PLEASE ANSWER QUESTION 3A. Answers for questions 1 and 2 are answered above for reference.

PLEASE ANSWER QUESTION 3A. Answers for questions 1 and 2 are answered above for reference.

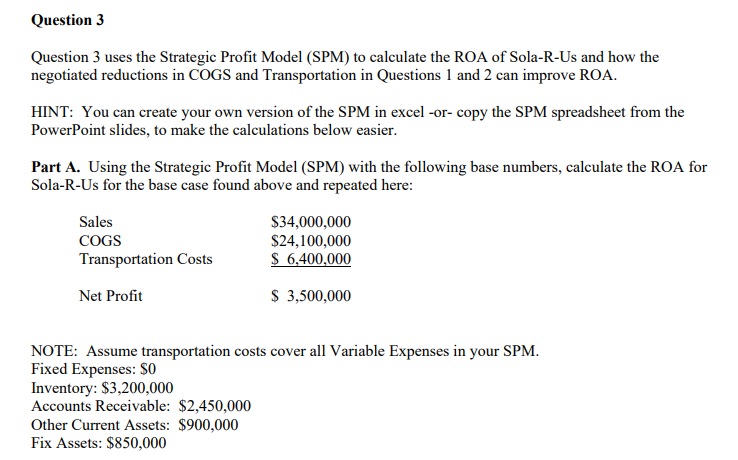

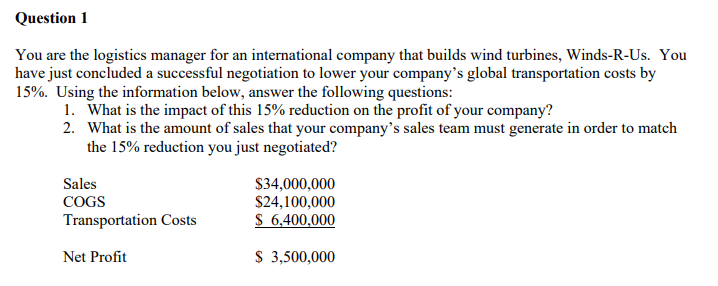

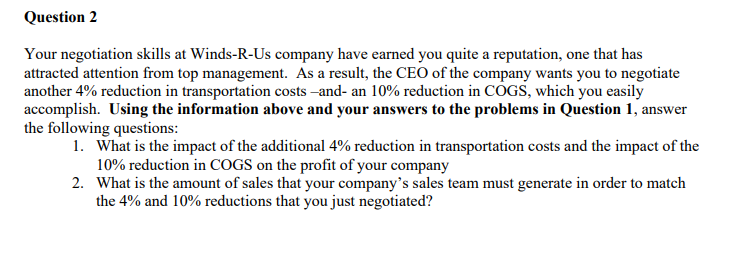

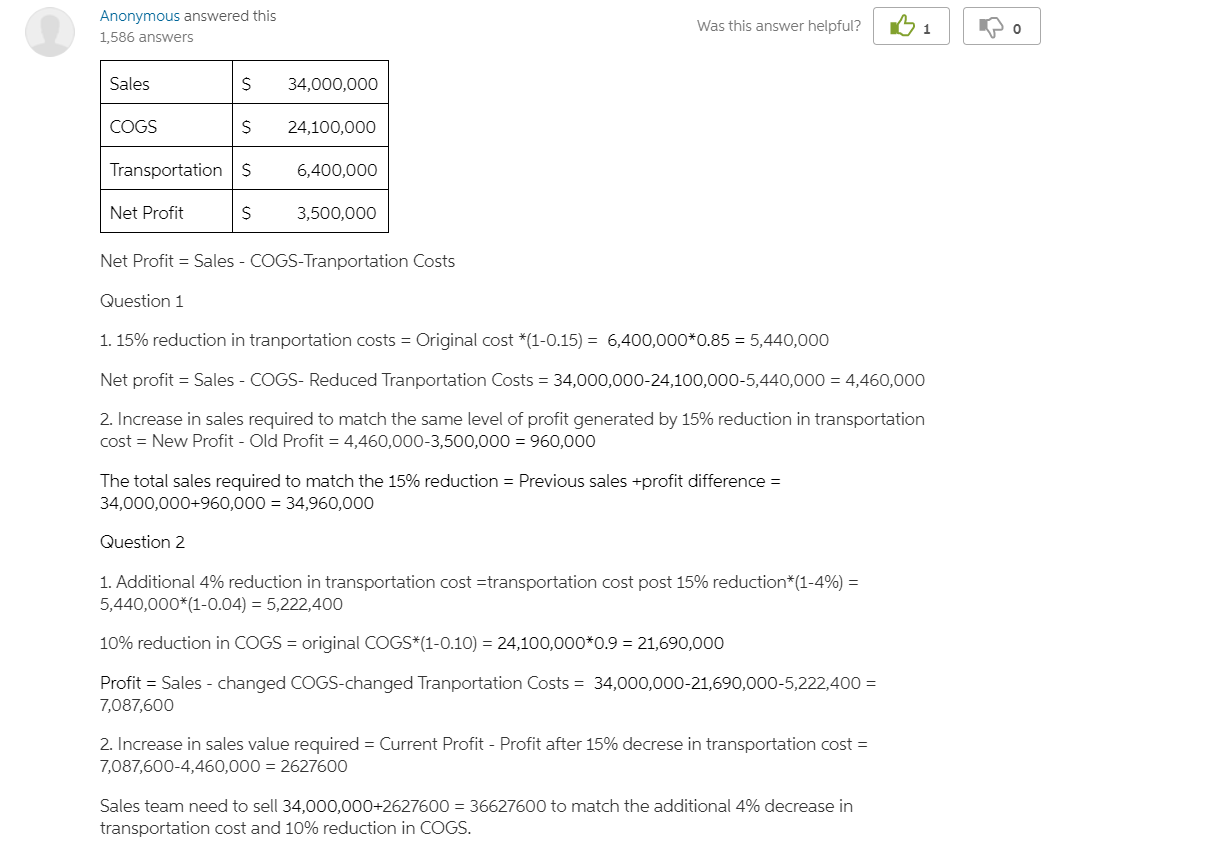

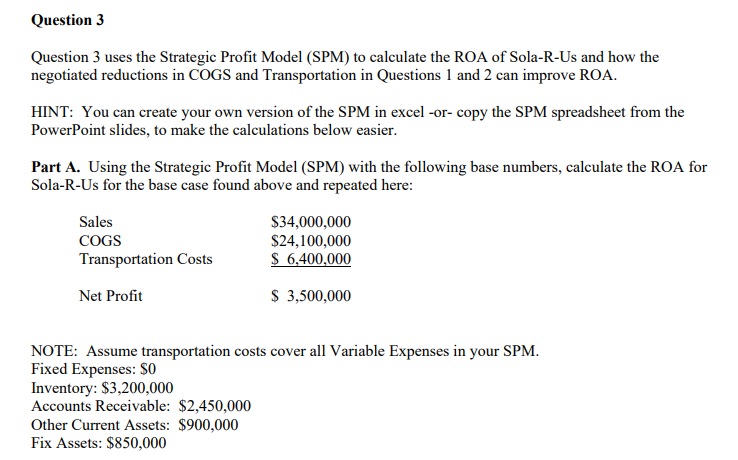

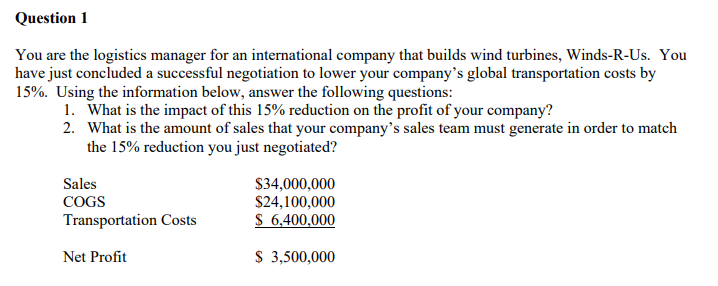

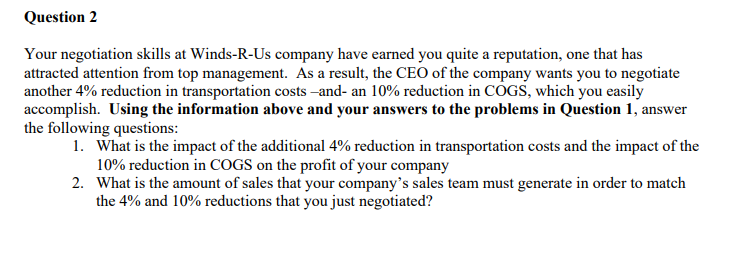

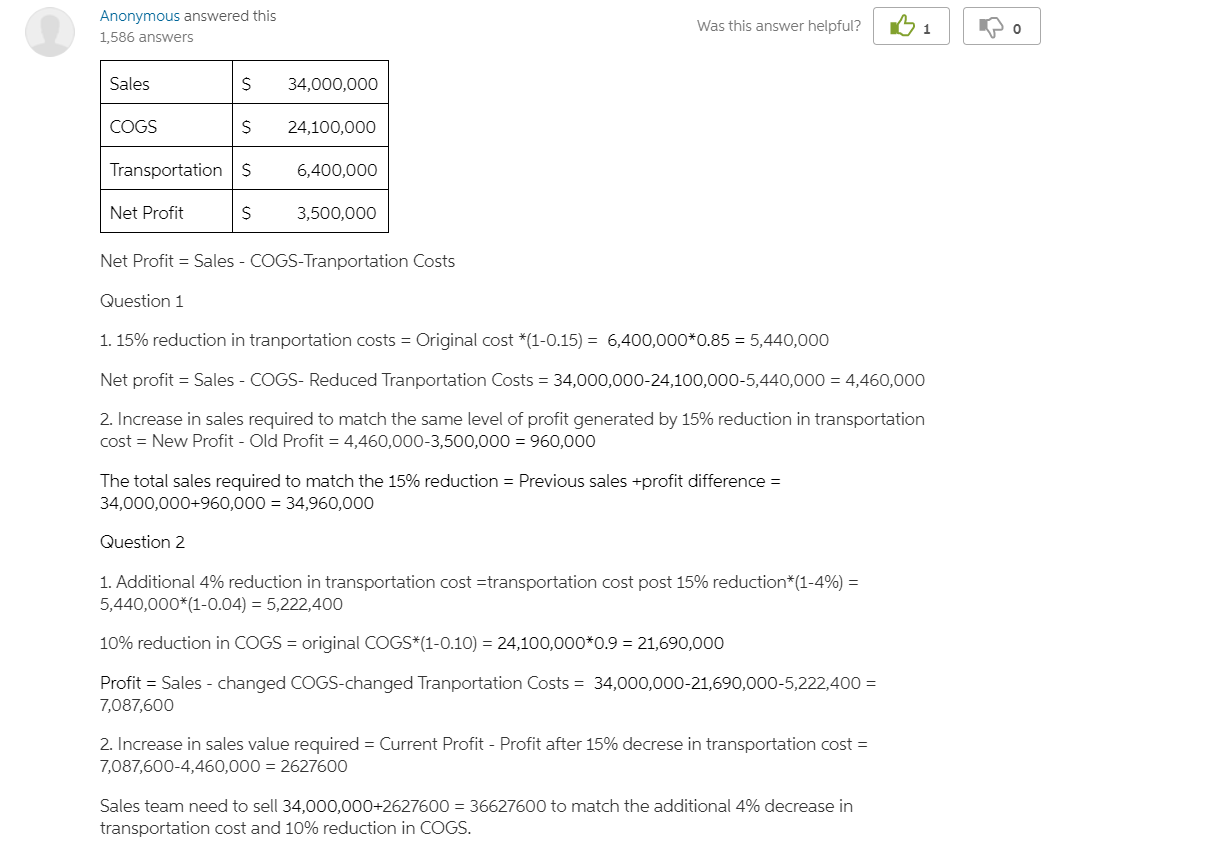

Question 3 Question 3 uses the Strategic Profit Model (SPM) to calculate the ROA of Sola-R-Us and how the negotiated reductions in COGS and Transportation in Questions 1 and 2 can improve ROA. HINT: You can create your own version of the SPM in excel -or-copy the SPM spreadsheet from the PowerPoint slides, to make the calculations below easier. Part A. Using the Strategic Profit Model (SPM) with the following base numbers, calculate the ROA for Sola-R-Us for the base case found above and repeated here: Sales COGS Transportation Costs $34,000,000 $24,100,000 $ 6,400,000 Net Profit $ 3,500,000 NOTE: Assume transportation costs cover all Variable Expenses in your SPM. Fixed Expenses: $0 Inventory: $3,200,000 Accounts Receivable: $2,450,000 Other Current Assets: $900,000 Fix Assets: $850,000 Question 1 You are the logistics manager for an international company that builds wind turbines, Winds-R-Us. You have just concluded a successful negotiation to lower your company's global transportation costs by 15%. Using the information below, answer the following questions: 1. What is the impact of this 15% reduction on the profit of your company? 2. What is the amount of sales that your company's sales team must generate in order to match the 15% reduction you just negotiated? Sales $34,000,000 COGS $24,100,000 Transportation Costs $ 6,400,000 Net Profit $ 3,500,000 Question 2 Your negotiation skills at Winds-R-Us company have earned you quite a reputation, one that has attracted attention from top management. As a result, the CEO of the company wants you to negotiate another 4% reduction in transportation costs-and-an 10% reduction in COGS, which you easily accomplish. Using the information above and your answers to the problems in Question 1, answer the following questions: 1. What is the impact of the additional 4% reduction in transportation costs and the impact of the 10% reduction in COGS on the profit of your company 2. What is the amount of sales that your company's sales team must generate in order to match the 4% and 10% reductions that you just negotiated? Anonymous answered this 1,586 answers Was this answer helpful? 1 o Sales $ 34,000,000 COGS S 24,100,000 Transportations 6,400,000 Net Profit $ 3,500,000 Net Profit = Sales - COGS-Tranportation Costs Question 1 1. 15% reduction in tranportation costs = Original cost *(1-0.15) = 6,400,000*0.85 = 5,440,000 Net profit = Sales - COGS- Reduced Tranportation Costs = 34,000,000-24,100,000-5,440,000 = 4,460,000 2. Increase in sales required to match the same level of profit generated by 15% reduction in transportation cost = New Profit - Old Profit = 4,460,000-3,500,000 = 960,000 The total sales required to match the 15% reduction = Previous sales +profit difference = 34,000,000+960,000 = 34,960,000 Question 2 1. Additional 4% reduction in transportation cost =transportation cost post 15% reduction*(1-4%) = 5,440,000*(1-0.04) = 5,222,400 10% reduction in COGS = original COGS*(1-0.10) = 24,100,000*0.9 = 21,690,000 Profit = Sales - changed COGS-changed Tranportation Costs = 34,000,000-21,690,000-5,222,400 = 7,087,600 2. Increase in sales value required = Current Profit - Profit after 15% decrese in transportation cost = 7,087,600-4,460,000 = 2627600 Sales team need to sell 34,000,000+2627600 = 36627600 to match the additional 4% decrease in transportation cost and 10% reduction in COGS

PLEASE ANSWER QUESTION 3A. Answers for questions 1 and 2 are answered above for reference.

PLEASE ANSWER QUESTION 3A. Answers for questions 1 and 2 are answered above for reference.