Answered step by step

Verified Expert Solution

Question

1 Approved Answer

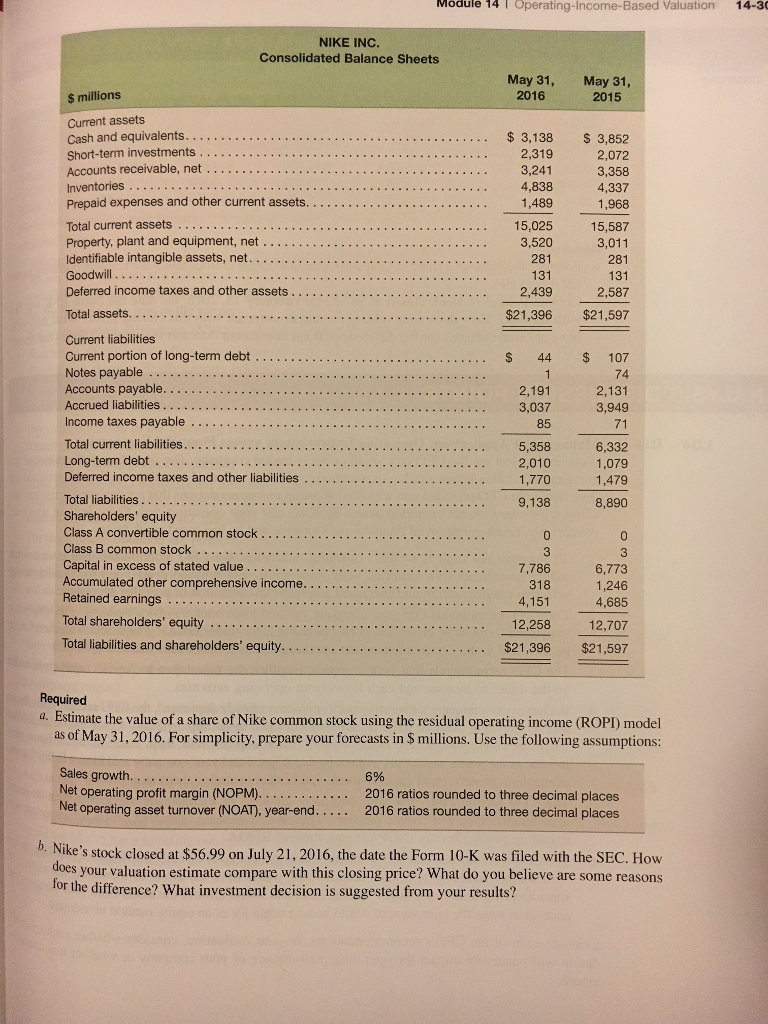

****PLEASE ANSWER QUESTION A & B FROM ABOVE SNAPSHOT**** L02 P14-29. Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following

****PLEASE ANSWER QUESTION A & B FROM ABOVE SNAPSHOT****

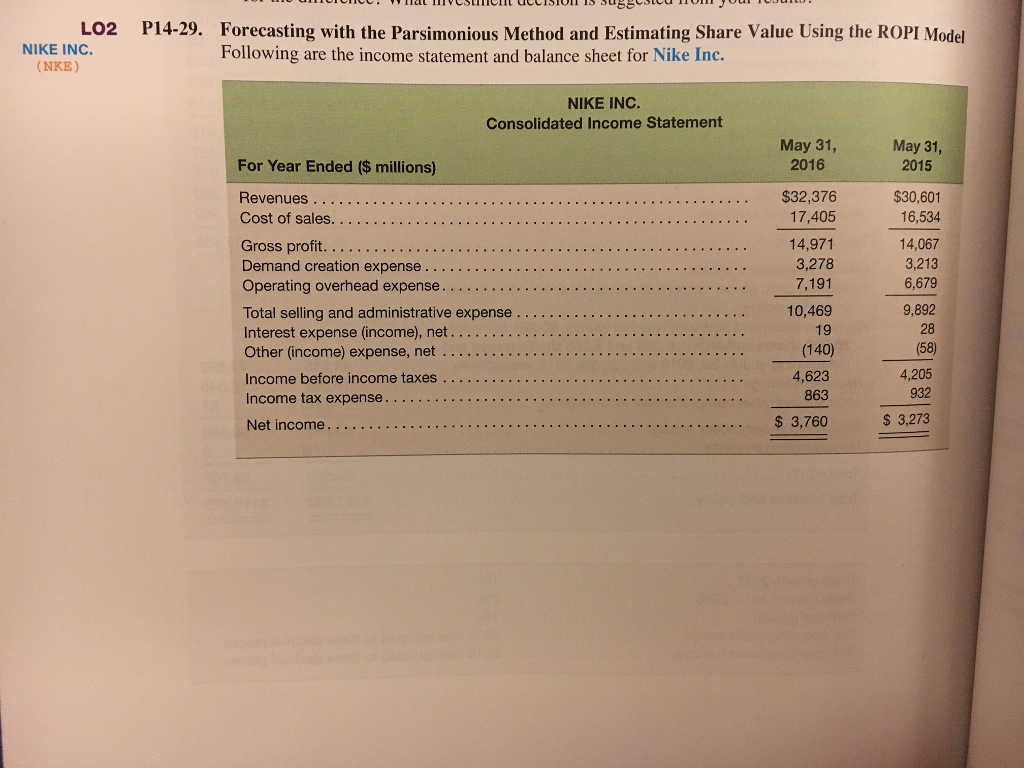

L02 P14-29. Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are the income statement and balance sheet for Nike Inc. NIKE INC. (NKE) NIKE INC. Consolidated Income Statement May 31, 2016 May 31, 2015 For Year Ended ($ millions) $32,376 17,405 14,971 3,278 7,191 10,469 $30,601 16,534 14,067 3,213 6,679 9,892 28 (58) 4,205 Cost of sales. .. Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net . Income before income taxes . . . . . . . . . Income tax expense... 19 (140) 4,623 863 . . 932 3,760 $ 3,273 L02 P14-29. Forecasting with the Parsimonious Method and Estimating Share Value Using the ROPI Model Following are the income statement and balance sheet for Nike Inc. NIKE INC. (NKE) NIKE INC. Consolidated Income Statement May 31, 2016 May 31, 2015 For Year Ended ($ millions) $32,376 17,405 14,971 3,278 7,191 10,469 $30,601 16,534 14,067 3,213 6,679 9,892 28 (58) 4,205 Cost of sales. .. Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net . Income before income taxes . . . . . . . . . Income tax expense... 19 (140) 4,623 863 . . 932 3,760 $ 3,273Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started