Question

Please answer question 3. 1.You have just graduated from college. Youre married. You and your spouse have both landed pretty good jobs. You calculate that

Please answer question 3.

1.You have just graduated from college. Youre married. You and your spouse have both landed pretty good jobs. You calculate that you can put away $2000 per month in an ordinary annuity that pays 4% compounded monthly. Thats good, because having moved to your new place of employment, you are broke. Even so, you want to buy a house. You figure you can get by with a $400,000 house will increase in price at a rate of 5% per year compounded monthlyso by the time you save up to the 20% down payment of $80,000, you still wont have saved up enough, because the down payment will be 20% of a bigger purchase price.

1A) FV = A * (1 + i)^t

= 400000 * (1 + .05/12)^(t*12)

1B) Down payment after 5 years = 400000 * (1 + .05/12)^(5*12) * 20% = 102,668.69

1C) FV = A * (1-(1+i)^-t)/i

= 2000 * (1-(1+.04/12)^-(t*12))/(.04/12)

1D) Value of annuity in 5 years= 2000 * (1-(1+.04/12)^-(5*12))/(.04/12) = 108598.14

1E) Time at which monthly annuity amount will equate to 20% down payment:

2000 * (1-(1+.04/12)^-(t*12))/(.04/12) = 102668.69

t = 3.96 years

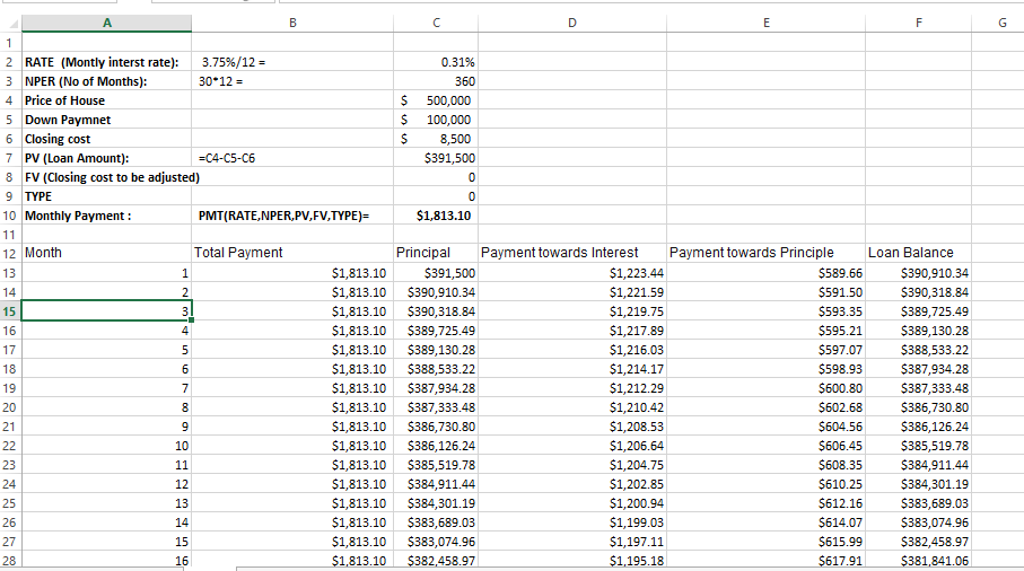

2. Ok, you can afford the down payment, and after some delay (life happens) you make a deal to purchase a nice house for $500,000 with $100,000 down and the rest financed over 30 years at 3.75% compounded monthly. You plan to pay the closing costs of approximately 8,500 out of your spouses bonus (you make note of this in case you ever get divorced!) Anyway

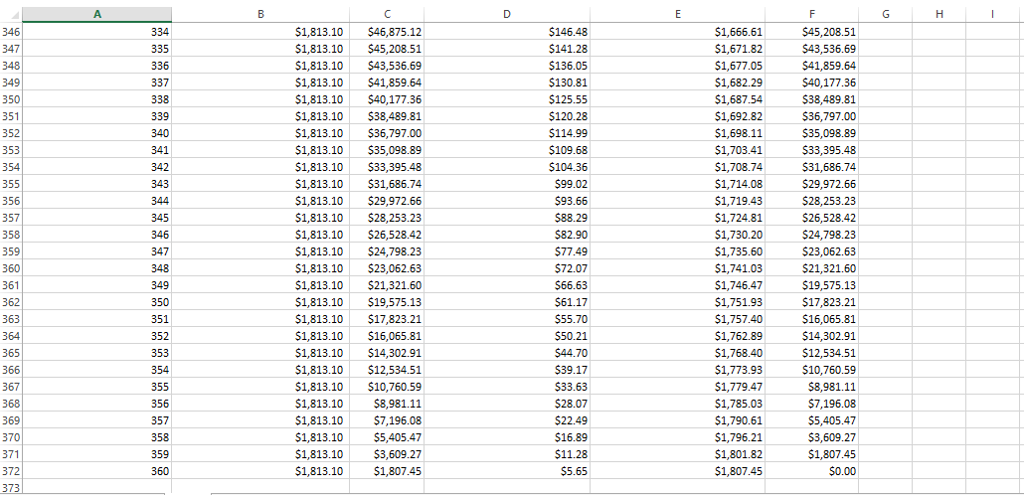

3) Now assume that after 10 years you can afford to make double payments. In other words, you can now afford to pay twice the amount of your usual monthly payment each month, and your loan has no repayment penalty.

A) If you make double payments starting in months 121, when will the loan be paid off? State your answer as the number of months after the 120th month rounded to two decimal places or to the next month.

B) Create a new amortization schedule showing the effect of the 121st double payment and each subsequent double payment until the month the loan is paid off. Make sure to adjust the last month for rounding.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started