please answer question 7,8,9

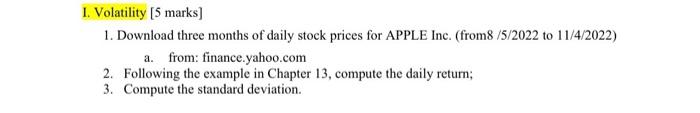

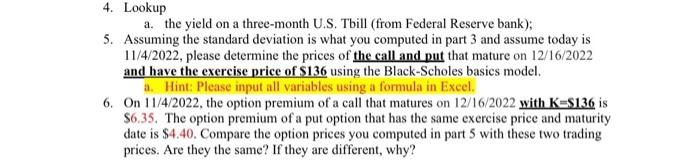

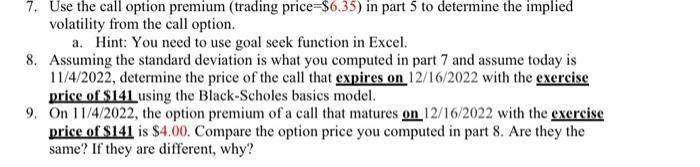

Volatility [5 marks] 1. Download three months of daily stock prices for APPLE Inc. (from8 /5/2022 to 11/4/2022) a. from: finance.yahoo.com 2. Following the example in Chapter 13, compute the daily return; 3. Compute the standard deviation. 4. Lookup a. the yield on a three-month U.S. Tbill (from Federal Reserve bank); 5. Assuming the standard deviation is what you computed in part 3 and assume today is 11/4/2022, please determine the prices of the call and put that mature on 12/16/2022 and have the exercise price of $136 using the Black-Scholes basics model. a. Hint: Please input all variables using a formula in Excel. 6. On 11/4/2022, the option premium of a call that matures on 12/16/2022 with K=S136 is \$6.35. The option premium of a put option that has the same exercise price and maturity date is $4.40. Compare the option prices you computed in part 5 with these two trading prices. Are they the same? If they are different, why? 7. Use the call option premium (trading price =$6.35 ) in part 5 to determine the implied volatility from the call option. a. Hint: You need to use goal seek function in Excel. 8. Assuming the standard deviation is what you computed in part 7 and assume today is 11/4/2022, determine the price of the call that expires on 12/16/2022 with the exercise price of $141 using the Black-Scholes basics model. 9. On 11/4/2022, the option premium of a call that matures on 12/16/2022 with the exercis price of $141 is $4.00. Compare the option price you computed in part 8 . Are they the same? If they are different, why? Volatility [5 marks] 1. Download three months of daily stock prices for APPLE Inc. (from8 /5/2022 to 11/4/2022) a. from: finance.yahoo.com 2. Following the example in Chapter 13, compute the daily return; 3. Compute the standard deviation. 4. Lookup a. the yield on a three-month U.S. Tbill (from Federal Reserve bank); 5. Assuming the standard deviation is what you computed in part 3 and assume today is 11/4/2022, please determine the prices of the call and put that mature on 12/16/2022 and have the exercise price of $136 using the Black-Scholes basics model. a. Hint: Please input all variables using a formula in Excel. 6. On 11/4/2022, the option premium of a call that matures on 12/16/2022 with K=S136 is \$6.35. The option premium of a put option that has the same exercise price and maturity date is $4.40. Compare the option prices you computed in part 5 with these two trading prices. Are they the same? If they are different, why? 7. Use the call option premium (trading price =$6.35 ) in part 5 to determine the implied volatility from the call option. a. Hint: You need to use goal seek function in Excel. 8. Assuming the standard deviation is what you computed in part 7 and assume today is 11/4/2022, determine the price of the call that expires on 12/16/2022 with the exercise price of $141 using the Black-Scholes basics model. 9. On 11/4/2022, the option premium of a call that matures on 12/16/2022 with the exercis price of $141 is $4.00. Compare the option price you computed in part 8 . Are they the same? If they are different, why