Answered step by step

Verified Expert Solution

Question

1 Approved Answer

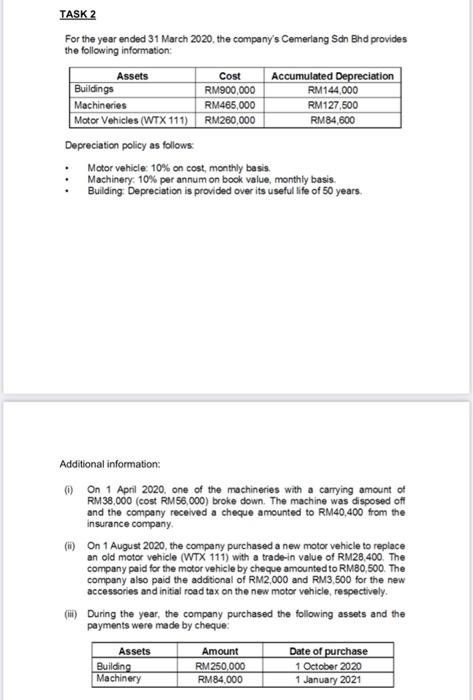

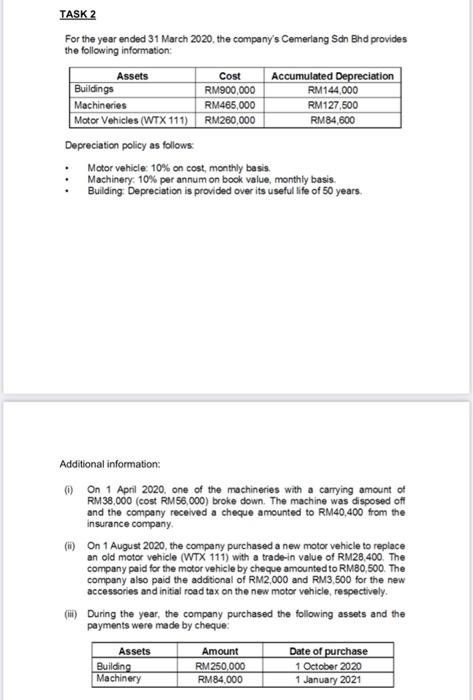

Please answer question 2(d). Show all workings TASK 2 For the year ended 31 March 2020, the company's Cemeriang Sdn Bhd provides the following information:

Please answer question 2(d). Show all workings

TASK 2 For the year ended 31 March 2020, the company's Cemeriang Sdn Bhd provides the following information: Assets Cost Accumulated Depreciation Buildings RM900,000 RM 144,000 Machineries RM465,000 RM127,500 Motor Vehicles (WTX 111) RM260,000 RM84,600 Depreciation policy as follows: Motor vehicle 10% on cost, monthly basis. Machinery 10% per annum on book value, monthly basis. Building Depreciation is provided over its useful life of 50 years. Additional information: 0 on 1 April 2020, one of the machineries with a carrying amount of RM38,000 (cost RM 56,000) broke down. The machine was disposed off and the company received a cheque amounted to RM40,400 from the insurance company On 1 August 2020, the company purchased a new motor vehicle to replace an old motor vehicle (WTX 111) with a trade-in value of RM28.400 The company paid for the motor vehicle by cheque amounted to RMBO,500. The company also paid the additional of RM2,000 and RM3,500 for the new accessories and initial road tax on the new motor vehicle, respectively. (1) During the year, the company purchased the following assets and the payments were made by cheque Assets Building Machinery Amount RM250,000 RM84.000 Date of purchase 1 October 2020 1 January 2021 (d) Extract Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 March 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started