Answered step by step

Verified Expert Solution

Question

1 Approved Answer

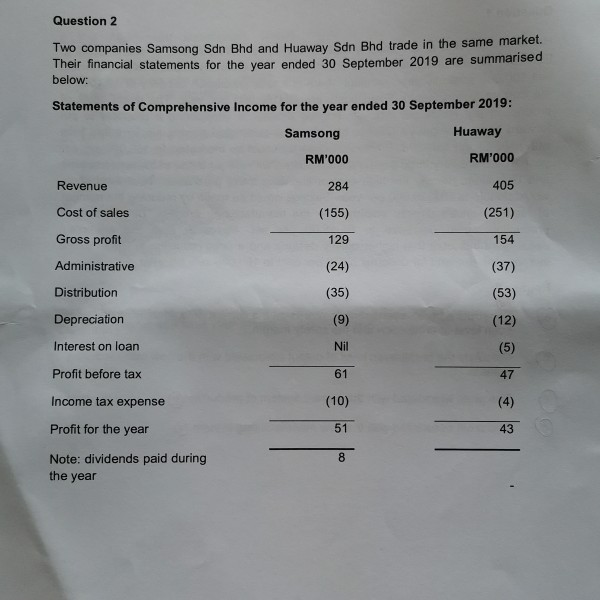

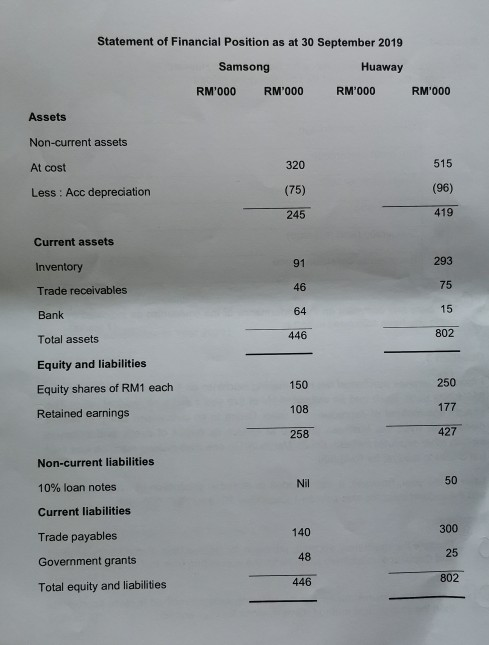

Please answer question a. Question 2 Two companies Samsong Sdn Bhd and Huaway Sdn Bhd trade in the same market. Their financial statements for the

Please answer question a.

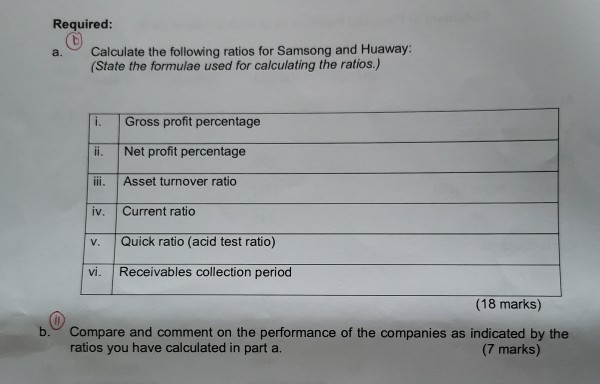

Question 2 Two companies Samsong Sdn Bhd and Huaway Sdn Bhd trade in the same market. Their financial statements for the year ended 30 September 2019 are summarised below: Statements of Comprehensive Income for the year ended 30 September 2019: Samsong Huaway RM'000 RM'000 Revenue 284 405 Cost of sales (155) (251) Gross profit 129 154 Administrative (24) (37) Distribution (35) (9) (53) (12) Depreciation Interest on loan Nil (5) Profit before tax 61 47 Income tax expense (10) (4) Profit for the year 51 43 Note: dividends paid during 8 the year Statement of Financial Position as at 30 September 2019 Samsong Huaway RM'000 RM'000 RM'000 RM'000 Assets Non-current assets At cost 320 515 Less : Acc depreciation (75) (96) 245 419 Current assets 91 293 Inventory Trade receivables 46 75 Bank 64 15 446 802 Total assets Equity and liabilities Equity shares of RM1 each 150 250 108 177 Retained earnings 258 427 Non-current liabilities Nil 50 10% loan notes Current liabilities 140 300 Trade payables 48 25 Government grants 446 802 Total equity and liabilities Required: a. Calculate the following ratios for Samsong and Huaway: (State the formulae used for calculating the ratios.) i. Gross profit percentage ii. Net profit percentage iii. Asset turnover ratio iv. Current ratio V. Quick ratio (acid test ratio) vi. Receivables collection period (18 marks) b Compare and comment on the performance of the companies as indicated by the ratios you have calculated in part a. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started