Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question 5 with justification You are given in the appendix the dividends yields for CAC40 companies. Most of the questions are based on

Please answer question 5 with justification

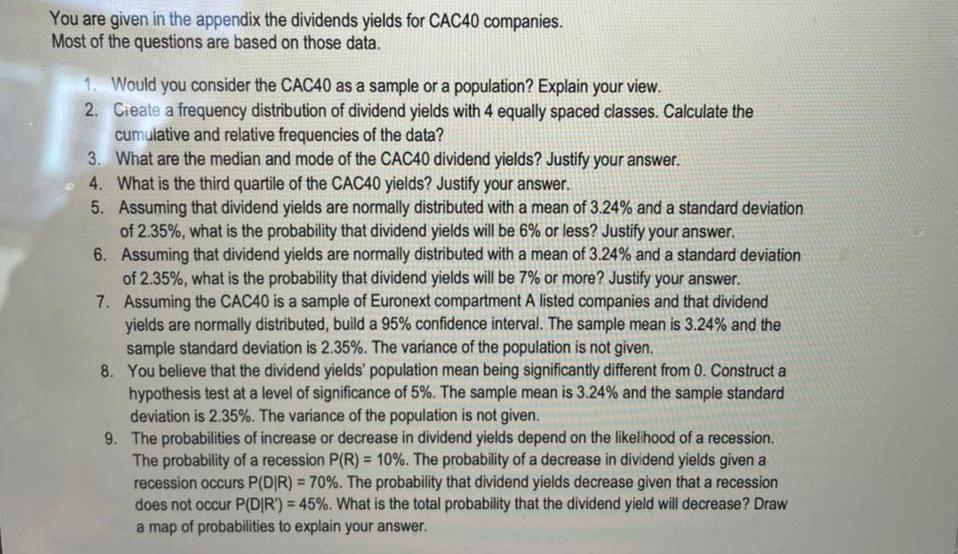

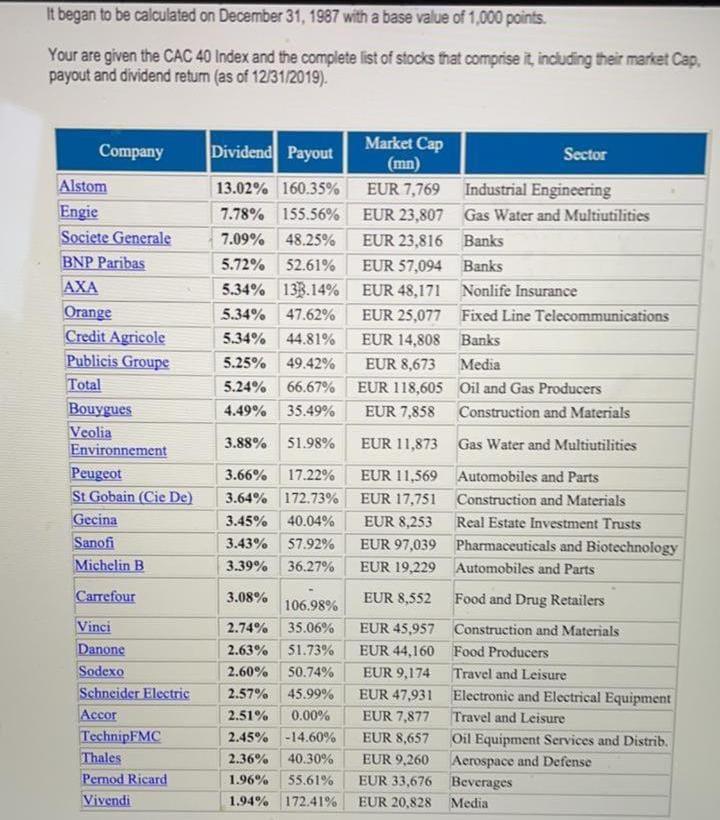

You are given in the appendix the dividends yields for CAC40 companies. Most of the questions are based on those data. 1. Would you consider the CAC40 as a sample or a population? Explain your view. 2. Cieate a frequency distribution of dividend yields with 4 equally spaced classes. Calculate the cumulative and relative frequencies of the data? 3. What are the median and mode of the CAC40 dividend yields? Justify your answer. 4. What is the third quartile of the CAC40 yields? Justify your answer. 5. Assuming that dividend yields are normally distributed with a mean of 3.24% and a standard deviation of 2.35%, what is the probability that dividend yields will be 6% or less? Justify your answer. 6. Assuming that dividend yields are normally distributed with a mean of 3.24% and a standard deviation of 2.35%, what is the probability that dividend yields will be 7% or more? Justify your answer. 7. Assuming the CAC40 is a sample of Euronext compartment A listed companies and that dividend yields are normally distributed, build a 95% confidence interval. The sample mean is 3.24% and the sample standard deviation is 2.35%. The variance of the population is not given. 8. You believe that the dividend yields' population mean being significantly different from 0. Construct a hypothesis test at a level of significance of 5%. The sample mean is 3.24% and the sample standard deviation is 2.35%. The variance of the population is not given. 9. The probabilities of increase or decrease in dividend yields depend on the likelihood of a recession. The probability of a recession P(R) = 10%. The probability of a decrease in dividend yields given a recession occurs P(DR) = 70%. The probability that dividend yields decrease given that a recession does not occur P(DIR") = 45%. What is the total probability that the dividend yield will decrease? Draw a map of probabilities to explain your answer. It began to be calculated on December 31, 1987 with a base value of 1,000 points. Your are given the CAC 40 Index and the complete list of stocks that comprise it including their market Cap. payout and dividend return (as of 12/31/2019). Company Alstom Engie Societe Generale BNP Paribas AXA Orange Credit Agricole Publicis Groupe Total Bouygues Veolia Environnement Peugeot St Gobain (Cie De Gecina Sanofi Michelin B Market Cap Dividend Payout Sector (mn) 13.02% 160.35% EUR 7,769 Industrial Engineering 7.78% 155.56% EUR 23,807 Gas Water and Multiutilities 7.09% 48.25% EUR 23,816 Banks 5.72% 52.61% EUR 57,094 Banks 5.34% 133.14% EUR 48,171 Nonlife Insurance 5.34% 47.62% EUR 25.077 Fixed Line Telecommunications 5.34% 44.81% EUR 14,808 Banks 5.25% 49.42% EUR 8,673 Media 5.24% 66.67% EUR 118,605 Oil and Gas Producers 4.49% 35.49% EUR 7,858 Construction and Materials 3.88% 51.98% EUR 11,873 Gas Water and Multiutilities 3.66% 17.22% 3.64% 172.73% 3.45% 40.04% 3.43% 57.92% 3.39% 36.27% EUR 11,569 Automobiles and Parts EUR 17,751 Construction and Materials EUR 8,253 Real Estate Investment Trusts EUR 97,039 Pharmaceuticals and Biotechnology EUR 19,229 Automobiles and Parts Carrefour EUR 8,552 Food and Drug Retailers Vinci Danone Sodexo Schneider Electric Accor TechnipFMC Thales Pernod Ricard Vivendi 3.08% 106.98% 2.74% 35.06% 2.63% 51.73% 2.60% 50.74% 2.57% 45.99% 2.51% 0.00% 2.45% -14,60% 2.36% 40.30% 1.96% 55.61% 1.94% 172.41% EUR 45,957 Construction and Materials EUR 44,160 Food Producers EUR 9,174 Travel and Leisure EUR 47,931 Electronic and Electrical Equipment EUR 7,877 Travel and Leisure EUR 8,657 Oil Equipment Services and Distrib. EUR 9,260 Aerospace and Defense EUR 33,676 Beverages EUR 20,828 MediaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started