Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question #2 Jamie Lee and Ross are estimating that they will be putting $40,000 from their savings account toward a down payment on

Please answer question #2

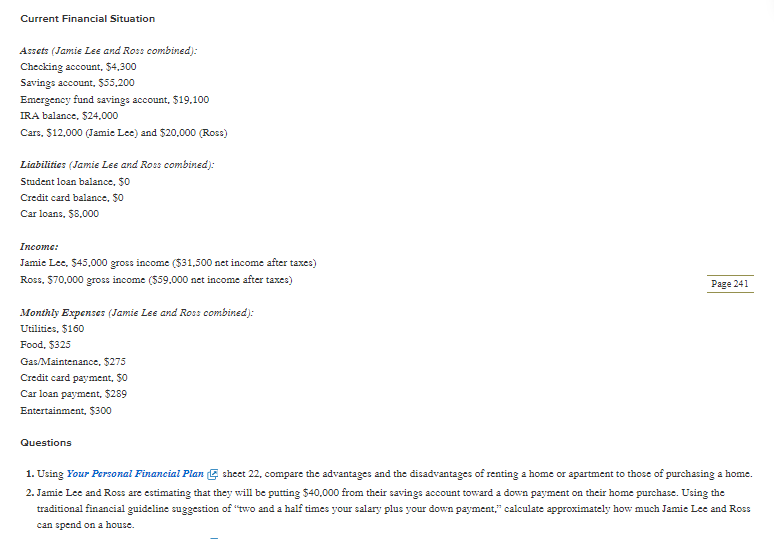

Jamie Lee and Ross are estimating that they will be putting $40,000 from their savings account toward a down payment on their home purchase. Using the traditional financial guidelines suggestion of "two and a half times your salary plus your down payment calculate approximately how much Jamie Lee and Ross can spend on a house.

Current Financial Situation Assets (Jamie Lee and Rose combined): Checking account. $4,300 Savings account. 555.200 Emergency fund savings account, $19.100 IRA balance, $24,000 Cars, 512.000 (Jamie Lee) and $20.000 (Ross) Liabilities (Jamie Lee and Ross combined): Student loan balance. $0 Credit card balance. $0 Car loans, $8.000 Income: Jamie Lee. 545.000 gross income ($31.500 net income after taxes) Ross, $70,000 gross income (559.000 net income after taxes) Page 241 Monthly Expenses (Jamie Lee and Ross combined): Utilities, $160 Food, $325 Gas/Maintenance, $275 Credit card payment. $0 Car loan payment, $289 Entertainment, $300 Questions 1. Using Your Personal Financial Plan sheet 22, compare the advantages and the disadvantages of renting a home or apartment to those of purchasing a home. 2. Jamie Lee and Ross are estimating that they will be putting $40.000 from their savings account toward a down payment on their home purchase. Using the traditional financial guideline suggestion of "two and a half times your salary plus your down payment," calculate approximately how much Jamie Lee and Ross can spend on a houseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started