulated Depreciation - Delivery Vehicles (To record total depreciation expense on both delivery vehicles) (Truck =9,977, Van =10,330 ) ROUNDED Depreciation Expense - communication equipment Accumulated Depreciation - communication equipment (To record depreciation expense on communication equipment) (radio 1,600/6 = 266.67 or 267) Workings - depreciation on delivery truck Delivery truck: Carrying amount prior to improvement ($61460-$28230)Add:Costofimprovement(majoroverhaul)Less:CostofpartsreplacedLess:Residualvalue$33,2303,700(2,000)(5,000) Revised depreciable amount $29,930 Remaining useful life 3 years Revised annual depreciation - rounded $9,976.66 or 9,977