Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 4 Prepare T-accounts for each transaction from the previous step. Not that each T account should have: (a) the name of the

Please answer question 4

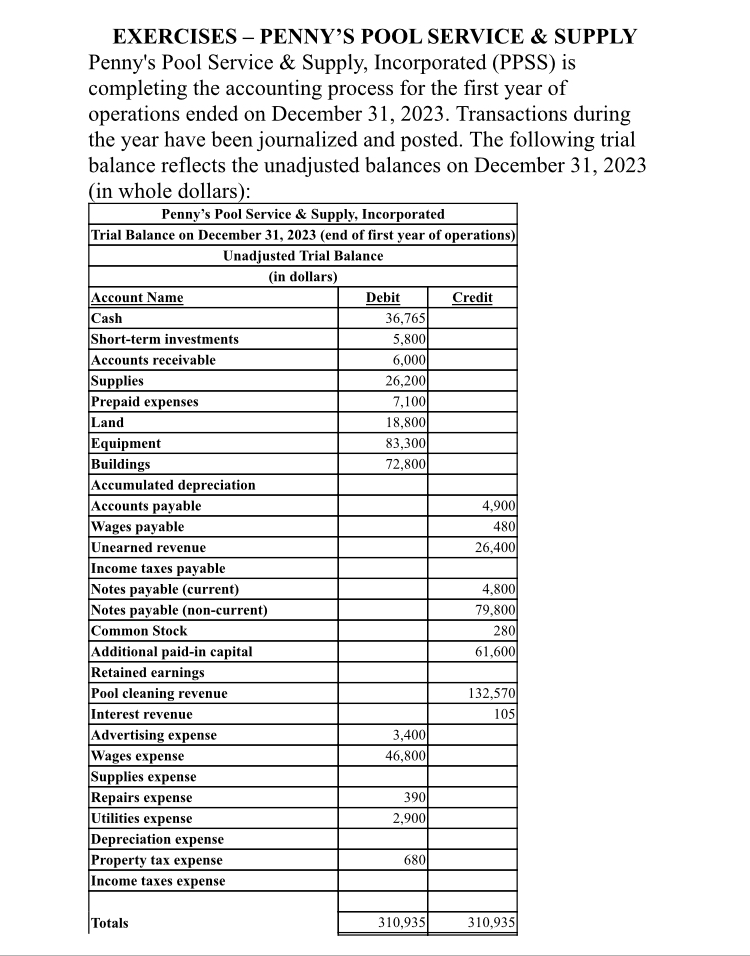

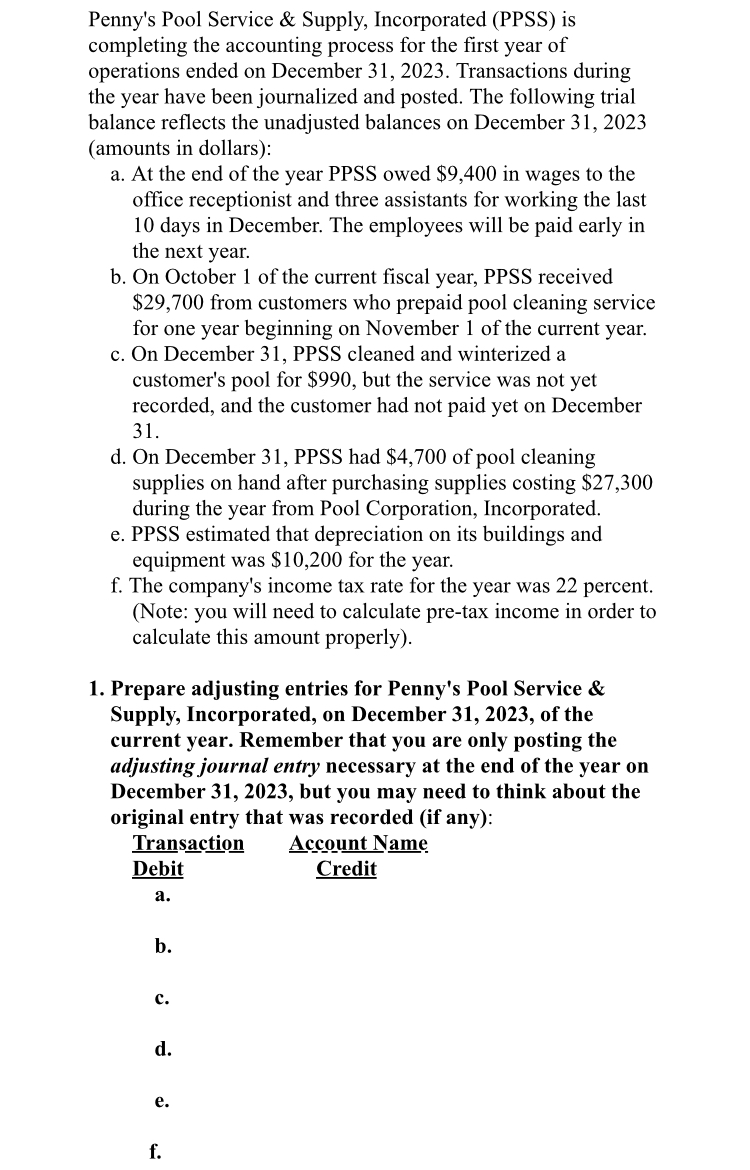

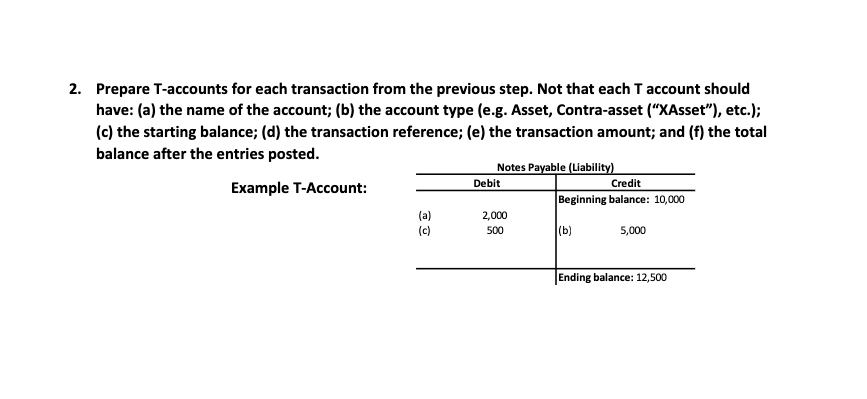

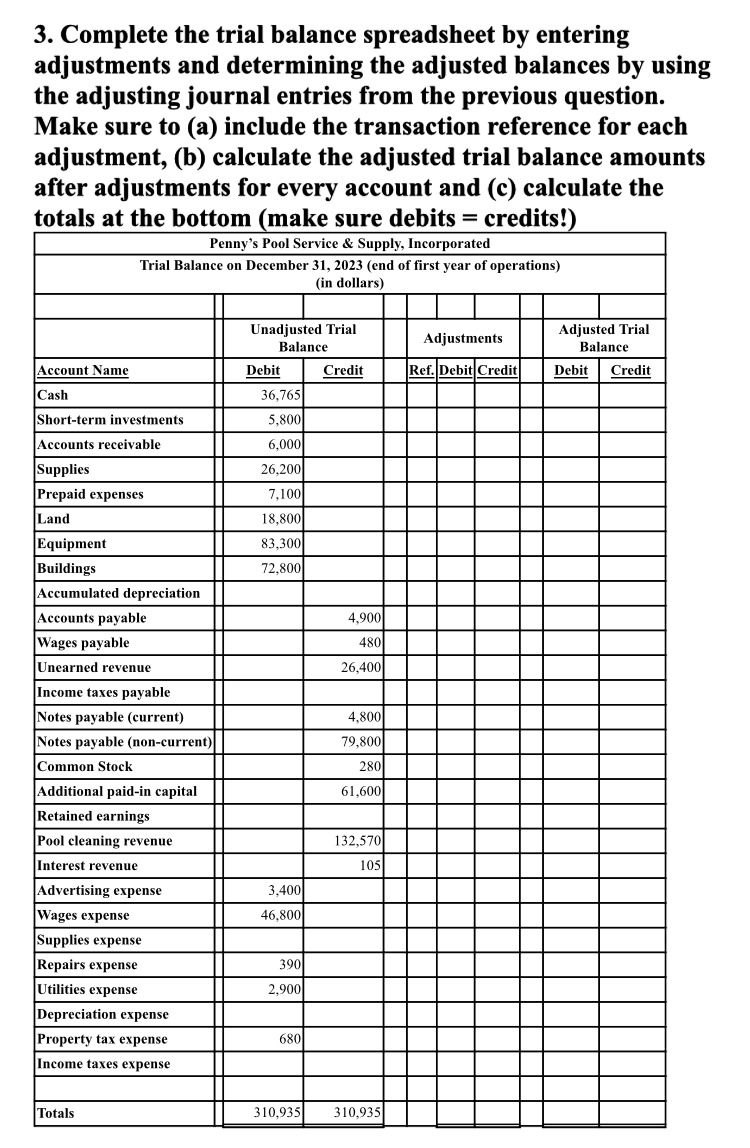

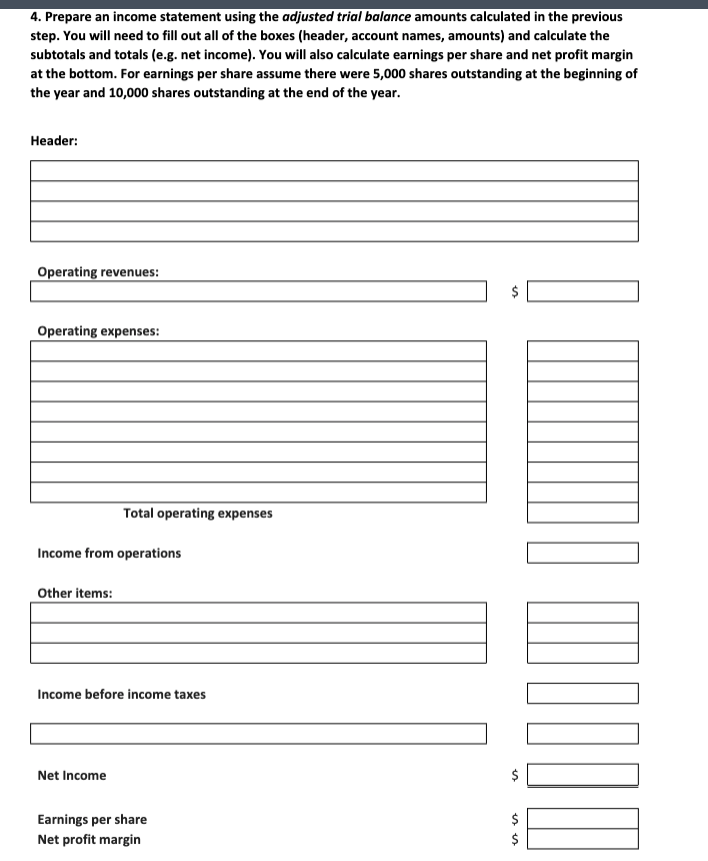

Prepare T-accounts for each transaction from the previous step. Not that each T account should have: (a) the name of the account; (b) the account type (e.g. Asset, Contra-asset ("XAsset"), etc.); (c) the starting balance; (d) the transaction reference; (e) the transaction amount; and (f) the total balance after the entries posted. 3. Complete the trial balance spreadsheet by entering adjustments and determining the adjusted balances by using the adjusting journal entries from the previous question. Make sure to (a) include the transaction reference for each adjustment, (b) calculate the adjusted trial balance amounts after adjustments for every account and (c) calculate the totals at the bottom (make sure debits = credits!) 4. Prepare an income statement using the adjusted trial balance amounts calculated in the previous step. You will need to fill out all of the boxes (header, account names, amounts) and calculate the EXERCISES - PENNY'S POOL SERVICE \& SUPPLY Penny's Pool Service \& Supply, Incorporated (PPSS) is completing the accounting process for the first year of operations ended on December 31, 2023. Transactions during the year have been journalized and posted. The following trial balance reflects the unadjusted balances on December 31, 2023 (in whole dollars): Penny's Pool Service \& Supply, Incorporated (PPSS) is completing the accounting process for the first year of operations ended on December 31, 2023. Transactions during the year have been journalized and posted. The following trial balance reflects the unadjusted balances on December 31, 2023 (amounts in dollars): a. At the end of the year PPSS owed $9,400 in wages to the office receptionist and three assistants for working the last 10 days in December. The employees will be paid early in the next year. b. On October 1 of the current fiscal year, PPSS received $29,700 from customers who prepaid pool cleaning service for one year beginning on November 1 of the current year. c. On December 31, PPSS cleaned and winterized a customer's pool for $990, but the service was not yet recorded, and the customer had not paid yet on December 31 . d. On December 31, PPSS had $4,700 of pool cleaning supplies on hand after purchasing supplies costing $27,300 during the year from Pool Corporation, Incorporated. e. PPSS estimated that depreciation on its buildings and equipment was $10,200 for the year. f. The company's income tax rate for the year was 22 percent. (Note: you will need to calculate pre-tax income in order to calculate this amount properly). 1. Prepare adjusting entries for Penny's Pool Service \& Supply, Incorporated, on December 31, 2023, of the current year. Remember that you are only posting the adjusting journal entry necessary at the end of the year on December 31, 2023, but you may need to think about the original entry that was recorded (if any)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started