Please answer question #3 with an explanation of the Prepare a budget of Olive Garden for New Accounting Year section. Thank you.

3. For the individual restaurant budget only, calculate margin of safety in $ (how much can project sales drop before hitting breakeven)

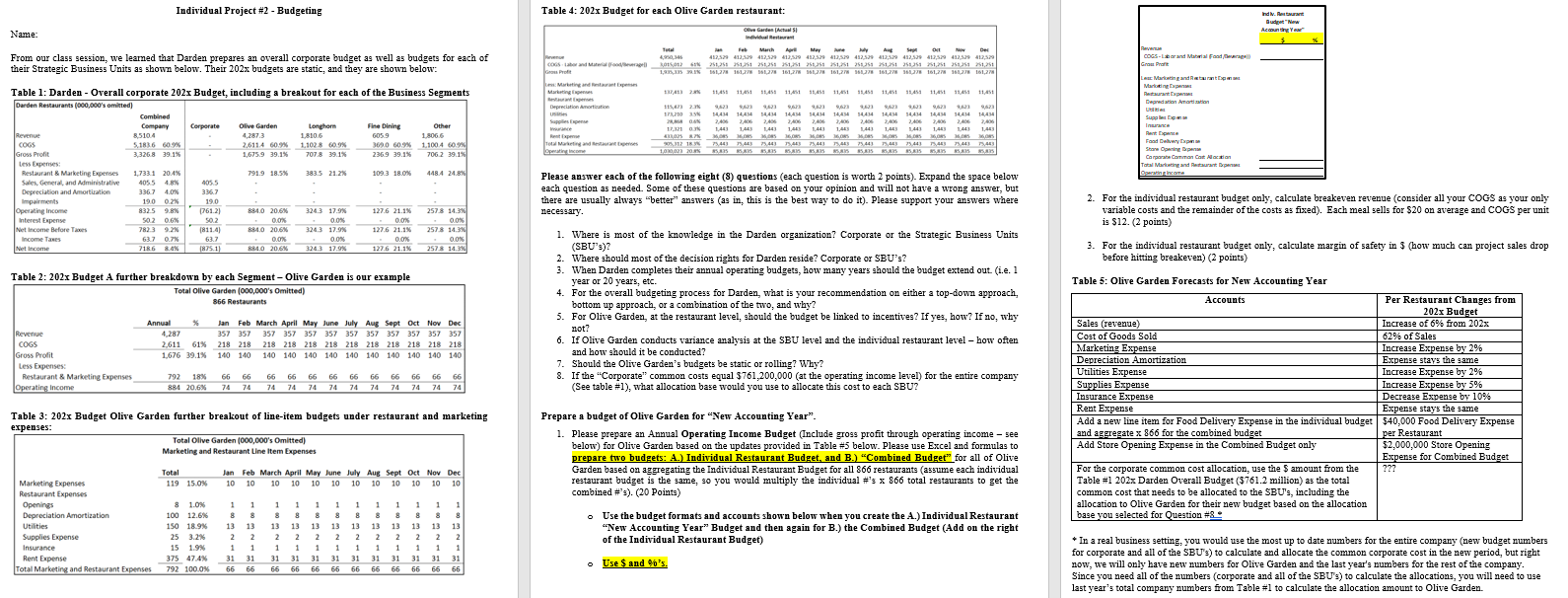

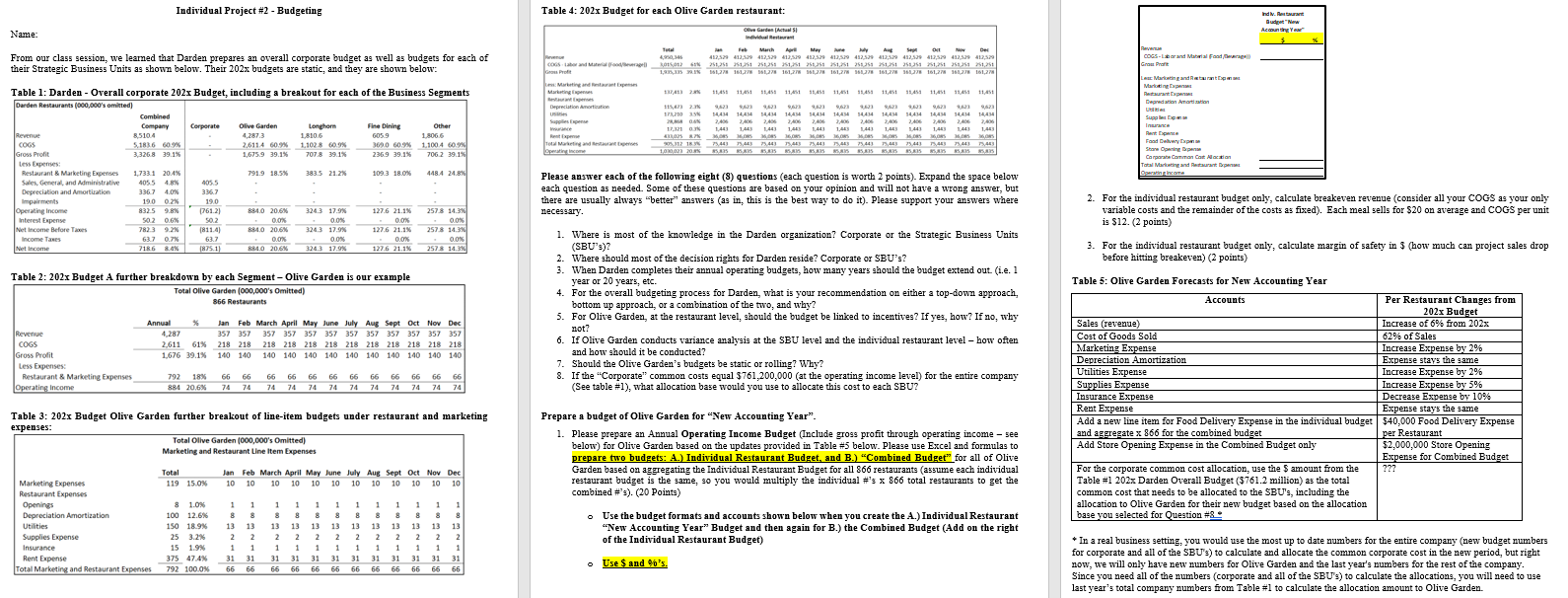

Individual Project #2 - Budgeting Table 4: 202x Budget for each Olive Garden restaurant: Indiv. Qudrat Accounting Year Name: From our class session, we learned that Darden prepares an overall corporate budget as well as budgets for each of their Strategic Business Units as shown below. Their 202x budgets are static, and they are shown below: Olle Garden Actual SI Individuale Feb Marth My A OMI Ny Der 4,90 412.529 412,529 432.522 112,579 412.529 412,529 412.529 412,529 412.529 412,529 482,529 412,529 BOIS0126 250 251 25131 75251 511 251351 311 255 1,251 259351 1251 259251 251,251 1,9,1 11,27 161,27 $ 161,77 161,278 SUN 161,77 92 161,27 161,27 Grow Profit Marianne Marketing Depreciation Amortization COGS-Labrador Giros Pro La Mata Maring Demar 7 1145 11451 1451 11,451 114 115 114 113 114 115 114 114 115,473 2. 0302 1722103 14.434 14,454 1444 1445454434 14454 14.454 14,454 54.434 14.45454434 14.454 24 2406 11,321 144 1:44 144 143 144 145 14431,443 144 145 1443 2025 2.78 MOSS SS SS SS SOMOS 12 18 248 248 248 15,483 344 343 344 345 346 347 348 3 10.02 203 SSS SS SS SS SS SS SS SS SS SS SS Toring and Table 1: Darden - Overall corporate 202x Budget, including a breakout for each of the Business Segments Darden Restaurants (000,000's omitted) Combined Company Corporate Olive Garden Longhorn Fine Dining Other Revenue 85104 4,287.3 1.810,6 6059 1.806.6 COGS 5.1836 60.9% 2,6114 60.9% 1,102.3 609% 369.0 60% 1,100.4 60.99 Gross Pront 33268 39.13 1,675.9 39.1% 707.8 39.1% 2369 39.1% 706 2 19.1% Less Expenses Restaurant & Marketing Expenses 1,7331 20:43 791.9 18.5% 383.5 21.2% 109.3 18.0% 448.4 21.8% Sales, General, and Administrative 40554 % 4055 Depreciation and Amortization 336.7 4.0% 336,7 Impairments 190 0.2% 19.0 Operating Income 8325 9.X 176121 881.0 20.6% 324.3 17.9% 127.6 21.1% 257.8 14.3% Interest Expense 502 0.6 50.2 0.0% OOK 0.0% 0.0% Net Income Before Taxes 7823 9.2 () (811.4) 881.0 20.6% 3243 17.0% 127.6 21.1% 2578 14.3% Income Taxes 63.7 0.7 63.7 0.0% OLOM 0.0 0.0% Net Income 7186 8.4% 1875.1) R10 20.6% 324.3 17.9% 127.6 21.1% 2573 14. % Suga w Pandawy Share On B Corporate Com Cat Total Martting and Leone Please answer each of the following eight (8) questions (each question is worth 2 points). Expand the space below each question as needed. Some of these questions are based on your opinion and will not have a wrong answer, but there are usually always "better" answers (as in, this is the best way to do it). Please support your answers where necessary 2. For the individual restaurant budget only, calculate breakeven revenue (consider all your COGS as your only variable costs and the remainder of the costs as fixed). Each meal sells for $20 on average and COGS per unit is $12. (2 points) 3. For the individual restaurant budget only, calculate margin of safety in 3 (how much can project sales drop before hitting breakeven) (2 points) Table 2: 202x Budget A further breakdown by each Segment - Olive Garden is our example Total Olive Garden (000,000's Omitted) 866 Restaurants 1. Where is most of the knowledge in the Darden organization? Corporate or the Strategic Business Units (SBU's)? 2. Where should most of the decision rights for Darden reside? Corporate or SBU's? 3. When Darden completes their annual operating budgets, how many years should the budget extend out. (i.e. 1 year or 20 years, etc. 4. For the overall budgeting process for Darden, what is your recommendation on either a top-down approach, bottom up approach, or a combination of the two, and why? 5. For Olive Garden, at the restaurant level, should the budget be linked to incentives? If yes, how? If no, why not? 6. If Olive Garden conducts variance analysis at the SBU level and the individual restaurant level how often and how should it be conducted? 7. Should the Olive Garden's budgets be static or rolling? Why? 8. If the "Corporate" common costs equal $761,200,000 (at the operating income level) for the entire company (See table #1), what allocation base would you use to allocate this cost to each SBU? Annual % Jan Feb March April May June July Aug Sept Oct Nov Dec 4,287 357 357 357 357 357 357 357 357 357 357 357 357 2,611 61% 218 218 218 218 218 218 218 218 218 218 218 218 1,676 39.1% 140 140 140 140 140 140 140 140 140 140 140 140 140 140 Revenue COGS Gross Profit Less Expenses Restaurant & Marketing Expenses Operating Income 792 18% 884 20.6% 66 66 74 74 66 74 66 66 66 66 66 66 66 66 66 66 74 74 74 74 74 74 74 74 74 Table 5: Olive Garden Forecasts for New Accounting Year Accounts Per Restaurant Changes from 202x Budget Sales (revenue) Increase of 6% from 202x Cost of Goods Sold 62% of Sales Marketing Expense Increase Expense by 2% Depreciation Amortization Expense stays the same Utilities Expense Increase Expense by 2% Supplies Expense Increase Expense by 5% Insurance Expense Decrease Expense by 10% Rent Expense Expense stays the same Add a new line item for Food Delivery Expense in the individual budget $40,000 Food Delivery Expense and aggregate x 866 for the combined budget per Restaurant Add Store Opening Expense in the Combined Budget only $2,000,000 Store Opening Expense for Combined Budget For the corporate common cost allocation, use the $ amount from the 727 Table #1 202x Darden Overall Budget ($761.2 million) as the total common cost that needs to be allocated to the SBU's, including the allocation to Olive Garden for their new budget based on the allocation base you selected for Question #8 Table 3: 202x Budget Olive Garden further breakout of line-item budgets under restaurant and marketing expenses: Total Olive Garden (000,000's Omitted) Marketing and Restaurant Line Item Expenses Prepare a budget of Olive Garden for "New Accounting Year". 1. Please prepare an Annual Operating Income Budget (Include gross profit through operating income - see below) for Olive Garden based on the updates provided in Table #5 below. Please use Excel and formulas to prepare two budgets: A.) Individual Restaurant Budget, and B.) "Combined Budget for all of Olive Garden based on aggregating the Individual Restaurant Budget for all 866 restaurants (assume each individual restaurant budget is the same, so you would multiply the individual #'s x 866 total restaurants to get the combined #'s). (20 points) Total 119 15.0% 8 Marketing Expenses Restaurant Expenses Openings Depreciation Amortization Utilities Supplies Expense Insurance Rent Expense Total Marketing and Restaurant Expenses 8 1.0% 100 12.6% 150 18.9% 25 3.2% 15 1.9% 375 47.4% 792 100.0% Jan Feb March April May June July Aug Sept Oct Nov Dec 10 10 10 10 10 10 10 10 10 10 10 10 1 1 1 1 1 1 1 1 1 1 1 1 8 8 8 8 8 8 13 13 13 13 13 13 13 13 13 13 13 2 2 2 2 2 2 2 2 2 2 2 1 1 1 1 1 1 1 1 1 1 1 31 31 31 31 31 31 31 31 31 31 31 66 66 66 66 66 66 66 66 66 66 66 66 o Use the budget formats and accounts shown below when you create the A.) Individual Restaurant "New Accounting Year Budget and then again for B.) the Combined Budget (Add on the right of the Individual Restaurant Budget) 2 1 & NE 31 o Use $ and * In a real business setting, you would use the most up to date numbers for the entire company (new budget numbers for corporate and all of the SBU's) to calculate and allocate the common corporate cost in the new period, but right now, we will only have new numbers for Olive Garden and the last year's numbers for the rest of the company. Since you need all of the numbers (corporate and all of the SBU's) to calculate the allocations, you will need to use last year's total company numbers from Table #1 to calculate the allocation amount to Olive Garden. Individual Project #2 - Budgeting Table 4: 202x Budget for each Olive Garden restaurant: Indiv. Qudrat Accounting Year Name: From our class session, we learned that Darden prepares an overall corporate budget as well as budgets for each of their Strategic Business Units as shown below. Their 202x budgets are static, and they are shown below: Olle Garden Actual SI Individuale Feb Marth My A OMI Ny Der 4,90 412.529 412,529 432.522 112,579 412.529 412,529 412.529 412,529 412.529 412,529 482,529 412,529 BOIS0126 250 251 25131 75251 511 251351 311 255 1,251 259351 1251 259251 251,251 1,9,1 11,27 161,27 $ 161,77 161,278 SUN 161,77 92 161,27 161,27 Grow Profit Marianne Marketing Depreciation Amortization COGS-Labrador Giros Pro La Mata Maring Demar 7 1145 11451 1451 11,451 114 115 114 113 114 115 114 114 115,473 2. 0302 1722103 14.434 14,454 1444 1445454434 14454 14.454 14,454 54.434 14.45454434 14.454 24 2406 11,321 144 1:44 144 143 144 145 14431,443 144 145 1443 2025 2.78 MOSS SS SS SS SOMOS 12 18 248 248 248 15,483 344 343 344 345 346 347 348 3 10.02 203 SSS SS SS SS SS SS SS SS SS SS SS Toring and Table 1: Darden - Overall corporate 202x Budget, including a breakout for each of the Business Segments Darden Restaurants (000,000's omitted) Combined Company Corporate Olive Garden Longhorn Fine Dining Other Revenue 85104 4,287.3 1.810,6 6059 1.806.6 COGS 5.1836 60.9% 2,6114 60.9% 1,102.3 609% 369.0 60% 1,100.4 60.99 Gross Pront 33268 39.13 1,675.9 39.1% 707.8 39.1% 2369 39.1% 706 2 19.1% Less Expenses Restaurant & Marketing Expenses 1,7331 20:43 791.9 18.5% 383.5 21.2% 109.3 18.0% 448.4 21.8% Sales, General, and Administrative 40554 % 4055 Depreciation and Amortization 336.7 4.0% 336,7 Impairments 190 0.2% 19.0 Operating Income 8325 9.X 176121 881.0 20.6% 324.3 17.9% 127.6 21.1% 257.8 14.3% Interest Expense 502 0.6 50.2 0.0% OOK 0.0% 0.0% Net Income Before Taxes 7823 9.2 () (811.4) 881.0 20.6% 3243 17.0% 127.6 21.1% 2578 14.3% Income Taxes 63.7 0.7 63.7 0.0% OLOM 0.0 0.0% Net Income 7186 8.4% 1875.1) R10 20.6% 324.3 17.9% 127.6 21.1% 2573 14. % Suga w Pandawy Share On B Corporate Com Cat Total Martting and Leone Please answer each of the following eight (8) questions (each question is worth 2 points). Expand the space below each question as needed. Some of these questions are based on your opinion and will not have a wrong answer, but there are usually always "better" answers (as in, this is the best way to do it). Please support your answers where necessary 2. For the individual restaurant budget only, calculate breakeven revenue (consider all your COGS as your only variable costs and the remainder of the costs as fixed). Each meal sells for $20 on average and COGS per unit is $12. (2 points) 3. For the individual restaurant budget only, calculate margin of safety in 3 (how much can project sales drop before hitting breakeven) (2 points) Table 2: 202x Budget A further breakdown by each Segment - Olive Garden is our example Total Olive Garden (000,000's Omitted) 866 Restaurants 1. Where is most of the knowledge in the Darden organization? Corporate or the Strategic Business Units (SBU's)? 2. Where should most of the decision rights for Darden reside? Corporate or SBU's? 3. When Darden completes their annual operating budgets, how many years should the budget extend out. (i.e. 1 year or 20 years, etc. 4. For the overall budgeting process for Darden, what is your recommendation on either a top-down approach, bottom up approach, or a combination of the two, and why? 5. For Olive Garden, at the restaurant level, should the budget be linked to incentives? If yes, how? If no, why not? 6. If Olive Garden conducts variance analysis at the SBU level and the individual restaurant level how often and how should it be conducted? 7. Should the Olive Garden's budgets be static or rolling? Why? 8. If the "Corporate" common costs equal $761,200,000 (at the operating income level) for the entire company (See table #1), what allocation base would you use to allocate this cost to each SBU? Annual % Jan Feb March April May June July Aug Sept Oct Nov Dec 4,287 357 357 357 357 357 357 357 357 357 357 357 357 2,611 61% 218 218 218 218 218 218 218 218 218 218 218 218 1,676 39.1% 140 140 140 140 140 140 140 140 140 140 140 140 140 140 Revenue COGS Gross Profit Less Expenses Restaurant & Marketing Expenses Operating Income 792 18% 884 20.6% 66 66 74 74 66 74 66 66 66 66 66 66 66 66 66 66 74 74 74 74 74 74 74 74 74 Table 5: Olive Garden Forecasts for New Accounting Year Accounts Per Restaurant Changes from 202x Budget Sales (revenue) Increase of 6% from 202x Cost of Goods Sold 62% of Sales Marketing Expense Increase Expense by 2% Depreciation Amortization Expense stays the same Utilities Expense Increase Expense by 2% Supplies Expense Increase Expense by 5% Insurance Expense Decrease Expense by 10% Rent Expense Expense stays the same Add a new line item for Food Delivery Expense in the individual budget $40,000 Food Delivery Expense and aggregate x 866 for the combined budget per Restaurant Add Store Opening Expense in the Combined Budget only $2,000,000 Store Opening Expense for Combined Budget For the corporate common cost allocation, use the $ amount from the 727 Table #1 202x Darden Overall Budget ($761.2 million) as the total common cost that needs to be allocated to the SBU's, including the allocation to Olive Garden for their new budget based on the allocation base you selected for Question #8 Table 3: 202x Budget Olive Garden further breakout of line-item budgets under restaurant and marketing expenses: Total Olive Garden (000,000's Omitted) Marketing and Restaurant Line Item Expenses Prepare a budget of Olive Garden for "New Accounting Year". 1. Please prepare an Annual Operating Income Budget (Include gross profit through operating income - see below) for Olive Garden based on the updates provided in Table #5 below. Please use Excel and formulas to prepare two budgets: A.) Individual Restaurant Budget, and B.) "Combined Budget for all of Olive Garden based on aggregating the Individual Restaurant Budget for all 866 restaurants (assume each individual restaurant budget is the same, so you would multiply the individual #'s x 866 total restaurants to get the combined #'s). (20 points) Total 119 15.0% 8 Marketing Expenses Restaurant Expenses Openings Depreciation Amortization Utilities Supplies Expense Insurance Rent Expense Total Marketing and Restaurant Expenses 8 1.0% 100 12.6% 150 18.9% 25 3.2% 15 1.9% 375 47.4% 792 100.0% Jan Feb March April May June July Aug Sept Oct Nov Dec 10 10 10 10 10 10 10 10 10 10 10 10 1 1 1 1 1 1 1 1 1 1 1 1 8 8 8 8 8 8 13 13 13 13 13 13 13 13 13 13 13 2 2 2 2 2 2 2 2 2 2 2 1 1 1 1 1 1 1 1 1 1 1 31 31 31 31 31 31 31 31 31 31 31 66 66 66 66 66 66 66 66 66 66 66 66 o Use the budget formats and accounts shown below when you create the A.) Individual Restaurant "New Accounting Year Budget and then again for B.) the Combined Budget (Add on the right of the Individual Restaurant Budget) 2 1 & NE 31 o Use $ and * In a real business setting, you would use the most up to date numbers for the entire company (new budget numbers for corporate and all of the SBU's) to calculate and allocate the common corporate cost in the new period, but right now, we will only have new numbers for Olive Garden and the last year's numbers for the rest of the company. Since you need all of the numbers (corporate and all of the SBU's) to calculate the allocations, you will need to use last year's total company numbers from Table #1 to calculate the allocation amount to Olive Garden