Answered step by step

Verified Expert Solution

Question

1 Approved Answer

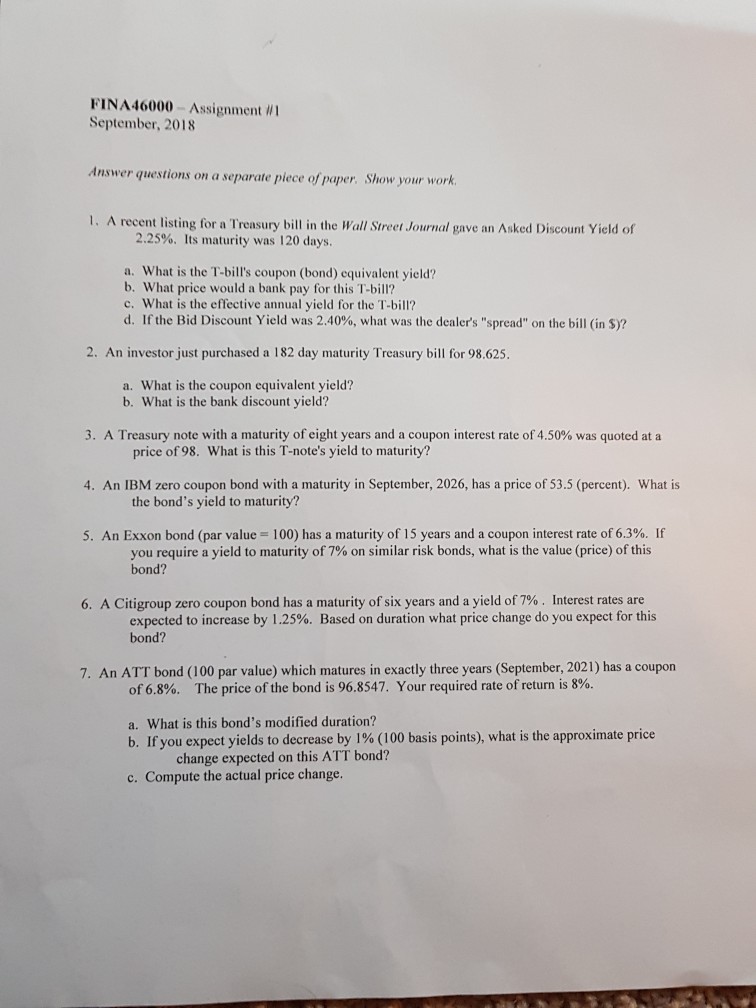

please answer question 5 and 6 and 7 FIN A46000-Assignment #1 September, 2018 Answer questions on a separate piece of paper. Show your work. 1.

please answer question 5 and 6 and 7

FIN A46000-Assignment #1 September, 2018 Answer questions on a separate piece of paper. Show your work. 1. A recent listing for a Treasury bill in the Wall Street Journal gave an Asked Discount Yield of 2.25%. Its maturity was 120 days. a. What is the T-bill's coupon (bond) equivalent yield? b. What price would a bank pay for this T-bill? c. What is the effective annual yield for the T-bill? d. If the Bid Discount Yield was 2.40%, what was the dealer's "spread" on the bill (in Sy 2. An investor just purchased a 182 day maturity Treasury bill for 98.625. a. What is the coupon equivalent yield? b. What is the bank discount yield? 3, A Treasury note with a maturity of eight years and a coupon interest rte of 4.50% was quoted at a 4. An IBM zero coupon bond with a maturity in September, 2026, has a price of 53.5 (percent). What is 5, An Exxon bond (par value-100) has a maturity of 15 years and a coupon interest rate of 6.3%. If price of 98. What is this T-note's yield to maturity? the bond's yield to maturity? you require a yield to maturity of 7% on similar risk bonds, what is the value (price) of this bond? 6, A Citigroup zero coupon bond has a maturity of six years and a yield of 7% . Interest rates are expected to increase by 1.25%. Based on duration what price change do you expect for this bond? 7. An ATT bond (100 par value) which matures in exactly three years (September, 2021) has a coupon of 6.8%. The price of the bond is 96.8547. Your required rate of return is 8%. a. What is this bond's modified duration? b. Ifyou expect yields to decrease by 1% (100 basis points), what is the approx inate price c. Compute the actual price change. change expected on this ATT bondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started