Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer Question 4 Use the following set-up to answer the next three questions: Consider the following model of a stock market. There are two

Please answer Question 4

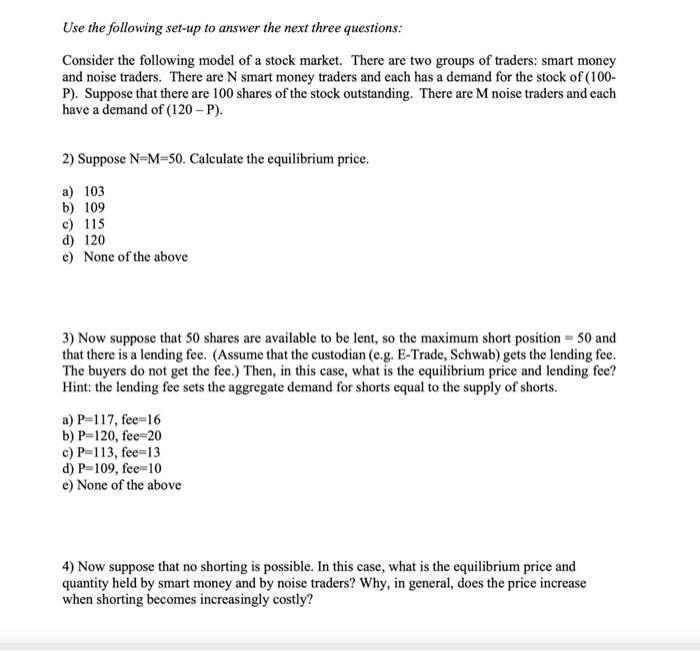

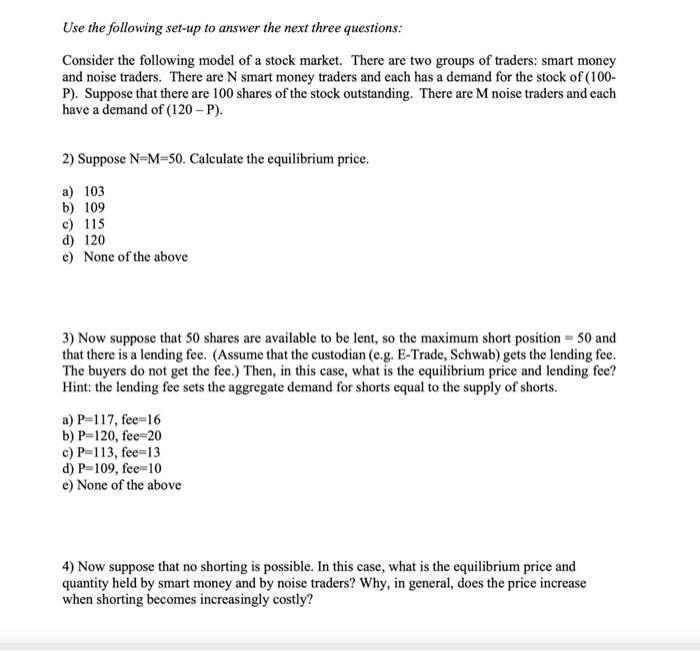

Use the following set-up to answer the next three questions: Consider the following model of a stock market. There are two groups of traders: smart money and noise traders. There are N smart money traders and each has a demand for the stock of (100- P). Suppose that there are 100 shares of the stock outstanding. There are M noise traders and each have a demand of (120-P). 2) Suppose N=M=50. Calculate the equilibrium price. a) 103 b) 109 c) 115 d) 120 e) None of the above 3) Now suppose that 50 shares are available to be lent, so the maximum short position - 50 and that there is a lending fee. (Assume that the custodian (e.g. E-Trade, Schwab) gets the lending fee. The buyers do not get the fee.) Then, in this case, what is the equilibrium price and lending fee? Hint: the lending fee sets the aggregate demand for shorts equal to the supply of shorts. a) P-117, fee16 b) P-120, fee-20 c) P-113, fee=13 d) P=109, fee=10 e) None of the above 4) Now suppose that no shorting is possible. In this case, what is the equilibrium price and quantity held by smart money and by noise traders? Why, in general, does the price increase when shorting becomes increasingly costly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started