please answer question 2 In full details

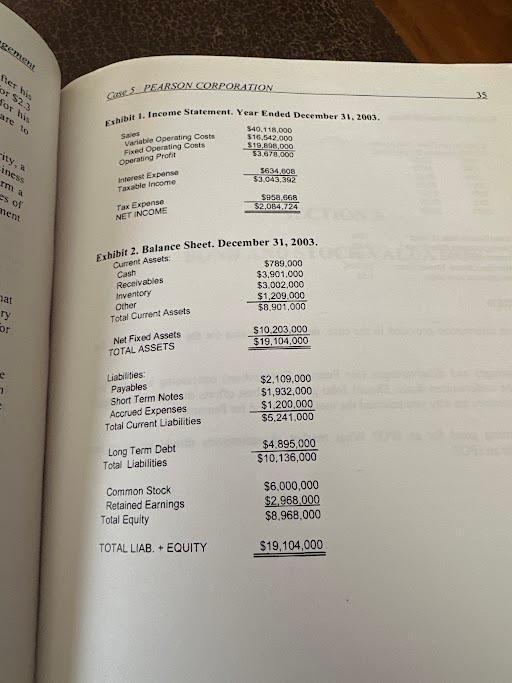

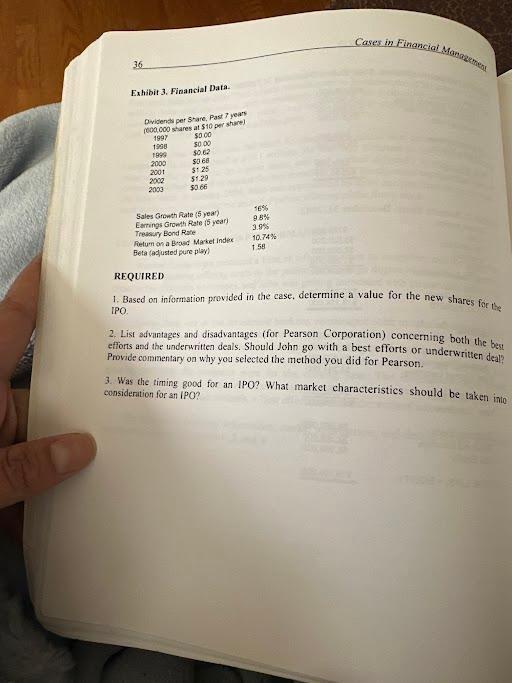

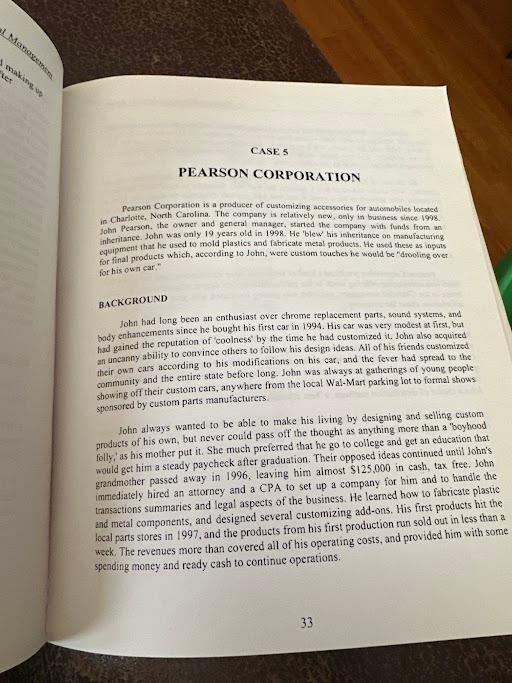

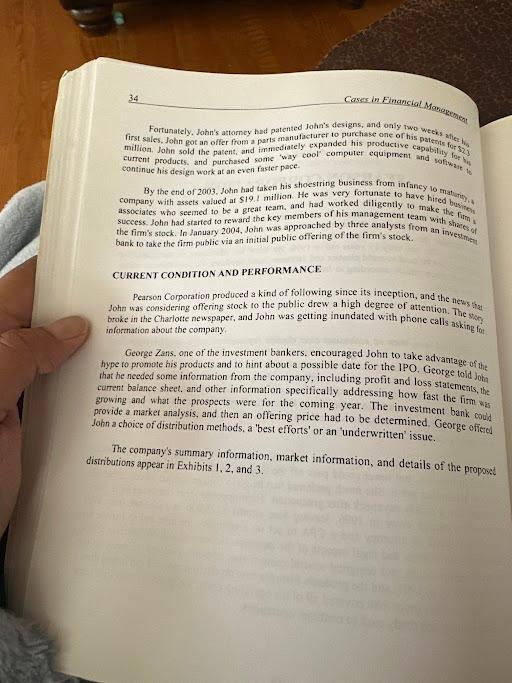

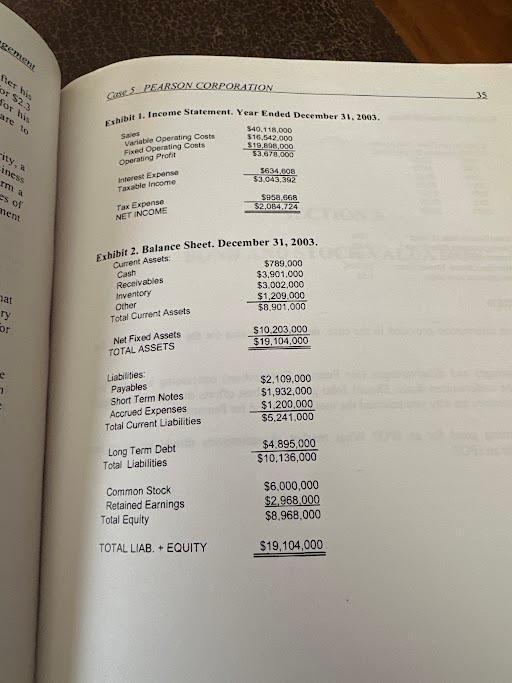

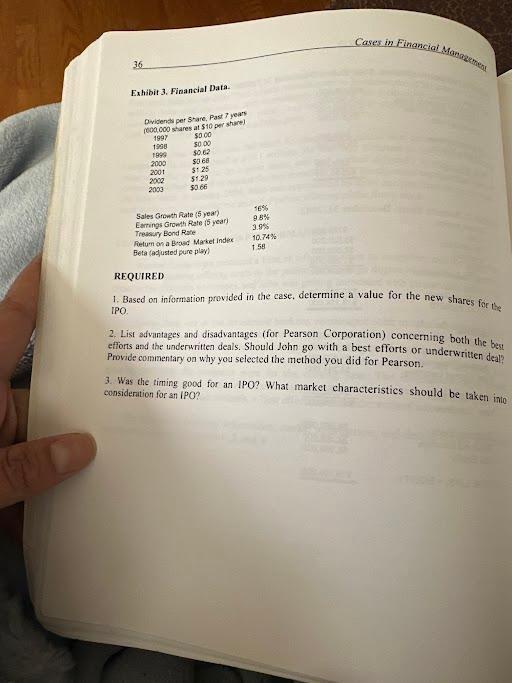

Pearson Corporation is a producet of customizing accessoties for aunomnbiles located in Charlotte, North-Carolina. The company is relatively new, anly in business unce 1998. jobn Pearson, the owner and general manager, started the company with funds from an. intieriance. John was only 19 years old in 1998 . He 'blew bis ieheritance on manuiacturing equprment that lee used to mold plastics and fabricate metal preducts. He uscd these as ingats for final products which, according to Joht, were custom fouches he would be "droolieg over for his own car." BACKGROUND John had long been an enthusiast over chrome replacement parts, sound systems, and body enhancements since he bought his first car in 1994 . His car was very modest at first, but had gained the reputation of 'coolness' by the time he had customized it. Iohn akso acquired an uncanny ability to convince others to follow his design ideas. All of his friends customized their own cars according to his modifications on his car, and the fever had spread to the community and the entire state before long. John was always at gatherings of young people showing off their custom cars, anywhere from the local Wal-Mart parking lot to formal shows sporisored by custom parts manufacturers John always wanted to be able to make his living by designing and selling custom products of his own, but never could pass off the thought as anything more than a "ooyhood folly,' as his mother put it. She much preferred that he go to college and get an education that would get him a steady paycheck after graduation. Their opposed ideas continued until John's grandmether passed away in 1996 , leaving him almost $125,000 in cash, tax free, John immediately hired an attorney and a CPA to set up a company for him and to handie the tmatactions summaries and legal aspects of the business. He learned how to fabricate plastic and metal components, and designed several customizing add-ons. His first products hit the local parts stores in 1997 , and the products from his first production nun sold out in less than week. The revenues more than covered all of his operating costs, and provided him with 50n spending money and ready cash to continue operations. milion, Johin sold the patent, and immediately expanded his productive capability for S2, current products. and parchased some 'way cool computer equipment and soly iof the pace. continue his design work at an even faster pace. CURRENT CONDITION AND PERFORMANCE Pearson Corporation produced a kind of following since its inception, and the neus thet John was considering offering stock to the public drew a high degree of attention. The she information about the company. George Zans, one of the investment bankers. encouraged John to take advantage of the that he needed some information from the company, including profit and loss stiteme sheet. and other information specifically addressing how fast the firm wis growing and what the prospects were for the coming year. The investment bank could provide a market analysis, and then an offering price had to be determined. George efiecol John a choice of distribution methods, a 'best efforts' or an 'underwritten' issue. The company's stmmary information, market information, and details of the proposed distributions appear in Exhibits 1, 2 , and 3. whibit 1. Income Statement. Year Ended December 31. 2003. Shoet. December 31,2003 , Exhibit 3. Financial Data. REQUIRED 1. Based on information provided in the case. determine a value for the new shares for the [PO. 2. List advantages and disadvantages (for Pearson Corporation) concerning both the bent efforts and the underwnitten deals. Should John go with a best efforts or underwritten deal? Provide cominentary on why you selected the method you did for Pearson. 3. Was the timing good for an IPO? What market characteristics should be taken inio considerition for in IPO